On Tuesday, Nifty traded within the range of the previous session, forming an inside bar. It remained sandwiched between the 20 DMA and 50 DMA, with limited price action, spanning only 62 points. This range-bound behavior occurred just before the monthly derivative expiry, suggesting trader reluctance to open fresh positions, evident from the low trading volumes (Rollovers at 37.55%). The key range to watch is 19734-19601, with the 20 DMA (19718) and 50 DMA (19633) serving as important levels. As long as Nifty remains above 19601, maintain a positive-neutral bias. Tuesday’s candle is indecisive, and a close above the Doji candle high will signal a reversal. A close above the 20 DMA will add upside momentum. However, the next two days are critical for establishing a directional bias, given the recent rise in India VIX.

Nifty50 traded in a narrow range on Tuesday, which is unusual before expiry. A move above 19686 is positive, targeting 19765, with a stop loss at 19645. Conversely, a move below 19645 is negative, with potential support at 19585 and a stop loss at 19686.

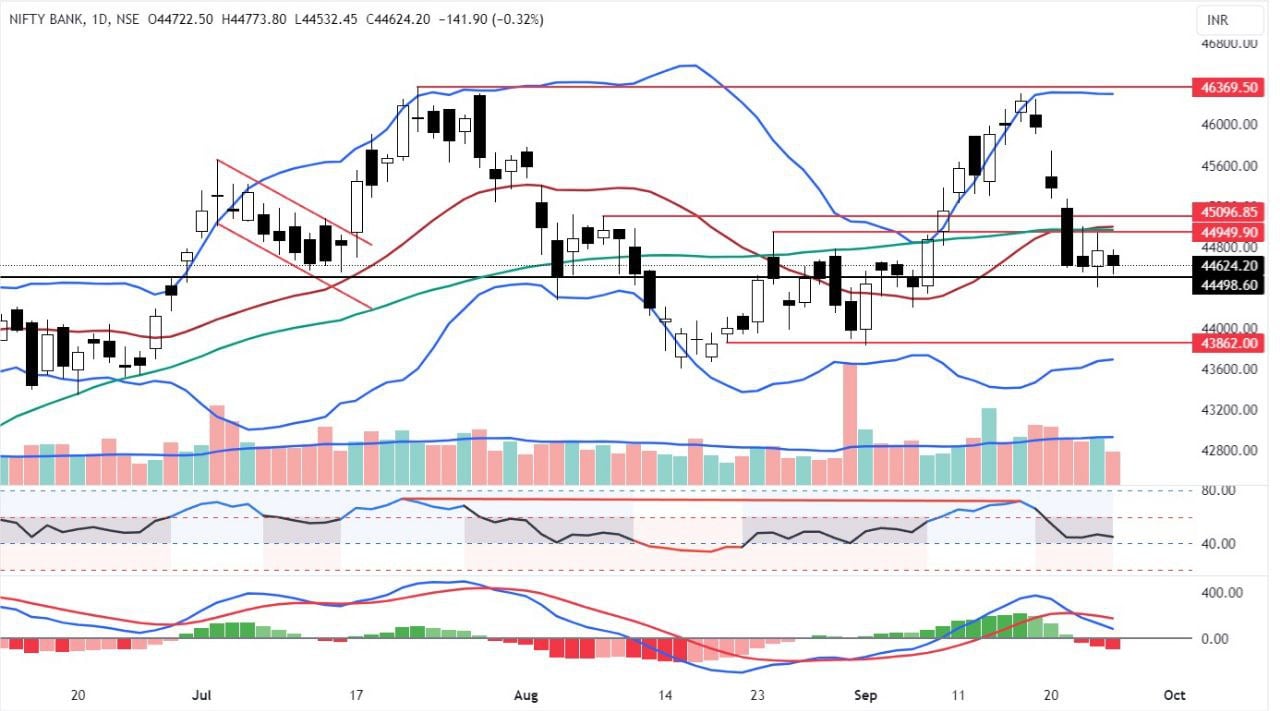

Bank Nifty also formed an inside bar and has been trading within a 600-point range for the last three days. It remained below the 20 and 50 DMAs for four consecutive days, accompanied by lower trading volumes and some unwinding of open interest. The previous day’s range of 44936-400 is crucial for determining the directional bias, with potential signals of continuation or reversal. Despite Monday’s recovery efforts, momentum remains negative, as indicated by a declining RSI and increasing MACD histogram on the downside. It’s advisable to maintain a neutral bias and await a range breakout.

Bank Nifty traded in a tight range without providing a clear directional indication. Key levels going forward are 44675 (positive) and 44600 (negative), targeting 44820 and 44400, respectively. Use stop losses at 44600 and 44700 for risk management. Consider trailing stop losses above 44820 or below 44400, depending on the breakout direction.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 27, 2023, 8:37 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates