On Thursday, the Bank Nifty underperformed compared to the NSE benchmark Nifty50 index. The Bank Nifty closed with a modest loss of 0.10% or 48.40 points, ending at 49,847. Meanwhile, the Nifty50 index finished the session higher by 0.33% or 76 points.

For the past seven trading sessions, the Bank Nifty has been trading within the range established by the long bearish candle formed on June 4. Notably, in six out of these seven sessions, the daily trading range has been below the 10-day average range, indicating compression in the Bank Nifty index. On Thursday, the Bank Nifty also formed a Narrow Range 7 (NR7) pattern.

The NR7 pattern, or “Narrow Range 7,” is a candlestick pattern indicating a period of consolidation or low volatility. It occurs when the day’s trading range (high-low) is narrower than the trading ranges of the six preceding days. Additionally, the Bank Nifty formed an inside bar pattern, meaning Thursday’s price range traded within the high and low of the previous session. This NR7 + Inside Bar pattern suggests price compression, a consolidation phase often preceding significant price movements when the range eventually breaks.

Given the Bank Nifty’s current compression phase, a shift from compression to expansion is anticipated. Typically, compression phases are followed by expansion phases, presenting an opportunity for traders. One effective strategy in this scenario is the “Long Straddle Strategy.”

A long straddle strategy is suitable when a significant price movement is expected but the direction is uncertain. This strategy involves buying both a call and a put option at the same strike price and expiration date.

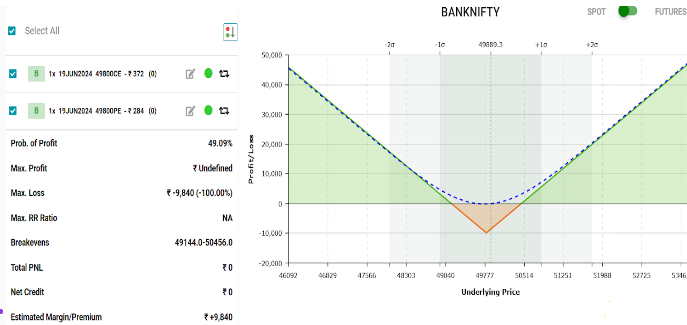

Bank Nifty Long Straddle Strategy:

The combined premium is Rs 9,840 per lot, which is the maximum loss if the Bank Nifty index expires between 49,144 and 50,456.

We anticipate a significant move on either side. If the index moves about 2.5% and reclaims its all-time high of 51,133, the strategy could yield a profit of more than Rs 10,000. The farther the index moves from the range of 49,144 to 50,456, the higher the profit will be.

In summary, the current consolidation in Bank Nifty suggests a potential for a significant price movement. The Long Straddle Strategy provides a balanced approach to capitalize on this expected volatility, regardless of the direction of the move.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jun 13, 2024, 6:43 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates