The Nifty FMCG index touched a milestone of 50,000 mark for the first time since its inception on Friday, May 26, 2023. The index went from strength to strength and marked a fresh all-time high of 58,850.25 on May 29, 2023.

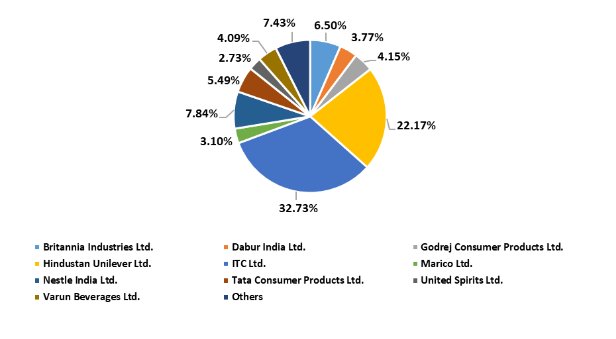

The Nifty FMCG Index is designed to reflect the behaviour of FMCGs Indian companies from (Fast Moving Consumer Goods) (FMCG) sector The Nifty FMCG index consists of 15 companies that are leading players in the FMCG sector. These companies operate in various segments such as food and beverages, personal care products, household products, and tobacco, among others.

In 2011, the Nifty FMCG index achieved a significant milestone by surpassing the 10,000 mark for the first time. Within a span of three years, it doubled in value and began trading above the 20,000 level. Subsequently, after a wait of four more years, in 2018, it reached the 30,000 mark and continued to trade above this level.

Reaching its all-time high of 33,167.9, the index faced a decline below this level during the COVID-19 breakdown, hitting a low of 22,699.05. However, in 2021, it once again achieved a new all-time high of 40,000. Presently, the index is successfully trading above 50,000, and on a YTD basis, the index is up by 14.75%.

The FMCG sector has always played a vital role in the economy of any country and is often considered a defensive sector. Even during the COVID-19 pandemic when countries implemented lockdowns, FMCG consumption remained resilient, demonstrating its stability.

After every increase of 10,000 points, a comparison of the trading levels of the Nifty 50 index and the Nifty FMCG index as below:

| Year > | 2011 | 2014 | 2018 | 2021 | 2023 |

| Nifty FMCG | 10000 | 20000 | 30000 | 40000 | 50000 |

| Nifty 50 | 5550 | 8017 | 11023 | 17234 | 18499 |

A comparison of Nifty 50 and Nifty FMCG CAGR return over the years.

| Index | 5 year | 3 year | 1 year |

| Nifty FMCG | 12% | 20% | 31% |

| Nifty 50 | 12% | 25% | 11% |

Over the course of one year, the Nifty FMCG index delivered an impressive return of 30.50%, surpassing the returns of the Nifty 50 index. Notably, Varun Beverage Ltd recorded a remarkable return of 134% during this period, while ITC achieved a return of 65%.

These are the top five performers in Nifty FMCG Index:

| Company | 5 year | 3 year | 1 year |

| Varun Beverages Ltd. | 50% | 82% | 134% |

| ITC Ltd. | 10% | 31% | 65% |

| Godrej Consumer Products Ltd. | 7% | 18% | 34% |

| Britannia Industries Ltd. | 10% | 11% | 29% |

| Nestle India Ltd. | 18% | 7% | 22% |

The FMCG Index has consistently generated wealth for its shareholders, except for the years 2008 and 2019 during the Global Financial Crisis. Throughout the remaining years, the index has consistently delivered positive annual returns. Considering this track record, there is significant potential for further upside soon. Investors should closely monitor this sector and its components for potential investment opportunities.

Published on: May 29, 2023, 3:33 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates