Nifty50 is a widely traded index in India, comprising the fifty largest and most actively traded stocks on the exchange. The second quarter of FY24 witnessed some interesting changes in the holdings of various investor groups in the components of the Nifty50 index. In this article, we will explore the alterations in Promoter, Mutual Fund, Foreign Institutional Investor (FII), Insurance Company, and Domestic Institutional Investor (DII) holdings.

| Participants | Holdings in Q1 FY24 % | Holdings in Q2 FY24 % |

| Promoter | 43.6 | 41.7 |

| Mutual Funds | 9.6 | 10.1 |

| FIIs | 22.6 | 23.8 |

| Insurance Companies | 7.7 | 7.8 |

| DIIs | 17.8 | 18.5 |

Let’s start with the promoters who have a significant impact on a company’s success and growth as they not only invest in the company but also hold executive positions. Hence, it is important for every investor to consider the stakes held by promoters. Promoters are individuals or entities who have founded or initiated a company and have a substantial stake in its ownership.

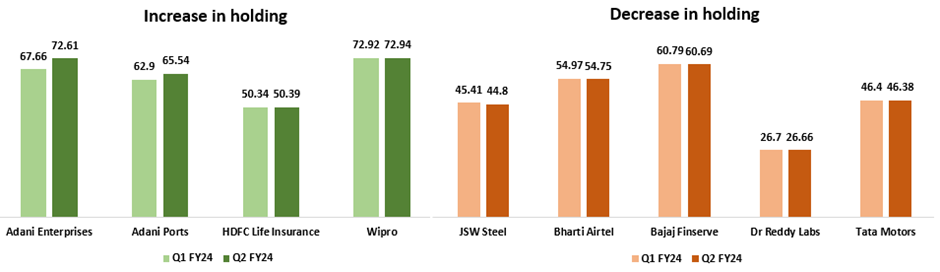

Promoters are at the core of many companies, and their holdings can significantly impact the market. In Q2 FY24, we witnessed a decrease of 1.9% in Promoter holdings in the Nifty index compared to the previous quarter. Some prominent stocks saw a mixed bag of changes in Promoter holdings. While Adani Enterprises, Adani Port, HDFC Life, and Wipro experienced an increase in Promoter holdings by 4.95%, 2.64%, 0.05%, and 0.02%, respectively, other giants like JSW Steel, Bharti Airtel, Bajaj Finserv, Dr. Reddy, and Tata Motors saw a decrease in Promoter holdings by 0.61%, 0.22%, 0.10%, 0.04%, and 0.02%, respectively.

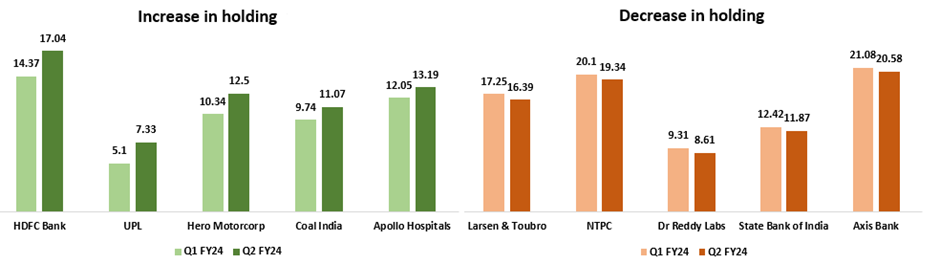

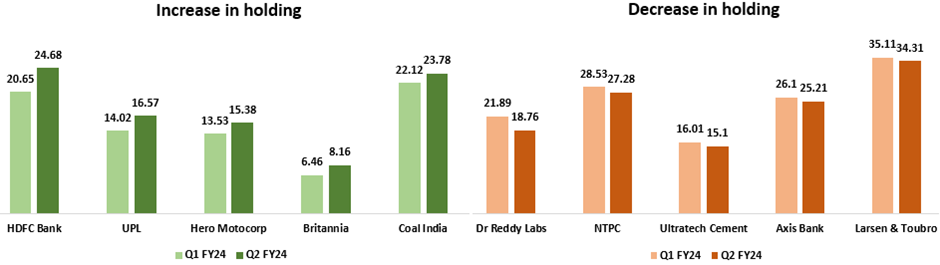

Mutual Funds play a pivotal role in the stock market, managing investments on behalf of countless retail investors. In Q2 FY24, Mutual Fund holdings in the Nifty index increased by 0.5%. This increase was reflected in the holdings of specific stocks such as HDFC Bank, UPL, Hero Motocorp, Coal India, and Apollo Hospitals, where Mutual Fund houses raised their holdings by 2.67%, 2.23%, 2.16%, 1.33%, and 1.14%, respectively. However, Mutual Fund houses reduced their holdings in L&T, NTPC, Dr. Reddy, SBI, and Axis Bank by 0.86%, 0.76%, 0.7%, 0.55%, and 0.5%, respectively.

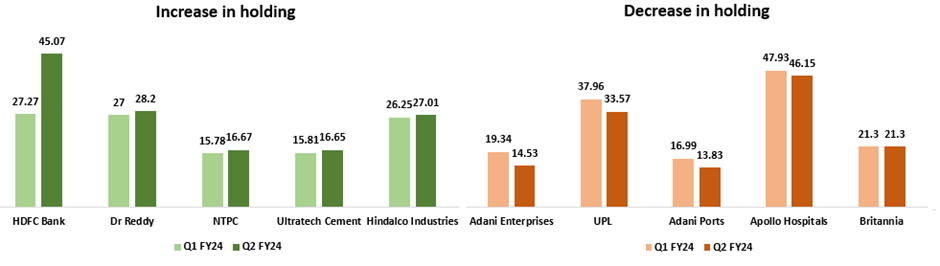

Foreign Institutional Investors (FIIs) have a significant influence on the Indian stock market. In Q2 FY24, FII holdings in the Nifty index increased by 1.2%. This increase was particularly evident in HDFC Bank, Dr. Reddy, NTPC, Ultratech, and Hindalco Industries, where FIIs increased their holdings by 17.83%, 1.2%, 0.89%, 0.84%, and 0.76%, respectively. Conversely, FIIs reduced their holdings in Adani Enterprises, UPL, Adani Port, Apollo Hospitals, and Britannia by 4.8%, 4.4%, 3.2%, 1.8%, and 1.6%, respectively.

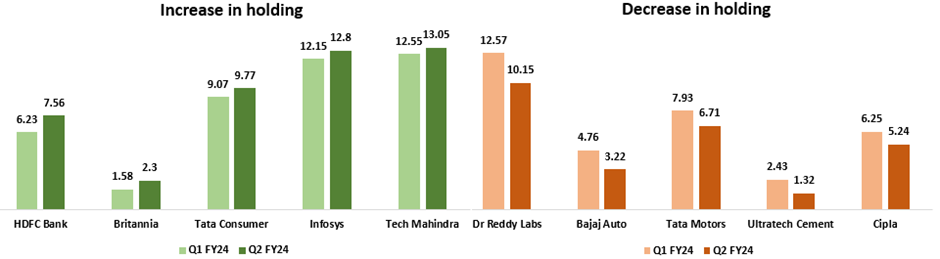

Insurance companies, another significant group of investors, also had their share of movements in the Nifty index. In Q2 FY24, insurance companies increased their holdings by 0.05%. Key stocks that benefited from this increase included HDFC Bank, Britannia, Tata Consumer, Infosys, and Tech Mahindra, where insurance companies raised their holdings by 1.33%, 0.7%, 0.7%, 0.65%, and 0.5%, respectively. On the flip side, insurance companies decreased their holdings in Dr Reddy, Bajaj Auto, Tata Motors, Ultratech Cement, and Cipla by 2.4%, 1.54%, 1.22%, 1.11%, and 1.01%, respectively.

Domestic Institutional Investors (DIIs) also contribute significantly to the stock market. In Q2 FY24, DIIs increased their holdings in the Nifty index by 0.6%. Stocks such as HDFC Bank, UPL, Hero Motocorp, Britannia, and Coal India saw an increase in DII holdings by 4.03%, 2.55%, 1.85%, 1.7%, and 1.66%, respectively. However, DIIs decreased their holdings in Dr Reddy, NTPC, Ultratech Cement, Axis Bank, and L&T by 3.13%, 1.25%, 0.91%, 0.89%, and 0.8%, respectively.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 25, 2023, 5:25 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates