Today, Nifty Mid Cap Index hits an all-time high of 35,396.85. It opened at 35,282.05, hit a high of 35,396.85 during the intraday session and a low of 35,276.45, and is currently trading around 35,369. Both Nifty Mid Cap and Nifty Small Cap are buzzing these days. Investors are very much interested to invest in this space. During the last week, it has generated a return of around 2.3%.

The Nifty Mid Cap Index is designed to track the price movements of mid-cap stocks. These stocks are generally known for their growth potential and can offer opportunities for investors seeking exposure to mid-sized companies.

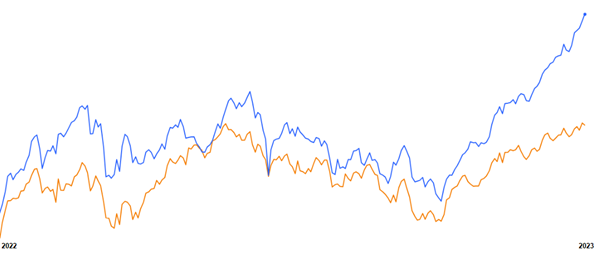

Over the past year, the Nifty Mid Cap index has delivered an impressive return of 35%, showcasing its exceptional performance. In the last month alone, it has generated a return of approximately 8%. In comparison, broader indices like Nifty50 and Sensex have provided returns of around 23% over the past year. However, in the last month, the Nifty50 index has generated a return of around 3.4% while the Sensex has generated approximately 2.4%. Despite trading near their all-time highs, when comparing the returns of the Nifty Mid Cap index with the broader indices, it becomes evident that the midcap index has outperformed both of them.

| Index | Nifty Mid Cap | Nifty50 | BSE Sensex |

| 1-Year Return % | 35.0% | 23.0% | 23.0% |

| 1 Month Return % | 7.9% | 3.4% | 2.4% |

Below is the chart presentation of the Nifty Mid Cap Index which is in Blue colour and Nifty50 is in orange colour.

| Company Name | Sector / Industry | CMP in Rs | % Change |

| Jindal Steel & Power | Steel | 573.25 | 5.34 |

| Dr Lal Pathlabs | Healthcare | 2,128.45 | 5.03 |

| Shriram Finance | Finance | 1,472.00 | 5.03 |

| M&M Finance | Finance | 318.9 | 4.56 |

| Max Health Care | Healthcare | 611.95 | 2.95 |

Top Companies Contributing to the Index Performance during last one month:

| Company Name | Sector / Industry | CMP in Rs | 1 Month Return % |

| Dixon Technologies | IT | 4,674.85 | 49.79 |

| Tata Communications | Telecom Service | 1,591.40 | 32.05 |

| Tata Teleservices | Telecom Service | 76.5 | 27.79 |

| Torrent Power | Power Generations | 675 | 27.29 |

| Paytm | E-Commerce | 894.8 | 26.05 |

Top Companies Contributing to the Index Performance during last one year:

| Company Name | Sector / Industry | CMP in Rs | 1-Year Return % |

| IDFC First Bank | Banking | 83.6 | 158.14 |

| Apollo Tyre | Tyre | 411 | 134.46 |

| CG Power | Power Generations | 367 | 126.21 |

| Tube Investment of India | Auto Ancillary | 3,064.10 | 100.92 |

| Power Finance Corporations | Finance | 198 | 99.29 |

Top 10 Companies underperformed during the last Year:

| Company Name | Sector / Industry | CMP in Rs | 1-Year Return % |

| Gland Pharma | Pharmaceuticals | 1,022.00 | -60.69 |

| Piramal Enterprises | Finance | 793 | -52.51 |

| Tata Teleservices | Telecom Service | 76.5 | -35.47 |

| Biocon | Pharmaceuticals | 246.3 | -22.03 |

| Lauras Labs | Healthcare | 369.45 | -21.42 |

| Bandhan Bank | Banking | 250.75 | -18.19 |

| Delhivery | Logistics | 391.1 | -17.36 |

| Voltas | Consumer Durables | 792.4 | -16.65 |

| Mphasis | IT | 1,870.05 | -15.19 |

| IPCA Labs | Healthcare | 733.15 | -15.11 |

The Indian markets are displaying strength and outperforming international markets, making India an attractive destination for global investors. India is becoming the first choice of every global investor and almost every investor wants to be the part of growing Indian economy. The country’s GDP reached a significant milestone of USD 3.75 trillion in 2023, establishing India as the world’s fifth-largest economy, following the USA, China, and Germany.

Amidst this impressive growth, Indian companies, particularly mid-sized ones, have exhibited exceptional performance, with even greater potential for future outperformance. Midcap companies have outperformed a few exceptional companies that have not performed well during the year but these companies also have the great potential to perform in the future.

Investors keep midcap space on their radar.

Published on: Jun 19, 2023, 2:51 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates