In Nifty Outlook of 21 July, 2022 expiry, we analyzed Nifty on Monthly, Weekly, Daily & Hourly time- frames.

Below was the summary for our analysis:

Monthly candle is an Inside bar for June month bearish candle. On a monthly timeframe indecisiveness is the state for nifty in long term.

This weekly candle is inside bar candle of previous week candle. 16300 being major resitance zone.

Nifty gave closing above 16000 level. Finding major support at 15900 level. However 16150 being major resistance zone.

In past days market been trading in downward falling channel. On Friday, Bulls broke the channel and gave closing above 16000 level.

Now, going forward on a Daily time-frame if we analyse:

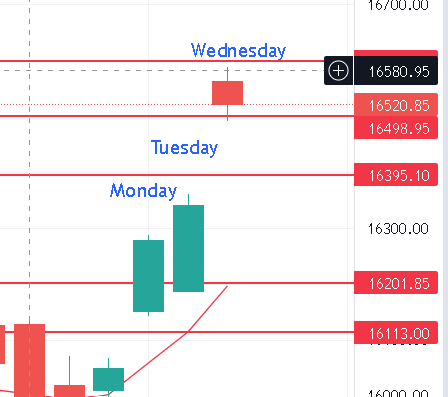

On Monday (18July) – We witnessed a huge gapup with good amount of buying, Bull took market above the resistance level of 16200.

On Tuesday (19July) – Again nifty rallied after slight gap down, gave good opportunity for buying on dip. On Tuesday 16300 level also broken.

On Wednesday – Big gap up Nifty closed above 16500. Candle closed in red, due to profit booking from 16600 levels.

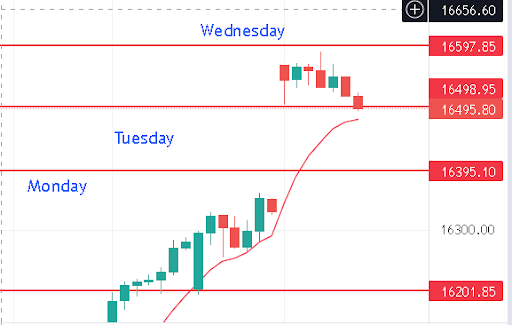

Now let’s analyse chart on a Hourly time-frame:

The bulls pulled market from the lows of 15900 to above 16500.

Now at these levels, Bulls are facing resistance at 16600 levels.

But on a downside 16400 will act as good support now.

One can start booking profits in long positions and can reenter again when nifty finds support near 16400 levels.

So in this expiry two important levels are must to watch:

Resistance – 16600

Support – 16400

The easiest Options trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Published on: Jul 20, 2022, 5:04 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates