In Nifty Outlook of 23 June, 2022 expiry, we analyzed Nifty on Monthly, Weekly, Daily & Hourly time- frames.

Below was the summary for our analysis:

Monthly time-frame indicates complete bearishness in market, as price has broken the major support zone with big red candle.

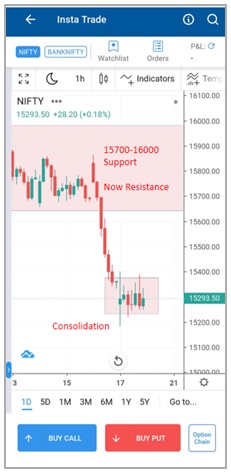

After testing support zone of 15700-16000, In last two week bears gripped the market with full power, broken the major support zone. Hence on weekly timeframe, Outlook is bearish.

Bears took charge & clearly broke 15700 level and opened path for further down-move. However, Nifty was mostly sideways in past days.

But, on Friday Bulls lost their 15700 territory & Bears took market to 15300 levels.

Now, going forward on a Daily time-frame if we analyse:

On Monday – we witnessed an indecisive candle, however gaining support at 15200 levels.

On Tuesday – A big bullish candle, Bulls tried to take market up to the important level of 15700.

On Wednesday – a Gap down, from the highs of 15700, then continued down move upto the level of 15413.

So it can be said market is in the hands of bears, but at 15200 levels Bulls are regained power and tried to move market up, but as 15700 level a support turned resistance level, took market down on Wed.

Now let’s analyse chart on a Hourly time-frame:

The bears dragged market from the high of 15800 to 15200 levels (600 pts).

Now at these levels, there is a tough fight between Bulls & Bears.

Bulls not ready to give 15200 support zones.

Bears are continuously giving pressure, and not going above 15700.

So in this expiry two important levels are must to watch:

Resistance – 15700

Support – 15200

However, bears seems more powerful as they dragged market from the high of 15800 to the lows of 15200 (600 Points), but Bulls are also not yet ready to easily give-up.

So If, Resistance 15700 is broken, then only we can assume that bulls will be able to defend their territory. Until then outlook is slight bearish.

If, major support level of 15200 level is broken with good volume and big candle, so that will be considered as the defeat of Bulls, then Bears will take market further down to the important level of 15000.

The easiest Options trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Published on: Jun 22, 2022, 6:22 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates