Today Nifty50 Index opened at 18682.35 and closed almost flat at 18691.20, while the Nifty MicroCap 250 Index opened at 12879.90 touching a high of 12989.40, and eventually closed at 12945.35. Its 52-week highs and lows are 13147.80 and 5802.95.

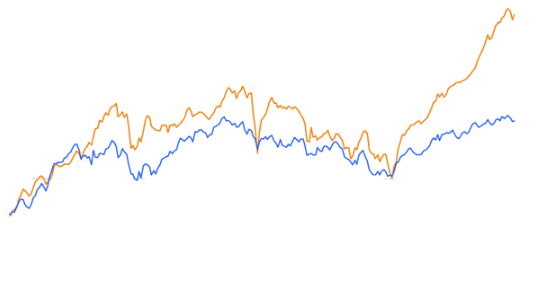

During the last year, the index has delivered a return of 41.16%, whereas the Nifty50 index has generated a modest return of only 18.9% in the same period despite trading around the all-time high of 18887.60.

| Index | Returns % | |||

| 1 month | 3 Months | 6 Months | 1 Year | |

| Nifty50 | 0.4% | 10.1% | 3.0% | 18.9% |

| Nifty MicroCap 250 | 7.9% | 29.5% | 16.2% | 41.1% |

It can be clearly examined that MicroCap 250 Index has outperformed the Nifty50 index across all the time frames. Additionally, it has generated a return of around 41% in the last year. Below is the graphical presentation of both indices. Orange depicts MicroCap 250, while blue is for Nifty50.

Following are the companies that generated a return of over 200% in the last year:

Following are the companies that generated a return of over 200% in the last year:

| Company Name | CMP (Rs) | M Cap (Rs Cr) | Industry / Sector | 52-Week High (Rs) | 3-Month Return % | 1 Yr Returns % |

| Power Mech Projects | 3,171.0 | 4,741.6 | Civil Construction | 3,450.0 | 36.3 | 274.0 |

| Anant Raj | 169.9 | 5,381.6 | Construction | 172.4 | 40.7 | 222.7 |

| Mrs. Bectors Food Specialities | 824.9 | 4,851.7 | FMCG | 857.3 | 54.6 | 220.6 |

| Safari Industry | 2,940.0 | 6,998.0 | Luggage / Plastic Products | 3,071.3 | 48.7 | 217.2 |

| Ujjivan Financial Services | 384.8 | 4,685.2 | NBFC | 408.3 | 59.3 | 214.2 |

| Kirloskar Oil Engines Ltd | 393.0 | 5,674.9 | Engines | 443.1 | 1.8 | 201.1 |

Power Mech Projects tops the list with 274% return in the past year, is an engineering and construction company, it undertakes mega power projects and thermal power projects. In FY23, the company’s revenue grew by 30.11%, reached to Rs 1174 Crore while the Net profit is Rs 75 Crore.

Anant Raj is engaged in the development and construction of IT parks, hospitality projects, SEZs, complexes, malls, and residential properties. Additionally, the stock has generated a return of 222.7% in just one year. In FY23, the company’s revenue surged by 107%, reached to Rs 957 Crore while the Net profit is Rs 149 Crore.

Mrs. Bectors Food Specialities Ltd manufactures biscuits and bakery products. The company’s revenue surged by 38%, reached to Rs 1362 Crore in FY23. For the first time revenue touched a milestone of over Rs 1000 Crore. The net profit of the company is Rs 90 Crore.

Safari Industry Ltd, a manufacturer, and trader of luggage and luggage accessories achieved a remarkable milestone in FY23 as its revenue surged by 72%, reached to Rs 1,212 Crore. This marked the first time that the company revenue surpassed the significant milestone of Rs 1,000 Crore. Additionally, the company reported a net profit of Rs 125 Crore.

Ujjivan Financial Services Ltd is an NFBC that primarily focuses on microfinance, offering small-ticket loans to individuals and small businesses. In FY23, the company’s revenue grew by 47.62%, reached to Rs 4421 Crore while the net profit is Rs 1140 Crore.

Kirloskar Oil Engines Ltd manufactures and services diesel engines and diesel generator sets. It also makes diesel, petrol, and kerosene-based pump sets. The company’s revenue surged by 25%, reached to Rs 5024 Crore in FY23. The net profit of the company is Rs 332 Crore.

The stocks included in the Nifty Microcap 250 Index have been generating significant attention and activity in recent times. These stocks have been experiencing heightened trading volumes and increased investor interest, leading to a buzz in the market. Additionally, being a micro-cap, which is generally smaller in size has great potential to grow in the future and may generate a multibagger return to their investors.

The performance and movements of these stocks are closely watched by market participants as they can provide potential opportunities for growth and investment. Investors must keep these stocks on their radar.

Published on: Jun 26, 2023, 6:16 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates