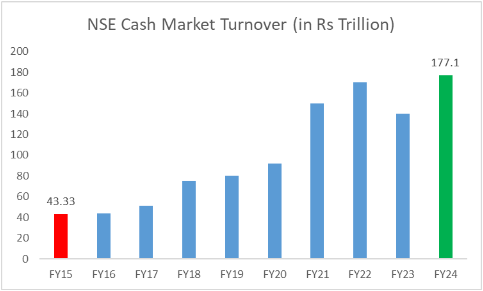

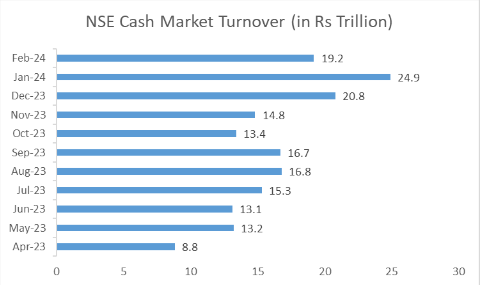

The National Stock Exchange (NSE) has once again demonstrated its prowess in the financial markets with a remarkable surge in cash market turnover for the fiscal year 2024. As of February 22, 2024, the NSE’s cash market turnover soared to an unprecedented high of Rs 177.1 trillion, shattering the previous record of Rs 165.7 trillion set in FY2022. This monumental achievement underscores the NSE’s pivotal role in driving liquidity and investor participation in India’s financial landscape.

Source: NSE

The journey to this historic milestone began with a solid foundation laid in the preceding fiscal years. In FY2023, the cash market turnover at NSE stood at Rs 133.1 trillion, marking a substantial increase of 33.1% from the previous year. This robust growth trajectory mirrored the evolving dynamics of India’s economy and capital markets, propelled by factors such as technological advancements, regulatory reforms, and growing investor confidence.

Source: NSE

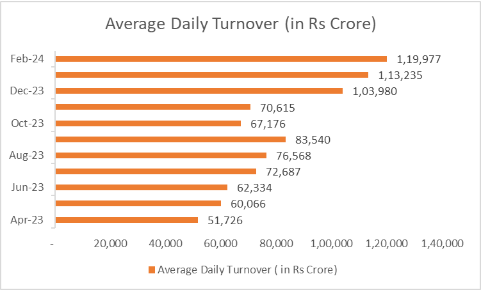

A key highlight of the FY2024 performance is the remarkable surge in the average daily turnover, reflecting the NSE’s increasing influence and market activity. From Rs 51,726 crore in April 2023, the average daily turnover has more than doubled, reaching an impressive Rs 1.2 trillion in February 2024. This exponential rise underscores the growing investor appetite, heightened trading volumes, and the NSE’s efficiency in facilitating seamless market transactions.

Source: NSE

The surge in cash market turnover not only reflects the NSE’s robust infrastructure and market mechanisms but also signifies the resilience and adaptability of India’s financial ecosystem amidst evolving global dynamics. As one of the leading stock exchanges in the world, the NSE continues to play a pivotal role in channelling investments, fostering capital formation, and driving economic growth.

Looking ahead, the NSE remains committed to further enhancing market efficiency, transparency, and accessibility to ensure a conducive environment for investors and market participants. With innovative initiatives, strategic partnerships, and a steadfast commitment to excellence, the NSE is poised to continue its trajectory of growth and contribute significantly to India’s journey towards becoming a global financial powerhouse.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Feb 26, 2024, 2:03 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates