In a world where financial landscapes evolve rapidly, open-end mutual funds have emerged as a versatile and accessible option for investors. These funds play a pivotal role in the investment arena, presenting opportunities for individuals to actively participate in financial markets.

At their heart, open-end mutual funds, commonly referred to as mutual funds, act as financial intermediaries. They pool funds from a diverse array of investors and strategically deploy these resources across a range of assets, including stocks, bonds, and securities. One of their distinctive features is their open-ended nature, meaning they issue an infinite number of shares at the net asset value (NAV) price, recalculated at the close of each trading day.

Investing in open-end mutual funds is a straightforward process. Begin by selecting a fund that aligns with your financial goals and risk tolerance. These funds offer the flexibility of direct investment through the fund company or via brokerage accounts. While no-load funds typically do not impose upfront sales charges, it’s imperative to be aware of account setup or transaction fees, which can vary based on the chosen investment platform.

A comprehensive review of the fund’s prospectus is crucial to gain insight into the details of fees before making any investment decisions.

| SCHEME NAME | START DATE | END DATE | REMAINING DAYS |

| Kotak FMP-323-90D(G) | 26-10-2023 | 01-11-2023 | 1 Day |

| Kotak FMP-323-90D(IDCW) (DP) | 26-10-2023 | 01-11-2023 | 1 Day |

| Bajaj Finserv Banking and PSU Fund-Reg(G) | 25-10-2023 | 06-11-2023 | 6 Days |

| Bandhan Nifty Alpha 50 Index Fund-Reg(G) | 25-10-2023 | 06-11-2023 | 6 Days |

| Helios Flexi Cap Fund-Reg(G) | 23-10-2023 | 06-11-2023 | 6 Days |

| Bajaj Finserv Banking and PSU Fund-Reg(IDCW) (DP) | 25-10-2023 | 06-11-2023 | 6 Days |

| Bandhan Nifty Alpha 50 Index Fund-Reg(IDCW) (DP) | 25-10-2023 | 06-11-2023 | 6 Days |

| Helios Flexi Cap Fund-Reg(IDCW) (DP) | 23-10-2023 | 06-11-2023 | 6 Days |

| Kotak Consumption Fund-Reg(G) | 25-10-2023 | 08-11-2023 | 8 Days |

| Kotak Consumption Fund-Reg(IDCW) (DP) | 25-10-2023 | 08-11-2023 | 8 Days |

| Adity Birla SL Transportation and Logistics Fund-Reg(G) | 27-10-2023 | 10-11-2023 | 10 Days |

| Adity Birla SL Transportation and Logistics Fund-Reg(IDCW) (DP) | 27-10-2023 | 10-11-2023 | 10 Days |

As of 31st October, 2023

Under the IDCW option, the profits made by the mutual fund scheme are paid out to investors at regular intervals. Alternatively, in the Growth option, the profits made by the mutual fund scheme are reinvested in the scheme instead of paying out to investors.

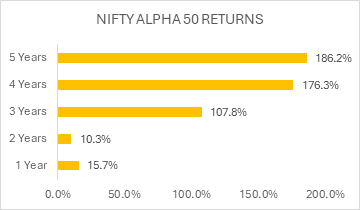

Nifty Alpha 50: Performance of 50 stocks with high Alphas in the last one year.

Weights of securities in the index are assigned based on the alpha values. Security with the highest alpha in the index is assigned the highest weight.

| SCHEME NAME | FUND MANAGER | MINIMUM INVESTMENT |

| Kotak FMP Series | Manu Sharma and Deepak Agrawal | Rs. 5,000 |

| Bajaj Finserv Banking and PSU Fund | Nimesh Chandan and Siddharth Chaudhary | Rs. 1,000 |

| Bandhan Nifty Alpha 50 Index Fund | Nemish Sheth | Rs. 1,000 |

| Helios Overnight Fund | Utsav Modi and Alok Bahl | Rs. 25,000 |

| Kotak Consumption Fund | Arjun Khanna and Abhishek Bisen | Rs. 5,000 |

| Adity Birla SL Transportation and Logistics Fund | Dhaval Joshi and Dhaval Gala | Rs. 500 |

The investment objective of the scheme is to generate income by investing in debt and money market securities, maturing on or before the maturity of the scheme.

The investment objective of the scheme is to generate income by predominantly investing in debt & money market securities issued by Banks, Public Sector Undertaking (PSUs), Public Financial Institutions (PFI), Municipal Bonds and Reverse repos in such securities, sovereign securities issued by the Central Government and State Governments, and / or any security. unconditionally guaranteed by the Govt. of India.

The investment objective of the Scheme is to replicate the Nifty Alpha 50 Index by investing in securities of the Nifty Alpha 50 Index in the same proportion / weightage with an aim to provide returns before expenses that tracks the total return of Nifty Alpha 50 Index, subject to tracking errors.

The primary objective of the Scheme is to seek to generate returns commensurate with low risk and provide a high level of liquidity, through investments made in debt and money market securities having a maturity of 1 business day including TREPS (Tri-Party Repo) and Reverse Repo.

The investment objective of the Fund is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity-related securities of companies engaged in consumption and consumption-related activities.

The investment objective of the Scheme is to achieve long-term capital appreciation by investing in equity and equity-related securities of companies following the transportation and logistics theme.

In conclusion, open-end mutual funds present a versatile and accessible investment option.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 31, 2023, 4:23 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates