Patanjali Foods, formerly known as Ruchi Soya, is a significant player in the FMCG industry, having been established in 1986. It specialises in producing and extracting edible oils and is recognized as a pioneer in the field of soya-based foods.

Following its insolvency in 2019, Patanjali Foods was acquired by Patanjali Ayurved, a company led by Baba Ramdev. Under the new ownership, the company underwent a rebranding process and emerged as Patanjali Foods.

In addition to edible oils, Patanjali Foods engages in the manufacturing and marketing of a wide array of consumer-packaged goods, including soya meals, noodles, cookies, honey, and various other products. This diversified range of offerings allows the company to cater to a broader customer base and fulfil different consumer needs

Adani Wilmar, a key player in the Indian FMCG sector, established in 1999 as a collaboration between the Wilmar Group and the Adani Group, stands as a prominent FMCG enterprise in India. The Wilmar Group, based in Singapore, and the Adani Group, led by Gautam Adani, each possess a 43.97% stake in the company, resulting in a combined promoter shareholding of 87%.

Adani Wilmar offers a diverse range of products, encompassing edible oils, wheat flour, rice, pulses, sugar, and packaged foods. The company has established a robust presence in the Indian market.

This article aims to analyse and compare the performance of two prominent players that have established a significant presence in the fast-moving consumer goods sector.

| Company Name | Adani Wilmar | Patanjali Foods |

| CMP Rs | 407.9 | 1,185.0 |

| Market Capitalisation Rs Cr | 53,013.8 | 42,896.4 |

| Price to Earnings | 87.0 | 48.4 |

| Revenue Rs Cr | 55,262.5 | 31,524.7 |

| OPM% FY23 | 2.9 | 4.1 |

| Net Profit Rs Cr | 607.2 | 886.4 |

| EPS FY23 Rs | 4.7 | 24.5 |

| Dividend Yield % | – | 0.4 |

| 1-Year Return % | -30.0 | 12.4 |

| ROCE % | 15.4 | 13.4 |

| ROE % | 7.9 | 11.0 |

| Cash Conversion Cycle (Days) | 9.0 | 54.0 |

| Inventory turnover ratio | 6.9 | 8.1 |

According to the provided data, Adani Wilmar Ltd has a higher market capitalisation of Rs 53,013.8 Crore compared to Patanjali Foods Ltd which has a market capitalisation of Rs 42,896.4. The shares of Adani Wilmar are trading at around Rs 407.9, while the shares of Patanjali are priced at Rs 1185, approximately three times the price of Adani Wilmar’s shares. Despite Patanjali trading at a higher share price, Patanjali’s price-to-earnings ratio is lower than that of Adani Wilmar which is currently at 48.4 times.

Both the companies from the FMCG space have single-digit operating margins, with Patanjali at 4.1% and Adani Wilmar at 2.9%, indicating relatively low profitability.

In terms of earnings per share, Adani Wilmar saw a 24% decline from Rs 6.22 to Rs 4.7 in FY23, while Patanjali Foods experienced a 10% decline from Rs 27.25 to Rs 24.49 in the same period. If we compare both companies, then Patanjali’s EPS is better comparatively.

Adani Wilmar demonstrates a higher return on capital employed of 15.4% compared to Patanjali Foods which is at 13.4%. However, Patanjali Foods outperforms in terms of return on equity with a rate of 11%.

The cash conversion cycle is an important metric for assessing working capital efficiency. Patanjali Foods has a significantly higher cash conversion cycle, taking around 54 days to convert initial capital investment into cash, whereas Adani Wilmar accomplishes this in just 9 days.

In terms of share performance, Patanjali Foods has generated a return of 20.5% in the last three months and 11.4% in the past year. Over the past ten years, the shares of Patanjali Foods have shown a staggering return of 10,900%. One important point to be noted for this 10-year return analysis, the shares of Patanjali Foods Ltd were trading earlier in the name of Ruchi Soya Ltd before the acquisition.

On the other hand, Adani Wilmar has generated a modest return of 3.12% in the last three months but has experienced negative returns of 30.2% and 29.74% over the past six months and one year, respectively.

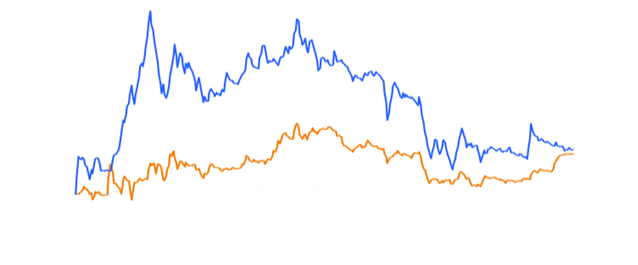

The following chart presents a comparison of stock prices between Adani Wilmar and Patanjali Foods. The blue colour represents Adani Wilmar, while the orange is Patanjali Foods.

Published on: Jul 4, 2023, 7:10 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates