PGIM India Mutual Fund launched a new fund, PGIM India Retirement Fund (NFO), on March 26, 2024. This open-ended solution-oriented fund aims to provide investors with capital appreciation and income for their retirement through a mix of equity, equity-linked instruments, REITs, InvITs, and fixed-income securities. The minimum investment amount is Rs. 5,000 and there is a lock-in period of 5 years or until the investor reaches 60 years old, whichever comes first. It is important to note that the scheme does not guarantee any returns.

The investment objective of the PGIM India Retirement Fund (NFO) is to provide capital appreciation and income to investors in line with their retirement goals by investing in a mix of securities comprising equity, equity-related instruments, REITs and InvITs, and fixed-income securities. However, there is no assurance that the investment objective of the scheme will be achieved. The Scheme does not guarantee/indicate any returns.

This NFO of PGIM India Retirement Fund is suitable for investors who are seeking long-term capital appreciation and investment predominantly in equity and equity-related instruments

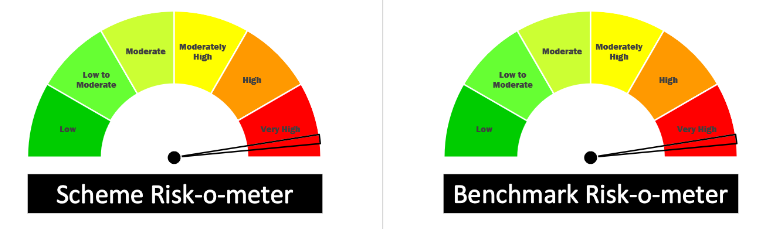

Risk-o-meter:

| Investments | Indicative Allocation | Risk Profile |

| Equity & equity-related instruments | Minimum 75% – Maximum 100% | Very high |

| Debt Securities and Money Market

Instruments, including cash, Triparty Repo and equivalent and units of mutual funds |

Minimum 0% – Maximum 25% | Low to Medium |

| Units issued by REITs and InVITs | Minimum 0% – Maximum 10% | Medium to High |

The performance of the PGIM India Retirement Fund is benchmarked against the S&P BSE 500 TRI.

Mr. Vinay Paharia, Chief Investment Officer overseeing the equity portion, holds a Bachelor’s degree in Commerce (B.Com.) and a Master’s in Management Studies (M.M.S.). With a cumulative experience exceeding 20 years in the Indian financial markets, his expertise lies predominantly in equity research and fund management.

On the other hand, Mr. Puneet Pal, responsible for managing the debt, REITs, and InVITs portion, serves as the Head of Fixed Income. Aged 47 and holding an MBA in Finance from Symbiosis Institute of Business Management, Pune, Mr. Pal boasts over two decades of dedicated involvement in the debt markets within the mutual fund domain.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as of – 22-03-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| All Retirement Funds | – | – | – | 2.61 | 19.28 | 1.63 | 15.99 | 12.12 |

| HDFC Retirement Savings Equity Regular Plan | 07-02-2016 | 4705.30 | 1.82 | 4.01 | 32.62 | 8.57 | 42.52 | 18.26 |

| UTI Retirement Fund – Regular Plan | 26-12-1994 | 4309.18 | 1.65 | 2.72 | 16.69 | 5.28 | 18.53 | 12.38 |

| Nippon India Retirement Wealth Creation Scheme | 05-02-2015 | 2991.30 | 1.96 | 3.62 | 31.07 | 1.62 | 32.13 | 0.6 |

| SBI Retirement Benefit Aggressive Plan Regular Plan | 05-02-2021 | 2153.49 | 2 | 0.08 | 26.72 | 7.75 | – | – |

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Mar 26, 2024, 2:44 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates