Polymatech Electronics, India’s first opto-semiconductor chip manufacturer submitted its draft red herring prospectus to the capital markets regulator Sebi on October 5, 2023. The main objective of this submission is to raise funds through an initial public offering.

As per the details, the company plans to raise funds by issuing new equity shares with a face value of Rs 10 each, totalling an issue size of up to Rs 750 crore through the book-building route. Furthermore, there will be no offer-for-sale involved in this IPO.

The company mentioned its intention to use the net proceeds generated from the issue to acquire new machinery, thereby improving, and expanding its existing facility located in Oragadam, Kancheepuram, Tamil Nadu.

About Opto-semiconductor

Opto-semiconductors are electronic devices that work with light. They can either emit light (like LEDs) or detect light (like photodiodes). These components are used in various technologies, from lighting and displays to sensors and communication systems, by harnessing the interaction between light and semiconductor materials.

It consists of a light-sensitive surface that absorbs and emits light. These can be constructed using different materials, such as silicon, germanium, and others.

Opto-semiconductors find application in a myriad of industries and technologies where light plays a crucial role. For example, LEDs, Smartphones, Automobiles, Medical devices, and even aerospace and defence systems.

In the Indian opto-semiconductor market, LEDs constitute the majority share, representing 40.6% of the total market, followed by image sensor opto-semiconductors.

Global and Indian Market Overview:

The global opto-semiconductor industry is expected to reach USD 59,224 million by 2028, growing at a CAGR of 5.2% from 2022 to 2028. This growth is expected to be driven by the expansion of industries such as the automotive sector, as well as lighting in both community areas and households. Furthermore, it is expected to be bolstered by the growth of AI. China holds a 36% market share in the same space whereas India holds a 9% share.

In 2018, the Indian opto-semiconductor market was valued at approximately USD 1,515 million, and by 2022, it had experienced a compound annual growth rate (CAGR) of 12%, reaching a total of USD 2,344 million.

Polymatech is India’s first opto-semiconductor chip manufacturer. The company is engaged in various aspects of the opto-semiconductor industry, including the design, production, packaging, and assembly of semiconductor chips, chip modules, sensors, LEDs (Light Emitting Diodes), Liquid Crystal Displays (LCDs), transducers, actuators, touch panels, Nanoelectronic components, and more.

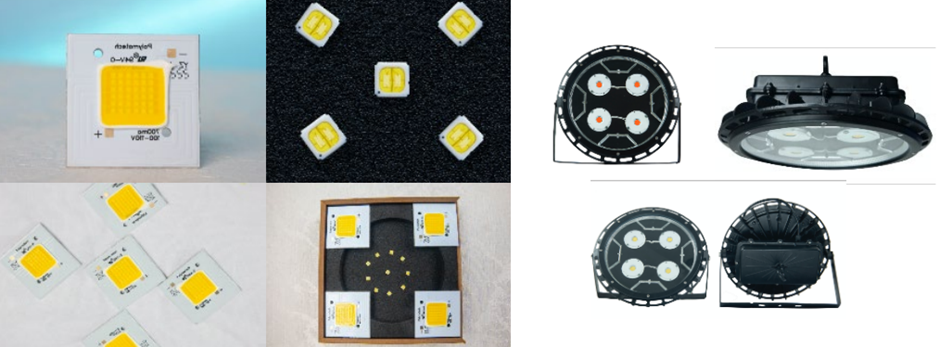

The company’s product is divided into two categories. Firstly, it specializes in the production of fully packaged Opto-Semiconductor Chips which are referred to as “Opto-Semiconductor Chips” or simply “Chips.” Additionally, it offers a range of Luminaries.

The company’s manufacturing facility is strategically in Tamil Nadu in Oragadam, Sriperumbudur, and Kancheepuram.

Company’s Product Images:

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 6, 2023, 1:18 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates