The Prestige Group has firmly established itself as one of the leading and most successful developers of real estate in India by imprinting its indelible mark across all asset classes. The Group has completed 285 projects spanning a developable area of 170 million square feet (mn sqft) and has 54 ongoing projects across segments, with a total developable area of 75 mn sqft. Further, it is planning 48 projects spanning 99 mn sqft and holds a land bank of over 710 acres as of June 2023. The company has been graded CRISIL DA1+ by CRISIL and enjoys a credit rating of ICRA A+.

The Nifty Realty Index is designed to reflect the performance of real estate companies that are primarily engaged in the construction of residential and commercial properties. As per NSE, Prestige has a 6.8% weightage in the Nifty Realty Index.

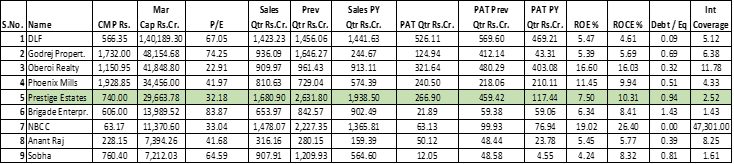

Following are some top companies from the Index:

Overall, as the numbers show, Prestige Estates, a dark horse in the real estate industry, has surged past its rivals to achieve the highest sales and one of the highest profit growths.

Prestige Estates has delivered a very strong performance for Q2FY24, with pre-sales increasing 102% year-over-year (YoY) to Rs 7,093 crore. This was driven by a 50% increase in sales volume (6.84/msf). Profit margins also improved quarter-over-quarter (QoQ). Collections are also stable at Rs. 2640 crore up 1% YOY. The average realisation of the company increased by 29% to 10,369/square feet on a YOY basis.

During the year, the company launched 14 new residential projects with a saleable area of 16.5msf (15.5msf in FY22) and six commercial project with a saleable area of 9.9msf (1.3msf in FY22).

Prestige Estates achieved sales of Rs 11,007 crore in the first six months of FY24, which is close to the sales of the entire FY23. The company has a promising pipeline of projects, including Prestige Ocean Towers at Marine Lines, Mumbai; Prestige City Hyderabad- Apartments; Prestige Pallava Gardens in Chennai, etc. The company is poised for continued growth throughout the rest of the year.

In Q2 FY24, Prestige Estates achieved significant launches, including Prestige Park Grove and Prestige Serenity Shores, which received overwhelming responses, contributing to 5000+ cr of the quarterly sales. Mumbai continues to perform well, garnering formidable sales. The company also inaugurated Kochi’s iconic new landmark- the Forum Thomsun Mall.

Strong performance of Prestige Estates in recent quarters is a testament to its strong fundamentals and its ability to execute its growth strategy. With a promising pipeline of projects and a management team committed to excellence, Prestige Estates is well-positioned to continue its growth trajectory in the years to come.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 11, 2023, 4:35 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates