PTC Industries, a company which was considered as a small-cap entity a few years back but now has grown multi-fold and given unimaginable returns to its shareholders, is one such stock market performer which has made its presence felt in a big way. The company is engaged in the manufacture of components in metal, for supercritical and critical applications, for various sectors like shipping, marine, liquefied natural gas (LNG), oil & gas and defense, etc.

PTC Industries, a company with a rich history of providing high-quality castings, machined components, and fabricated parts, has recently reached a significant milestone. At the start of the trading session today, its stock opened at Rs 8,590 per share, compared to the previous day’s closing figure of Rs 8,377.30 on the BSE. As the day progressed, the shares soared to Rs 9,869.40 per share and even touched an all-time high of Rs 10,000. This remarkable rise from around Rs 100 per share in 2020 signifies a multibagger return of nearly 9,900% over just 1,536 days, placing it among the top gainers on the NSE.

PTC Industries has shown impressive financial growth, particularly in the past year. In Q4 FY24, the company reported a revenue of Rs 72 crore, marking a 16.36% increase from Rs 62 crore in the same quarter the previous year. Its operating profit for Q4 FY24 stood at Rs 22 crore, up from a net profit of Rs 18 crore the previous year, while net profit was Rs 15 crore for the quarter. Annually, PTC Industries reported a revenue of Rs 257 crore for FY24, up from Rs 219 crore in FY23, with a net profit of Rs 42 crore for FY24.

PTC Industries is renowned for its expertise in producing castings, machined components, and fabricated parts for critical applications worldwide. The company offers a diverse range of materials, including Titanium Alloys, Alloy Steel, Stainless Steel, Duplex and Super Duplex Stainless Steel, Creep Resistant Steel, Heat Resistant Steel, Nickel-Based Alloys and Cobalt-Based Alloys

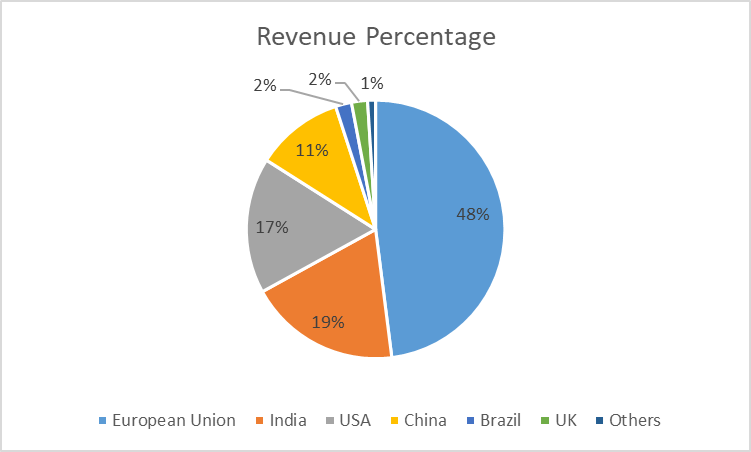

The company exports over 75% of its products, serving markets across Europe, North America, and other regions. In FY22, the geographical revenue split was as follows:

PTC Industries’ clientele includes global giants such as Kongsberg (previously Rolls Royce), Flowserve, Metso, Emerson, Siemens, and Alstom.

PTC Industries operates state-of-the-art manufacturing facilities in Uttar Pradesh and Gujarat, featuring two foundries, two CNC machine shops, and a DSIR-approved R&D lab. The company invested Rs 190 crore between 2015-2020 to establish a production unit capable of manufacturing castings up to 6 tonnes, utilizing advanced technologies like RepliCast, RapidCast, ForgeCast, PrintCAST, and Titanium Cast.

To strengthen its foothold in the defense and aerospace sectors, PTC Industries formed a subsidiary, Aerolloy Technologies Limited (ATL), in FY21, focusing on high-quality cast components for both domestic and international markets. The company invested approximately Rs 13.5 crore in ATL during FY22.

Furthering its innovation drive, PTC Industries spent Rs 1.8 crore on R&D (~1% of sales) in FY22 and successfully completed its Technology Development and Demonstration Programme (TDDP) for the commercialization of RapidCast™ technology for manufacturing stainless steel castings up to 6,000 kilograms.

PTC Industries has made significant strides by becoming the first company in India to introduce Titanium Casting technology, a move poised to substitute imports and boost self-reliance in critical manufacturing sectors. In H1FY24, the company enhanced its aerospace and defense manufacturing capabilities by acquiring advanced equipment like a Vacuum Arc Remelter, an Electron Beam Cold Hearth Remelting furnace, a Plasma Arc Melting furnace, and a Vacuum Induction Melting furnace.

Moreover, PTC Industries was allotted 50 acres of land next to the Brahmos facility by UPEIDA in the Lucknow node of the UP Defence Industrial Corridor, further solidifying its strategic positioning.

To fuel its growth, PTC Industries undertook a rights issue worth Rs 785.86 lakh in the ratio of 3:2 and issued 2,89,600 equity shares and 6,30,170 fully convertible warrants on a preferential basis, raising a total of approximately Rs 214 crore. Additionally, the company issued 1,80,000 equity shares on a preferential basis at an issue price of Rs 2,500 per share, aggregating to around Rs 45 crore. These funds are primarily being utilized for capital expenditure.

PTC Industries is aggressively exploring new markets and products, translating these efforts into viable commercial production. The company is also focusing on import substitution for critical components, paving the way for self-reliance in manufacturing across industries such as aerospace and space exploration.

PTC Industries’ journey from Rs 100 to Rs 10,000 per share is a testament to its robust business model, strategic investments, and relentless focus on innovation and market expansion. With a solid financial foundation, state-of-the-art manufacturing capabilities, and a commitment to excellence, PTC Industries is well-positioned to continue delivering exceptional value to its shareholders and driving growth in critical industries worldwide.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 3, 2024, 6:14 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates