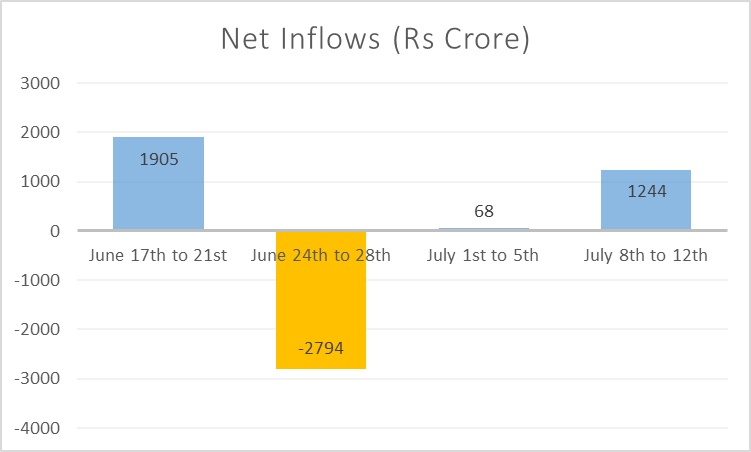

Quant Mutual Fund experienced a significant shift in investor sentiment following front-running allegations. During the week of June 17th to 21st, the fund saw a substantial net inflow of Rs 1905 crore. However, the subsequent week from June 24th to 28th, there was a reversal due to the news of the front-running case in quant mutual fund, with net outflows amounting to Rs 2794 crore.

The first week of July, from the 1st to the 5th, marked a slight recovery with a modest net inflow of Rs 68 crore. This positive trend continued into the week of July 8th to 12th, where net inflows reached Rs 1244 crore. These figures indicate that, despite the initial outflows, investor confidence in Quant Mutual Fund appears to be returning.

Source: Value Research Estimates

The Securities and Exchange Board of India (SEBI) is investigating a suspected case of front-running involving Quant Mutual Fund, which manages Rs 93,000 crore. This has caused concern among many investors. SEBI conducted raids at Quant’s headquarters in Mumbai and at the Hyderabad locations of suspected beneficiaries. They seized mobile phones, computers, and other digital devices to uncover who might have leaked confidential information from the asset management company for illicit profits.

Front-running occurs when someone, often an insider or broker, trades based on privileged information before others can act. For instance, if a broker knows a big client will buy many shares and buys some shares for himself before the client’s transaction, it is front-running. This practice is illegal and prohibited under SEBI regulations.

In the Quant Mutual Fund case, SEBI’s surveillance indicated possible front-running by entities with insider knowledge of Quant’s trades. It is suspected that Quant executives with information about the size and timing of orders may have leaked this to beneficiaries. The AMC has stated it will fully cooperate with SEBI and provide the necessary data regularly.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 22, 2024, 4:36 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates