RBM Infracon Limited is primarily engaged in the engineering, execution, testing, commissioning, operation, and maintenance of mechanical and rotary equipment for oil and gas refineries, cement, fertilizers, petrochemicals, and coal or gas-based power plants. Today, the company experienced a significant surge in its share price.

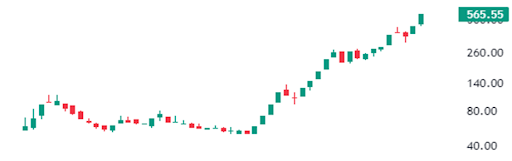

At the start of the day’s trading session, the stock opened at Rs 565.50 per share, indicating an approximate 4.98% increase compared to the previous day’s closing figure of Rs 538.65 per share on the NSE. As of the time of writing this article, the shares are currently at Rs 565.50 per share on the NSE. The stock has reached the upper circuit price limit of 5%, reflecting strong demand in the market with no sellers willing to offer shares, resulting in potential buyers being unable to make purchases, leading to disappointment among buyers.

The company’s current market capitalisation stands at Rs 477 crore, and the stock has generated an impressive return of 251% during the past three months and around 930% return in the past one year.

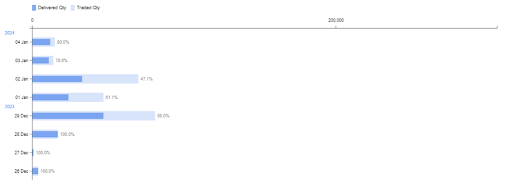

Furthermore, the company’s stock was listed on January 4, 2023, and has completed one year of its listing journey as of yesterday, January 4, 2024. It closed at Rs 538.65 on the NSE and has generated an impressive multibagger return of around 1400% over its final issue price of Rs 36 per share.

RBM Infracon Limited is an India-based company that operates as a specialist contractor providing construction, maintenance, and turnaround services to oil and gas refineries, petrochemicals, fertilizers, gas cracker plants, coal/gas/WHR-based power plants, chemicals, cement, fertilizers, sugar plants, paper plants, irrigation, and other allied sectors.

Its activities encompass the fabrication and erection of structural work on an EPC basis, tankage work, fabrication and erection of piping (such as CS/SS/Alloy steel, including above ground and underground), ARC maintenance of refineries, petrochemicals, fertilizers plants, turnaround (Shutdown) of power, refineries, and petrochemicals, blasting and painting for various industries, insulation and refractory work, electrical and instrumentation services, and wagon tipplers, conveying systems (raw material handling). Additionally, it is engaged in catalyst loading and unloading in all types of reactors in oil refineries and petrochemical plants.

In the second quarter of FY24, the company reported revenues of Rs 39.07 crore, reflecting a growth of 67% YoY compared to the same quarter in the previous year, when the revenue stood at Rs 23.36 crore. The company posted an operating profit of Rs 4.07 crore for the quarter, in contrast to an operating profit of Rs 1.47 crore in the corresponding quarter of the previous year.

Furthermore, the company reported a net profit of Rs 2.15 crore, compared to a net profit of Rs 0.65 crore in the same period last year. The company’s net profit has shown a significant growth of around 230% YoY this quarter. The company’s ROCE and ROE ratios are 19.9% and 18.5%, respectively, while the stock is trading at a PE of 123 times in the market.

In terms of ownership, the promoter holds 72.45% while the remaining 27.54% is held by public investors, as per the most recent update.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 5, 2024, 11:08 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates