Small and medium enterprises (SMEs) have achieved a significant milestone in raising approximately ₹3,000 crore through an initial public offering (IPO) in the first half of 2024. This fundraising activity marks the highest sum of money raised within the first six months of the calendar year 2024, since the inception of the platform in 2012 on the BSE’s SME platform.

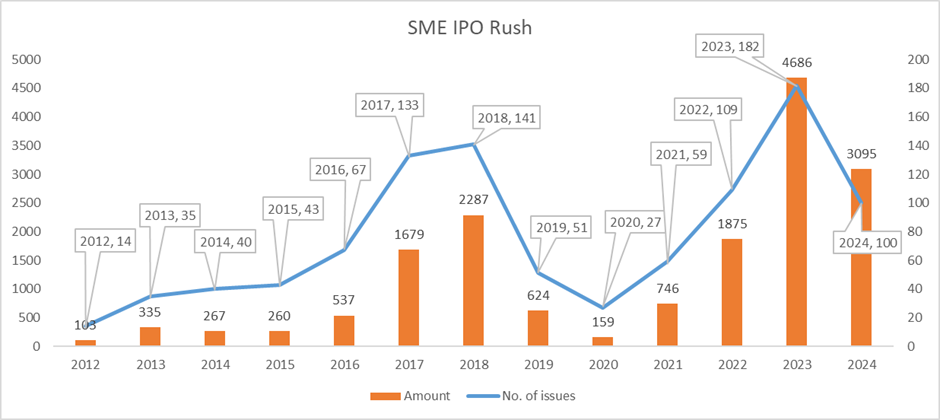

The SME IPO platform has seen significant growth over the years. Here’s a look at the number of issues and the amounts raised annually:

Source: NSE, SEBI.

The BSE SME platform has shown impressive growth in recent years, rising by 79.6% in 2024, 96% in 2023, and 42% in 2022.

Retail investor enthusiasm, driven by the strong post-listing performance of SME stocks, has been a significant factor behind the robust fundraising in the SME segment. Initially, high net-worth individuals (HNIs) and savvy investors turned their attention to SME IPOs due to their promising returns. This shift in focus has been supported by an increase in dematerialised accounts across the country, indicating greater direct participation from retail investors.

Differences exist between the SME platform and the Mainboard, thereby serving small ventures that wish to raise lower financial limits. However, unlike the Mainboard, the SME platform was brought into existence in 2012 to provide for distinct laws. For example, the smallest size should be around ₹1 lakh when it comes to SME issues, whereas it should be ₹15,000 as far as those of Mainboard are concerned.

The high demand for SME IPOs has raised concerns about potential manipulation in trading and stock issuance. This has prompted the Securities and Exchange Board of India (SEBI) to address these issues. Stock exchanges have introduced additional surveillance measures for SME stocks and tightened criteria for migration to the mainboard.

Merchant bankers need to exercise greater diligence in selecting suitable companies. They may see policy adjustments for SME IPOs concerning minimum thresholds or enhanced oversight of the secondary market.

Despite these measures, market analysts urge SEBI to take concrete steps to prevent substantial fluctuations in SME IPOs. We have seen warnings in futures and options. In SME IPOs, rapid gains on the first day of debut and swift allotments have accelerated turnover. Investors often overlook warnings when there are robust returns unless some of these companies fail despite oversubscriptions.

The higher ticket size, intended to discourage retail investors, no longer acts as a deterrent. Many investors are now comfortable bidding amounts exceeding ₹1 lakh. Experts believe this threshold is unlikely to increase significantly from these levels.

The first half of 2024 has set a new benchmark for SME IPO fundraising. While the sector faces regulatory challenges and market fluctuations, the growing interest from retail and HNI investors signals a robust future for SME investments. As always, potential investors are advised to thoroughly understand a company and its prospects before committing to long-term holdings.

Stay ahead with the latest on Upcoming IPOs! Discover promising opportunities and get ready to invest.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 14, 2024, 3:07 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates