In May 2024, retail investors faced significant market volatility, leading to a record number of systematic investment plan (SIP) stoppages. Data from the Association of Mutual Funds in India (AMFI) showed that 43.9 lakh SIPs were either discontinued or had their tenures completed. This surge in stoppages coincided with the Lok Sabha elections, which brought uncertainty and heightened market fluctuations.

Despite the market turmoil, new SIP registrations remained robust. In May, 4.97 million new SIPs were registered. However, the number of SIPs discontinued or completed reached an unprecedented level, resulting in a SIP stoppage ratio of 88.4%. This was a substantial increase compared to the previous months, where the stoppage ratios were 52% in April and 54% in March.

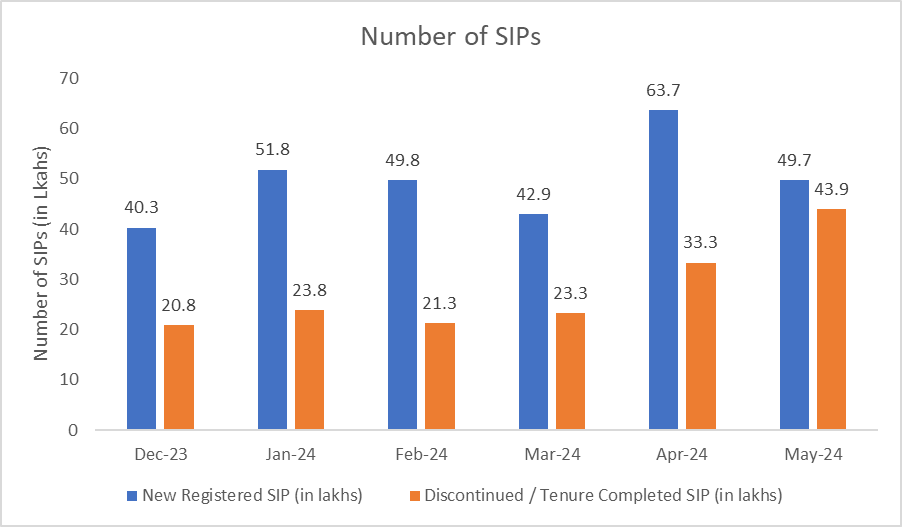

Here’s a detailed look at the SIP data for the last six months:

| Month | New Registered SIP (in lakhs) | Discontinued / Tenure Completed SIP (in lakhs) |

| Dec-23 | 40.3 | 20.8 |

| Jan-24 | 51.8 | 23.8 |

| Feb-24 | 49.8 | 21.3 |

| Mar-24 | 42.9 | 23.3 |

| Apr-24 | 63.7 | 33.3 |

| May-24 | 49.7 | 43.9 |

Source: AMFI

The increased volatility in May, driven by the ongoing Lok Sabha elections, caused significant market swings. The Sensex fluctuated by 4,143.67 points, or 5.8%, ranging from a high of 76,009.68 points to a low of 71,866.01 points. The BSE Mid-cap and Small-cap indices experienced even sharper movements, gyrating 9.3% and 8.7% respectively.

The rising discontinuations from March can also be attributed to valuation concerns. The Securities and Exchange Board of India (Sebi) had raised concerns about overvaluations, especially in small-cap funds, and directed stress tests for this category. As a result, March saw net outflows in small-cap mutual funds for the first time since September 2021.

Despite the high stoppage ratio, SIP inflows into equity mutual funds reached a record ₹20,904 crore in May 2024, compared to Rs 14,749 crore in May 2023. This indicates that while many investors discontinued their SIPs, overall inflows continued to grow, reflecting a mixed sentiment in the market.

In FY24, small-cap funds saw net inflows of Rs 40,000 crore, with assets under management (AUM) increasing by 82.5% due to higher inflows and mark-to-market gains. In contrast, large-cap funds’ AUM rose by 33.3%.

Industry experts advise investors to maintain their SIPs despite short-term market volatility. Advisors emphasized that investors should align their portfolios with their risk profiles but continue their SIPs to benefit from long-term gains.

Conclusion

The record-high SIP stoppages in May highlight the impact of market volatility on investor behavior. While the market faced significant fluctuations due to the elections, the underlying trend of increasing SIP registrations and inflows into equity mutual funds suggests a resilient investor base. Financial advisors continue to recommend maintaining SIPs to navigate through short-term volatility and achieve long-term financial goals.

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Published on: Jun 12, 2024, 6:01 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates