What is common between Omarosa Manigault Newman, Steve Bannon, Rex Tillerson and Gary Cohn? If you are still groping for an answer; all of them were close aides of Donald Trump but had either resigned or were asked to leave in the last 6 months. Normally, exits from the hallowed portals of White House are few and far between. The speed at which officials at senior positions are either moving out or being moved out, gives the current Trump government a dubious distinction. In fact, there have been nearly 20 exits of senior officials since Trump took charge in 2017, something hitherto unheard of.

While seasoned names like Rex Tillerson and Steve Bannon will leave a gap, from the markets point of view the one exit that really sent the markets into a tailspin was the exit of Gary Cohn. Gary Cohn was not only Trump’s top economic advisor but also an ex-Goldman Sachs hand who understood the nuances of the market better than anyone else. Interestingly, the resignation of Gary Cohn owes much to the differences with Trump over the imposition of import tariffs. Gary Cohn was brought in specifically to help Trump shape his policy on taxes and tariffs. How will Gary Cohn’s exit affect markets in general and commodities in particular?

It is believed that Gary Cohn’s exit had to do with his failure to prevent the Trump government from imposing predatory tariffs on Steel and Aluminium. The Trump administration was in favour of 25% import duty on steel and 10% on aluminium. Gary Cohn was averse to the idea as he believed that it would be detrimental to the user industries of steel and aluminium within the US and would also invite retaliatory tariffs from China and the EU. Trump has exempted Canada and Mexico from the tariffs but that only means that these two nations will have to adhere to a watered down NAFTA agreement that would be more suitable to the US. Cohn was of the view that Trump’s trade policy should be more liberal and aimed at making US industry competitive and working on its competitive advantages rather than giving protection to inefficient producers of steel and aluminium in America. This difference in approach was what eventually led to the departure of Gary Cohn from Donald Trump’s inner circle.

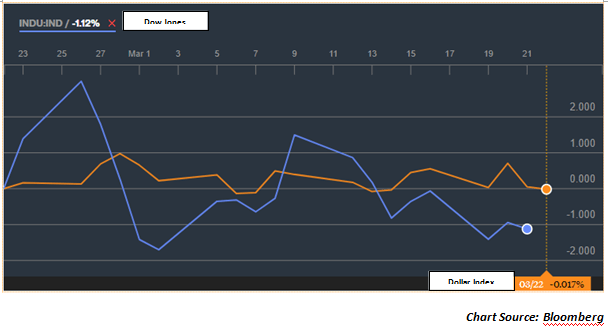

As market strategists summed it up eloquently, “Of all of Trump’s aides, the markets had supreme confidence in the wisdom on Gary Cohn in sustaining the principles of free trade and free markets in the US”. With Cohn’s exit, that confidence has been shaken and not surprisingly the US dollar and the US equity markets reacted nervously. The chart below captures the US Dollar Index and the US Dow Jones returns in the last 1 month…

The last month has been negative for the US$ and for the Dow Jones with the correction being quite sharp after the exit of Gary Cohn in early March.

Strategists are also worried about the impact of Gary Cohn’s exit on the bond markets. Bond prices are likely to correct for 2 reasons post Gary Cohn’s exit. Firstly, the exit almost affirms that the tariffs will be implemented. Higher tariffs on steel and aluminium will mean higher imported inflation and that will push up bond yields of 10-year benchmark close to 3% and depress bond prices further. Secondly, the US tariffs could invite Chinese selling of US Treasuries which could depress prices further in the absence of demand. This problem becomes pronounced as China holds the world’s largest chest of US treasuries to the tune of over $1.2 trillion. Most analysts called Gary Cohn the true blue grown-up in the White House and his departure opens the doors for a series of unstable measures by the Trump government. What will be the impact of Cohn on commodities?

The immediate impact of a trade war is expected to be on the price of crude oil. After touching a high of $70/bbl, Brent Crude has already corrected down. The view is that post Cohn’s departure, the tariff imposition on steel and aluminium is likely to go through and that will mean retaliatory tariffs from the EU and China, lower global demand and falling demand for oil. We have seen in the past that weak demand can really depress oil prices rapidly and that could repeat if the tariffs become a reality. That is something the markets need to be wary of.

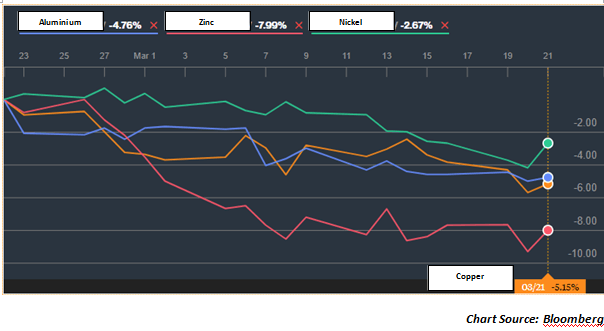

Just as oil has a worry that prices could fall due to a demand slack, there is concerns on the front of industrial metals too. Consider the chart below…

The price trend of copper, aluminium, zinc and nickel (the four principal industrial metals) shows deep cuts in prices. The reasons are not far to seek. These are industrial inputs and any slowdown in demand and production will lead to depressed demand for industrial metals. That is showing in the price trend. Like oil, industrial metals are also vulnerable to a sharp fall in industrial output and a consequent depression in demand for industrial inputs. What about gold prices?

Gold prices have held firm above the $1300/oz mark and that is a sign that there are widespread expectations of a tumult in other industrial markets. If Trump goes ahead and officially implements these tariffs then we could see retaliation from the EU and China. In the midst of the tumult we could see gold prices appreciating and that could be the first sign that industrial commodities could be in for a tough time ahead! For now, the real cost of Cohn’s exit is still being calculated…

Published on: Mar 28, 2018, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates