The Reserve Bank of India (RBI) has recently released its bi-monthly report (May 2024) about Consumer Confidence Survey (CCS).

The survey report indicates the perceptions of people (current vs. that of last year) and their expectation of how things would be after one year. The survey is done across 19 cities. The current survey was conducted during the period May 2-11, 2024, the sample had around 6,083 respondents, of which females constituted around 52.7 percent of this sample.

The survey consists of multiple parameters that are tracked on a periodic basis to arrive at the general perception. These are – the general economic situation, employment scenario, overall price situation, income and spending.

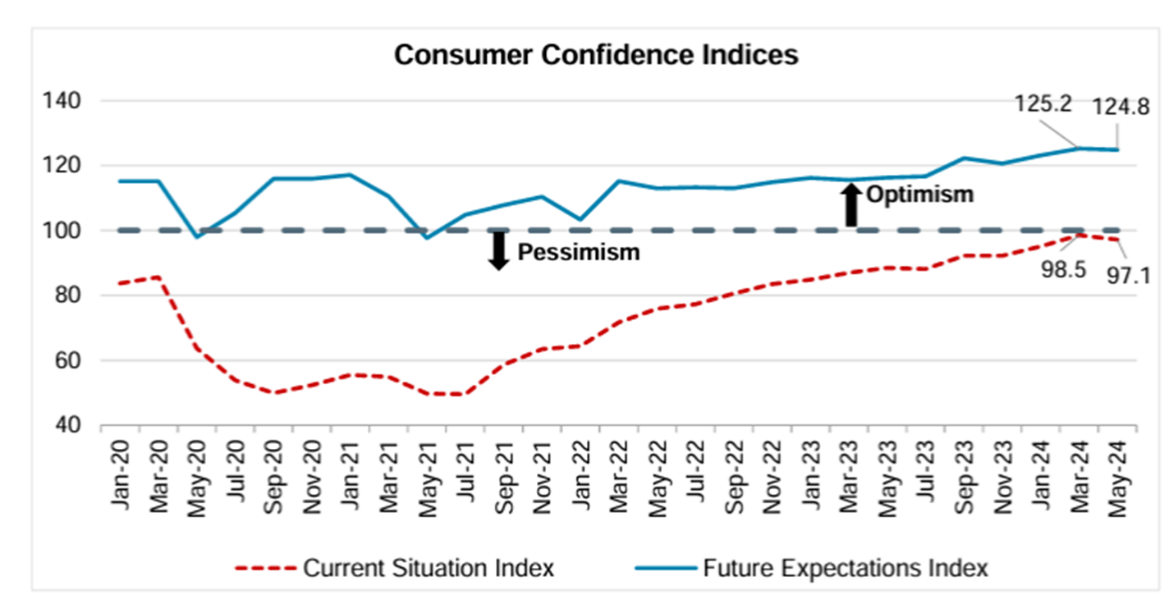

The current survey report released by RBI suggests that for the year ahead , the consumer confidence is high and optimistic However, there is a marginal dip in the level of confidence vs. previous survey round due to general economic situation and employment prospects ( as shown in the graph below).

The future expectations index (FEI) stood at 124.8 in May 2024 (vs.125.2 in the previous survey round).

Consumers expect higher rise in overall spending over the next one year vis-à-vis the previous survey round; more respondents expect an increase in both essential and non-essential spending.

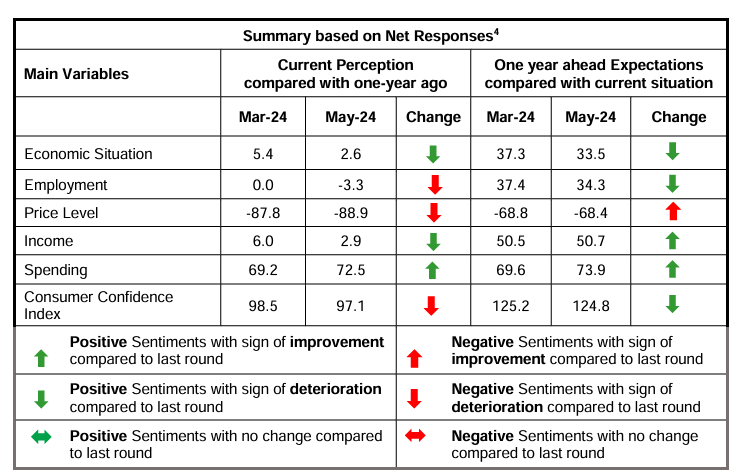

The ‘Net response’ given in the above table is the difference (in %) optimism and pessimism, reported in the survey. The value ranges between -100 and 100. Value that is above 0 implies expansion/ optimism, while values below zero indicate contraction/ pessimism.

Given below is the data as released by RBI as part of the Consumer Perception Survey (May 2024) on two important parameters i.e. perception and expectations on the General Economic Situation and Employment.

| Perceptions and Expectations on the General Economic Situation | ||||||||

| Survey Round | Current Perception | One Year Ahead Expectation | ||||||

| Increased | Remained Same | Decreased | Net Response | Will Increase | Remain Same | Will Decrease | Net Response | |

| May-23 | 32.1 | 19 | 48.9 | -16.8 | 51 | 15.8 | 33.2 | 17.8 |

| Jul-23 | 30.4 | 18.5 | 51.1 | -20.7 | 51.1 | 15.1 | 33.8 | 17.2 |

| Sep-23 | 36.1 | 19.9 | 44 | -7.9 | 56.8 | 15.1 | 28.1 | 28.6 |

| Nov-23 | 33.1 | 22.5 | 44.4 | -11.3 | 54.3 | 17.2 | 28.5 | 25.7 |

| Jan-24 | 37.5 | 22.3 | 40.2 | -2.7 | 59.2 | 15.3 | 25.5 | 33.7 |

| Mar-24 | 41.2 | 23.1 | 35.8 | 5.4 | 60.7 | 15.8 | 23.4 | 37.3 |

| May-24 | 40 | 22.6 | 37.4 | 2.6 | 59 | 15.6 | 25.4 | 33.5 |

| Perceptions and Expectations on Employment | ||||||||

| Survey Round | Current Perception | One Year Ahead Expectation | ||||||

| Increased | Remained Same | Decreased | Net Response | Will Increase | Remain Same | Will Decrease | Net Response | |

| May-23 | 32.1 | 20.2 | 47.7 | -15.6 | 52.1 | 18.7 | 29.2 | 22.9 |

| Jul-23 | 30.8 | 21 | 48.2 | -17.5 | 51.4 | 18.3 | 30.3 | 21.1 |

| Sep-23 | 34 | 21.8 | 44.2 | -10.2 | 55.8 | 18.1 | 26.2 | 29.6 |

| Nov-23 | 32.3 | 23 | 44.7 | -12.4 | 53.6 | 19.7 | 26.8 | 26.9 |

| Jan-24 | 35.3 | 23.4 | 41.3 | -6 | 58.7 | 17.4 | 24 | 34.7 |

| Mar-24 | 38.1 | 23.8 | 38.1 | 0 | 60 | 17.4 | 22.6 | 37.4 |

| May-24 | 36.8 | 23 | 40.2 | -3.3 | 58 | 18.3 | 23.7 | 34.3 |

Source: RBI

May 2024

Published on: Jun 20, 2024, 4:45 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates