The red metal has surged in recent weeks, driven by optimism over lower interest rates and stimulus measures from top importer China. Bets on tighter supplies due to refiner cuts in China and stricter sanctions on Russian metal exports have further fueled copper buying

The biggest boost to copper prices came from a short squeeze on the Comex Exchange last week. Heavy buying of long-term copper contracts pushed prices up significantly, causing short positions to scramble. U.S. copper futures saw a notable spike, with traders racing to secure copper supplies for the July contract.

Expectations that reduced mining output won’t keep pace with future copper demand, driven by the global push for green energy and electrification, have fueled long positions. Additionally, stimulus measures in China, the world’s largest copper importer, have boosted bullish bets. China recently loosened property market restrictions and began a massive 1 trillion-yuan (USD 138 billion) bond issuance.

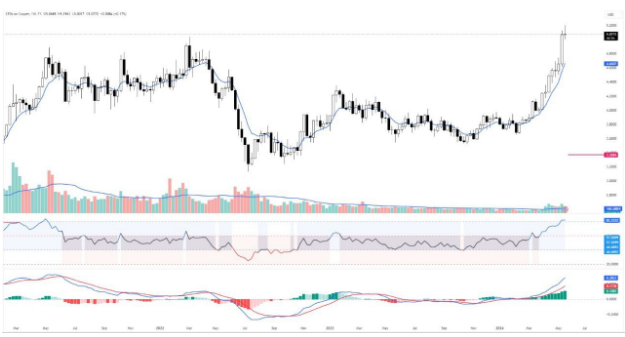

After last week’s remarkable 9% surge, copper has reached another high at USD 5.19, representing a substantial 37% increase over the past year. However, technical indicators are now signaling a potential retracement. The Weekly RSI is currently in the extreme zone, suggesting a possible pullback towards USD 4.65. On the daily chart, the retracement seems to have been initiated as indicated by the formation of a shooting star candle. Moreover, both the daily RSI and Stochastic RSI are reacting from the extreme zone, indicating overbought conditions. The CCI also indicates that copper has reached a top. Should the price decline below USD 4.84, it may trigger a sharp correction. Despite these indicators, the MACD still demonstrates bullish momentum. Given these technical signals, it is advisable to refrain from initiating fresh buying positions and instead await a base formation, preferably around the USD 4.7 to USD 4.5 range.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: May 21, 2024, 11:19 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates