RVNL, a prestigious Navratna Central Public Sector Enterprise (CPSE) operating under the aegis of the Ministry of Railways, Government of India, was conceived to address the critical infrastructure lacunae prevalent within the extensive Indian Railways network. The inception of the ambitious National Rail Vikas Yojana (NRVY) dates back to August 15, 2002, when the revered late Shri Atal Bihari Vajpayee, then Prime Minister, officially announced this visionary project during his historic address from the iconic Red Fort. NRVY was formally launched on December 26, 2002, with RVNL entrusted to spearhead its multifaceted initiatives. Subsequently, RVNL was established as a 100% government-owned Public Sector Unit (PSU) under the esteemed Ministry of Railways on January 24, 2003. RVNL’s central objectives encompass sourcing additional financial resources and expediently executing projects with a primary focus on enhancing and modernizing rail infrastructure. By March 2005, RVNL had achieved full operational capability, signifying a momentous milestone in its dedicated mission to augment and modernize the sprawling Indian rail network.

The journey of RVNL’s stock price is nothing short of remarkable. Notably, in March 2020, the stock price touched a nadir at Rs 10. However, this marked the beginning of an unprecedented trajectory, as it surged to a zenith of Rs 199.25 in September 2023, epitomizing an extraordinary value creation odyssey. Over the last three years, the stock price demonstrated an astounding CAGR of 108%, underscoring its magnetic appeal to discerning investors and alluding to a compelling narrative of growth. The preceding year was particularly noteworthy, boasting an incredible CAGR of 351%, reflecting profound investor enthusiasm and substantial capital appreciation.

Furthermore, RVNL is eagerly anticipating project approvals in Kyrgyzstan and remains sanguine about positive outcomes arising from its arbitration proceedings with Krishnapatnam Rail Company Limited. RVNL’s strength in orders, growth trajectory, and strategic vision make it a prominent player in India’s rail infrastructure sector

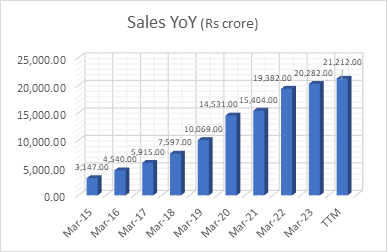

1. Impressive Sales Growth

Over the past five years, RVNL has showcased a robust sales growth rate of 22%, signifying a commendable expansion in its top-line revenue. While the growth trajectory exhibited a modest deceleration over the last three years, registering at 12%, the trailing twelve months (TTM) still managed to maintain a positive sales growth rate of 5%. This demonstrates RVNL’s resilience and adaptability to navigate through varying economic conditions while consistently driving its revenue higher.

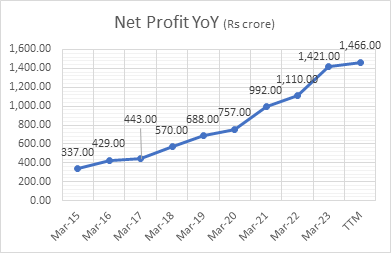

2. Profit Momentum

The profit trajectory of RVNL tells a more promising story. Over the last five years, the company achieved an impressive Compound Annual Growth Rate (CAGR) of 20% in profits. Over the subsequent three years, this growth momentum accelerated even further, attaining a substantial CAGR of 23%. Even in the most recent TTM period, RVNL maintained a solid profit growth rate of 17%. This signifies a company that not only elevates its revenue but also adeptly converts it into substantial profits, delivering enduring bottom-line growth.

3. Robust Return on Equity (ROE)

RVNL consistently boasts a healthy Return on Equity (ROE), a pivotal metric gauging the efficient utilization of shareholders’ equity to generate profits. Over the last five years, the ROE stood at a commendable 18%. The last three years experienced a slight improvement, elevating the ROE to 19%. In the most recent year, the ROE witnessed a further increase to 21%, underscoring the company’s efficiency in delivering favorable returns to its valued shareholders.

In conclusion, RVNL’s financial performance and stock price trajectory exemplify a company on a remarkable upward trajectory. With a robust order book and a track record of impressive profit and sales growth, RVNL is ideally positioned to leverage opportunities within the railway sector. The company’s efficiency in generating returns for shareholders, as evidenced by the escalating ROE, augments its already positive outlook. As RVNL navigates the complex railway landscape and extends its footprint, it embodies promise and potential, reflecting its remarkable journey of value creation.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 19, 2023, 3:59 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates