SBI Mutual Fund has launched the SBI Innovative Opportunities Fund, an open-ended equity scheme aiming to provide long-term capital appreciation by investing in companies focused on innovation. This New Fund Offer (NFO) is open from July 29 to August 12, 2024. The scheme, categorised as equity-sectoral/Thematic, requires a minimum investment of Rs 5,000.

The investment objective of the SBI Innovative Opportunities Fund is to provide investors with opportunities for long-term capital appreciation by investing in equity and equity-related instruments of companies that seek to benefit from the adoption of innovative strategies & themes. However, there is no assurance that the investment objective of the scheme will be achieved.

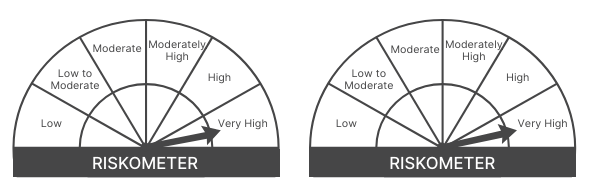

This NFO of SBI Innovative Opportunities Fund is suitable for investors who are seeking wealth creation over long term and want to invest predominantly in equity and equity-related instruments of large-cap companies.

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equities & Equity related securities of large-cap companies | 80 | 100 |

| Equities & Equity related securities of other than large-cap companies, equity & equity-related securities of foreign companies | 0 | 20 |

| Debt & Money Market instruments | 0 | 20 |

| Units issued by REITs & InvITs | 0 | 10 |

The performance of the SBI Innovative Opportunities Fund will be benchmarked to the performance of the Nifty 500 TRI.

Mr. Prasad Padala joined SBIFML in September 2017 as an Equity Research Analyst. He has an overall 15 years of experience. He worked for the past 11 years in the area of financial services and 4 years before that in the software industry.

Prior to the current role as a fund manager, Prasad has worked as an equity analyst at SBIFML from September 2017 to August 2023 and an external consultant from August 2023 to February 2024 handling equity research.

Mr. Pradeep Kesavan, Fund Manager for managing investments in Foreign Securities. Mr Pradeep Kesavan joined SBIFML in July 2021. He has over 18 years of experience in the financial services sector.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | 10 Years Returns (%) | Since Launch Return (%) |

| Franklin India Opportunities | 4575.97 | 1.87 | 70.83 | 30.5 | 28.31 | 18.83 | 14.34 |

| ICICI Prudential Innovation Fund | 5721.12 | 1.83 | 55.52 | – | – | – | 58.66 |

| ICICI Prudential India Opportunities | 21021.31 | 1.63 | 43.67 | 30.51 | 27.6 | – | 24.47 |

Data as of July 29, 2024

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 30, 2024, 3:37 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates