SBI Mutual Fund launched a new Exchange Traded Fund (ETF) named SBI Nifty50 Equal Weight ETF. This open-ended scheme invests in stocks that replicate the Nifty 50 Equal Weight Index. The minimum investment amount is Rs. 5,000. The new fund offer will be open for subscription from July 8th, 2024 to July 12th, 2024.

The investment objective of the SBI Nifty50 Equal Weight ETF is to provide returns that, closely correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

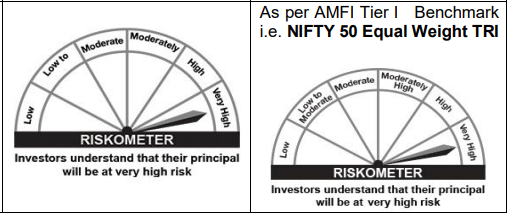

This NFO of SBI Nifty50 Equal Weight ETF is suitable for investors who are seeking long term capital Appreciation and an investment in securities covered by Nifty50 Equal Weight Index.

| Instruments | Indicative allocations (% of total assets) |

| Securities covered by Nifty50 Equal

Weight TRI |

100 – 95 |

| Government. Securities including

Triparty Repo, and units of liquid mutual fund |

5- 0 |

The performance of the SBI Nifty50 Equal Weight ETF will be benchmarked to the performance of the Nifty50 Equal Weight Index

Mr. Viral Chhadva is 40 years old with a CFA charter and has experience of 17 years in financial sector. Mr. Viral Chhadva (Equity Dealer) joined SBIFML in December 2020. Prior to joining SBIFML, he was previously associated with IIFL Securities Limited (June 2008 till December 2020) and ICICI Securities Limited (June 2006 till June 2008) wherein he primarily handled the execution of trades into Direct Market Access, Exchange Traded Funds and Derivatives.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | Since Launch Returns (%) |

| DSP Nifty 50 Equal Weight ETF | 183.7925 | 0.3 | 36.16 | – | – | 17.87 |

| Nippon India ETF Nifty 50 Shariah BeES | 16.9406 | 0.96 | 27.25 | 9.79 | 16.82 | 14.15 |

| ICICI Pru Nifty 50 ETF | 15870.66 | 0.03 | 27.17 | 16.96 | 17.33 | 14.77 |

| DSP Nifty 50 ETF | 314.483 | 0.07 | 27.17 | – | – | 16.22 |

| Nippon India ETF Nifty 50 BeES | 27031.1 | 0.04 | 27.15 | 16.95 | 17.32 | 14.93 |

| Axis Nifty 50 ETF | 701.9958 | 0.07 | 27.15 | 16.94 | 17.29 | 15.32 |

| ABSL Nifty ETF | 2291.29 | 0.06 | 27.14 | 16.96 | 17.33 | 13.12 |

| Motilal Oswal Nifty 50 ETF | 39.6594 | 0.06 | 27.13 | 16.94 | 17.2 | 8.71 |

| SBI Nifty 50 ETF | 180683.1 | 0.043 | 27.13 | 16.92 | 17.29 | 13.6 |

| UTI Nifty 50 ETF | 52120.16 | 0.05 | 27.13 | 16.93 | 16.69 | 14.86 |

| Mirae Asset Nifty 50 ETF (MAN50ETF) | 2388.154 | 0.04 | 27.13 | 16.93 | 17.33 | 17.15 |

| HDFC Nifty 50 ETF Gr | 3352.313 | 0.05 | 27.12 | 16.93 | 17.29 | 15.79 |

| Bandhan Nifty 50 ETF | 24.122 | 0.09 | 27.08 | 16.84 | 17.18 | 15.7 |

| Quantum Nifty 50 ETF | 52.55084 | 0.09 | 27.06 | 16.91 | 17.24 | 12.52 |

| Invesco India Nifty 50 Exchange Traded Fund | 82.3762 | 0.1 | 27.05 | 16.87 | 17.24 | 13.17 |

| Kotak Nifty 50 ETF | 2278.797 | 0.04 | 27.03 | 16.85 | 17.2 | 12.57 |

| Tata Nifty 50 Exchange Traded Fund | 629.726 | 0.07 | 27.02 | 16.88 | 17.34 | 17.19 |

| LIC MF Nifty 50 ETF | 768.9174 | 0.06 | 26.92 | 16.87 | 17.29 | 15.27 |

Data As of July 08, 2024

Elevate your savings strategy with our easy-to-use SIP Return Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 9, 2024, 6:27 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates