In a significant boost to India’s fiscal landscape, the Gross Goods and Services Tax (GST) revenue for March 2024 soared to a remarkable Rs 1.78 lakh crore. This achievement marks the second-highest collection in history, showcasing an impressive 11.5% year-on-year growth. The surge primarily stems from a notable increase in GST collection from domestic transactions, which witnessed a robust growth rate of 17.6%. Notably, the GST revenue, net of refunds for March 2024, stands at Rs 1.65 lakh crore, reflecting a remarkable growth of 18.4% compared to the same period last year.

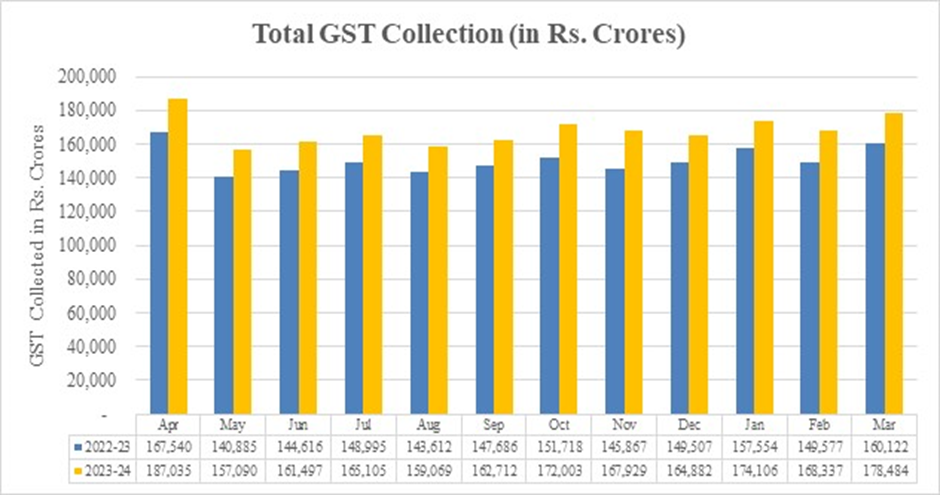

The fiscal year 2023-24 stands as a milestone with the total gross GST collection reaching Rs 20.14 lakh crore, surpassing the Rs 20 lakh crore mark. This achievement represents an impressive 11.7% increase compared to the previous fiscal year. The average monthly collection for FY 2023-24 stands at Rs 1.68 lakh crore, significantly exceeding the previous year’s average of Rs 1.5 lakh crore. Additionally, the GST revenue, net of refunds as of March 2024 for the current fiscal year, amounts to Rs 18.01 lakh crore, showcasing a commendable growth of 13.4% over the same period last year.

Breaking down the March 2024 collections reveals a positive performance across various components:

Similar encouraging trends are observed in the entire FY 2023-24 collections across different components.

In March 2024, the Central Government settled Rs 43,264 crore to CGST and Rs 37,704 crore to SGST from the IGST collected. This translates to a total revenue of Rs 77,796 crore for CGST and Rs 81,450 crore for SGST for March 2024 after regular settlement. Throughout FY 2023-24, the central government settled Rs 4,87,039 crore to CGST and Rs 4,12,028 crore to SGST from the IGST collected.

The chart below illustrates the trends in monthly gross GST revenues during the current year.

Source: PIB

This remarkable performance in GST revenue collection underscores India’s continued economic resilience and the effectiveness of its taxation policies in driving growth and fiscal stability. As the nation navigates through various economic challenges, such achievements serve as a testament to the collective efforts aimed at fostering sustainable economic development.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions

Published on: Apr 1, 2024, 5:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates