Indian specialty chemicals sector has created its own niche over the past few years. A sector which was mainly comprising of smaller players making it mainly an unorganised industry, has over the past few years has changed to get recognised as a major exporter. From termed as a sector having small companies with hardly any management bandwidth, the sector is witnessing significant amount being invested in capex. Company managements have shown intent to grow and are being consistently delivering despite all Challenges. No wonder even the investors were quick to reckon the same and the specialty chemical stocks have turned multi baggers. Not only the listed space was constantly buzzing, even the listing in primary markets had witnessed significant interest from the investing fraternity. Not only the over subscription was good, it was followed by significant listing gains. Lastly the specialty Chemical companies managed to sustain above the issue prices and in Most of the cases even above the listing gains. The names like Galaxy Surfactants and Fine Organics are examples of the same. Here the moot question is, after such a strong and consistent up-move – is there still any opportunity left in the sector? Or the prices have discounted everything on the growth front and hence are fully valued? Let’s try to get an answer to the same.

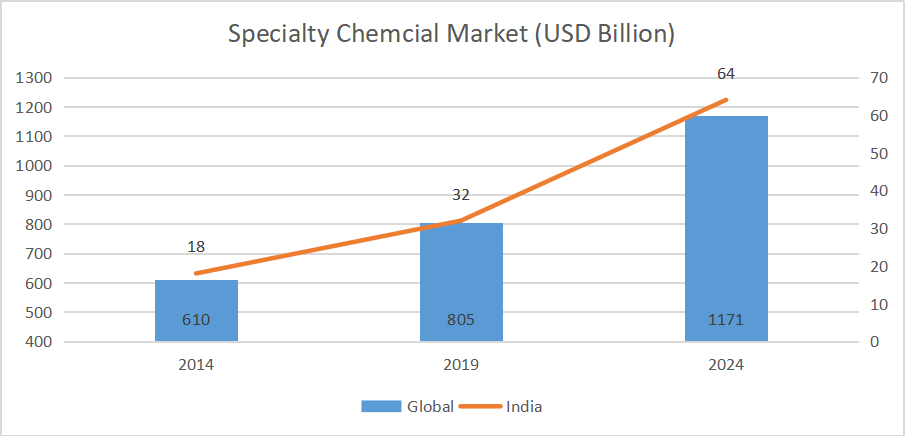

While we try to get the idea of Indian specialty Chemical sector, it is important to understand the global scenario in the sector. Just to put the numbers in perspective – Globally, the Specialty Chemicals business accounts for around 20 percent of the USD four trillion chemicals industry. While the global market of specialty chemicals has increased over the years, from having an insignificant presence of just 4.5 percent in this segment, India’s share in Specialty Chemicals is expected to double in the next few years. To be very specific, over the next five years – the Indian specialty Chemical segment is likely to grow with a CAGR of approximately 12 percent to become a USD 64 billion industry by 2025. The following chart clearly indicates how the past growth has been and how the growth would be in the next five years.

As regards the Global Chemical markets, the global chemicals market is valued at around USD 4,738 billion with China accounting for major market share (37 percent) in the segment followed by European Union (17 percent) and United States (14 percent). India accounts for around 3.5 percent market share in the global chemicals market. As regards the growth prospects, the global chemicals market is expected to grow at 6.2 percent CAGR reaching USD 6,400 billion by 2024.

The specialty chemicals market is characterized by high value-added, low volume chemical production. These chemicals are used in a wide variety of products, including fine chemicals, additives, advanced polymers, adhesives, sealants and specialty paints, pigments, and coatings. The specialty market is extremely fragmented.

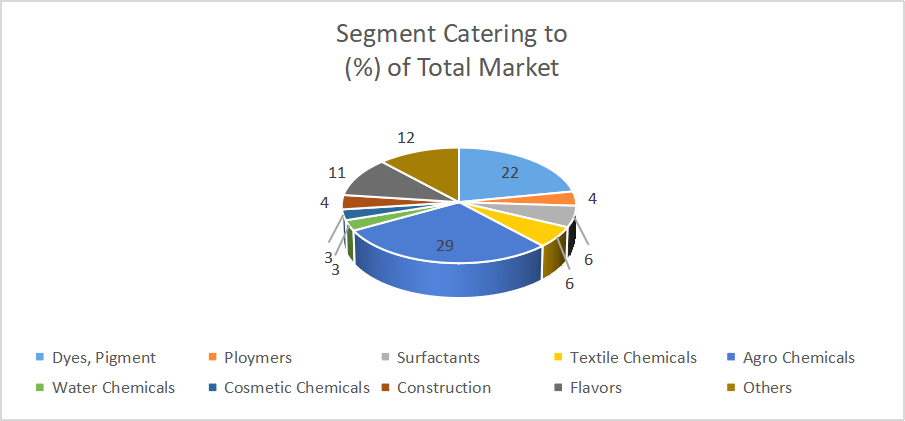

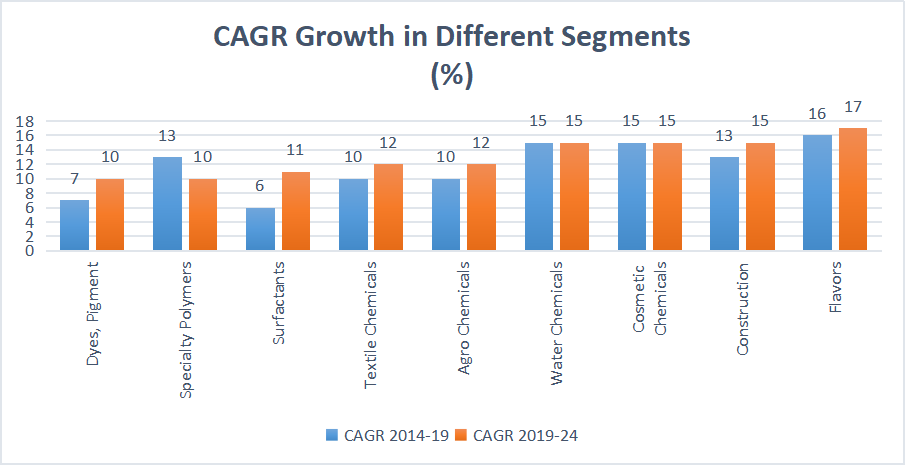

As regards to the market segmentation by Industry usage, the following chart gives a better idea.

As we always mention the world has changed After the Covid-19 pandemic and it has made an impact on different sectors. And the chemical Industry has been no exception. We feel the chemical industry is expected to see the following trends in the next few years.

First and the foremost is, most of the companies would try and shift focus towards new value streams and growing end markets, especially healthcare and personal care. Even the agro based would be on the priority list.

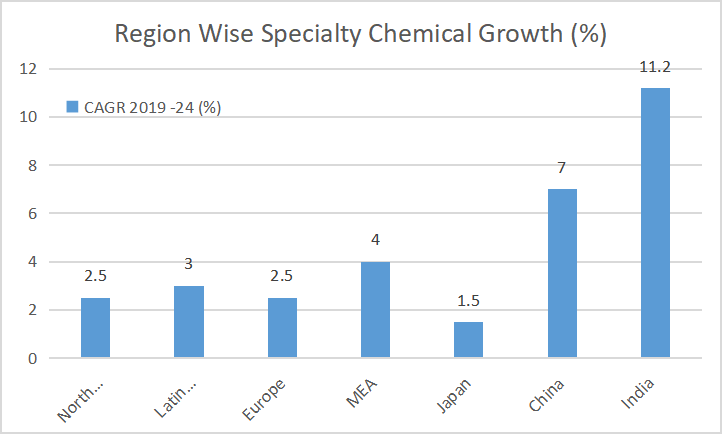

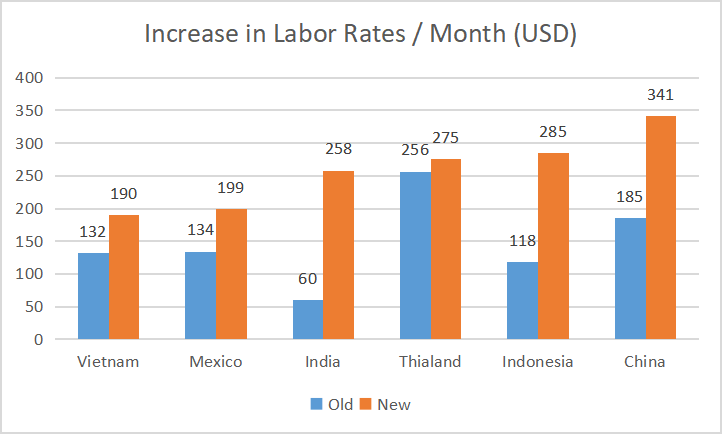

Second factor is many governments (countries) have announced policy proposals related to regulation, trade, and sustainability which could prove beneficial in shifting the dependence of the industry from China. With factors like Government Sops, Cheap Labour cost and most advanced R&D facilities – Indian specialty segment is likely to stand benefited. The following chart clearly shows the CAGR growth (2019-24) for Indian specialty chemicals sectors would be much ahead of the other countries.

Apart from this, the Specialty chemicals industry is driven by both domestic consumption and exports. One must understand that India’s specialty chemical companies are gaining favour with global MNCs because of the geopolitical shift after the outbreak of Covid-19 as the world looks to reduce its dependence on China. Currently China accounts for around 15-17 percent of the world’s exportable specialty chemicals, whereas India accounts less than 2 percent indicating that the country has a large scope of improvement and widespread opportunity. Various factors indicate that Specialty chemicals will be the next great export pillar for India.

Add to that the schemes like Performance Linked Incentives (PLI) and Make in India campaign is also expected to add impetus to the emergence of India as a manufacturing hub for the chemicals industry in the medium term. All in all, the Indian specialty chemicals industry is likely to continue to perform well in the near to medium term and is expected to capitalize on the Make in India benefits to assume leadership position in the market.

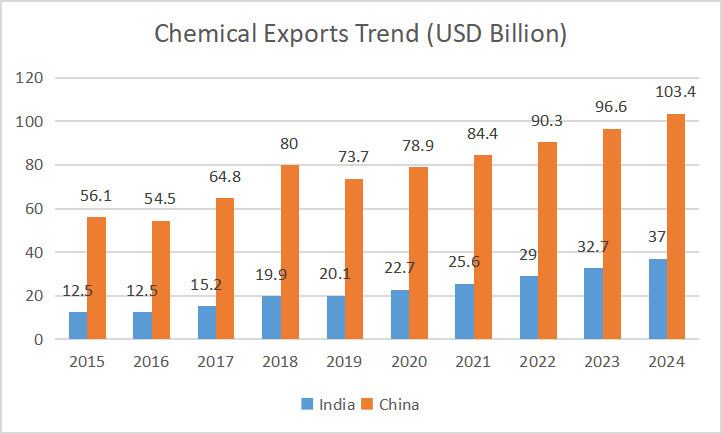

As regards the exports, Indian exports are on the rise as India is becoming a central manufacturing hub for such chemicals. Factors like tightening of environmental norms in developed countries and the slowdown of China are contributing to the growth of exports. Owing to shutdowns in China and lack of capacity additions in other developed countries, India stands to benefit in the export market.

India would be the biggest beneficiary as the US and European companies face pressures from institutional investors and significant lenders to re-base their supply chain away from China. Downstream industries also seek alternative manufacturing options; thus, have been seeking lower cost locations over China.

Also supporting the growth in India is its ability to manufacture at a lower price compared with its western counterparts. Moreover, the specialty chemicals consumption in the country is low compared with the global average. Specialty chemical companies will prosper in India because of its chemistry, R&D skillset and economies of scale achieved by the country.

Just to put in perspective, factors that favour the specialty chemicals industry in India, are strong domestic consumption, favourable labour cost and government impetus.

Further the growth in the user industry is also likely to be better. Following chart clearly shows how the different user industries are likely to grow.

If we take a look at the capacity additions, top companies have incurred Rs 3800 crore capex in the last three years ended FY21. And going ahead would spend a similar amount of Around Rs 3900 crore in next three years. Specialty Chemicals companies face low risk from competitors due to high entry barriers – given the complex nature of chemistries involved in producing these chemicals. Substantial R&D requirements, technical know-how, service capabilities, customer relationships, and adherence to required regulations create important entry barriers.

A Few factors like imposition of Anti-dumping duty on Chinese chemical imports in CY14 as a safeguard against dumping was the first Step in this regard. The other policy initiatives include the reduction of basic custom duty on naphtha to 2.5 percent (from 4 percent), export promotion schemes and free trade agreements.

All in all, the Segment has got many positives and no wonder the investor’s still have a fancy about the sector. However, we opine that most of the scrips in the segment are fully valued. Or would say are trading at higher valuations. For those who want to still take exposure to the segment following are few of the stocks to look at.

Also Read: Best Chemical Stocks To Invest In 2022

Atul is a Lalbhai (strong management bandwidth) group company, is one of India’s largest integrated chemical conglomerates, operating in two segments viz – Performance Chemicals (contributing 70 percent of total sales revenues) and Life Science Chemicals (30 percent). Its leadership position in key chemistries and products like P-Cresol, Epoxy resin, Resorcinol, Sulphur Black, 2,4- Dichlorophenol (2,4-D) and 4,4- Dichlorodiphynyl Sulfone (4,4 DCDPS) showcases its exemplary performance over the years which has been driven by the right mix of unique skills and core values.

Galaxy Surfactants is a leading manufacturer of Performance Surfactants and Specialty Care products with over 200 product grades. These products are used in consumer-centric Home and Personal care products such as hair care, oral care, skin care, cosmetics, soap, shampoo, lotion, detergent, cleaning products, etc. Galaxy is the preferred supplier to leading MNC’s, Regional and Local FMCG brands. Consistent financial performance, sustainable margins and reducing debt are the three important factors for Galaxy Surfactants.

Published on: Aug 31, 2021, 1:09 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates