Dive into the intriguing world of mutual fund schemes, where assets under management (AUM) act as musical notes, creating a symphony of investment choices.

Historic Milestone: Small Cap AAUM Surpasses Rs 2 Lakh Crore

In a groundbreaking achievement, the Small Cap category achieves an All-Time High AAUM, crossing the remarkable milestone of Rs 2 lakh crore for the first time in history.

Large Cap Resurgence: Inflow Rekindled After 6 Months

Breaking a six-month trend, the Large-cap category witnessed a noteworthy inflow in October 2023, totalling Rs 724 crore—a sign of renewed investor confidence in large-cap assets.

Gold ETF Rally: Inflow Soars Almost 4x MoM to Rs 840 Crore

The Gold ETF segment experienced a remarkable surge, with inflows skyrocketing nearly fourfold on a month-on-month basis, reaching an impressive Rs 840 crore.

SIP Triumph: Record-Breaking Contribution Hits Rs 16,928 Crore

October 2023 marks a historic high in Systematic Investment Plans (SIP) with an unprecedented contribution of Rs 16,928 crore, showcasing a robust and sustained investor commitment.

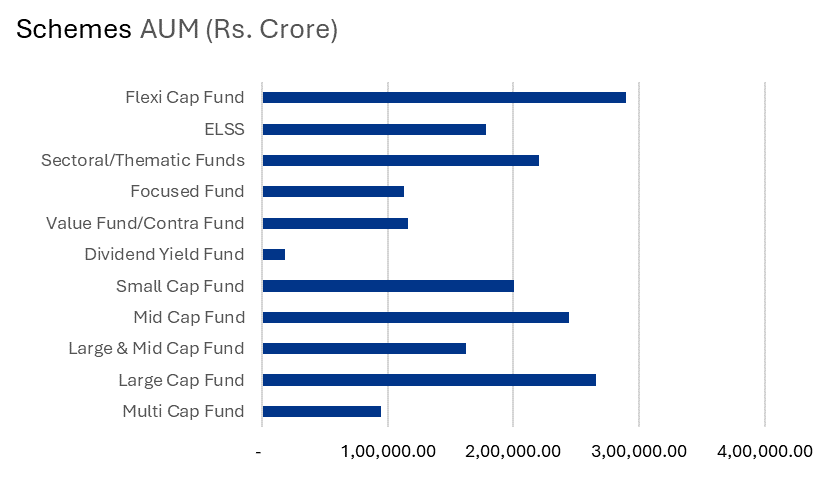

Multi Cap Fund (AUM: Rs. 94,391.23 Crore) – Versatility in Strategy: Embracing flexibility across market caps, this fund’s AUM highlights its diverse appeal.

Large Cap Fund (AUM: Rs. 2,66,148.53 Crore) – Trust in Stability: Boasting a colossal AUM, this fund reflects investor confidence in the stability of large-cap entities.

Large & Mid Cap Fund (AUM: Rs. 1,62,568.85 Crore) – Striking Balance: The substantial AUM underlines the popularity of a balanced approach, navigating both large and mid-sized opportunities.

Mid-Cap Fund (AUM: Rs. 2,44,515.68 Crore) – Tapping Growth Potential: Focused on mid-sized companies, this fund’s AUM mirrors investor appetite for potential growth.

Small Cap Fund (AUM: Rs. 2,00,288.56 Crore) – Risk and Reward: With a substantial AUM, this fund attracts investors seeking the high-risk, high-reward dynamics of small-cap investments.

Dividend Yield Fund (AUM: Rs. 18,613.23 Crore) – Steady Income Niche: Despite a modest AUM, this fund appeals to investors seeking a consistent income stream.

Value Fund/Contra Fund (AUM: Rs. 1,16,203.24 Crore) – Contrarian Confidence: Unearthing opportunities through contrarian strategies, this fund’s AUM reflects investor trust.

Focused Fund (AUM: Rs. 1,13,117.38 Crore) – Concentrated Brilliance: With a considerable AUM, this fund indicates investor confidence in focused, concentrated portfolios.

Sectoral/Thematic Funds (AUM: Rs. 2,20,512.13 Crore) – Riding Trends: Capturing the pulse of market trends, these funds command a substantial AUM.

ELSS (AUM: Rs. 1,78,610.21 Crore) – Tax-Saving Favourite: Offering dual benefits of tax savings and wealth creation, this fund’s AUM reflects its popularity.

Flexi Cap Fund (AUM: Rs. 2,89,670.00 Crore) – Adaptive Allocation Demand: With a significant AUM, this fund meets investor demand for adaptable market cap strategies.

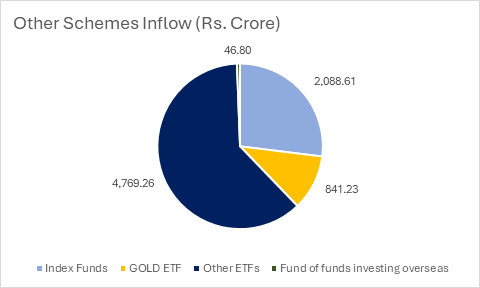

In October 2023, the mutual fund landscape witnessed a varied influx of funds. Index Funds led the charge with 2,088.61 Crore, followed by a notable surge in Gold ETFs at 841.23 Crore. The total inflow of 7,745.89 Crore, reflecting a dynamic and diversified investor interest across different investment avenues.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 9, 2023, 6:51 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates