Shares of Paras Defence and Space Technologies witnessed a significant surge today. The stock commenced trading at Rs 685, marking a 1% increase compared to the previous day’s closing price of Rs 680.40. During the intraday session, the stock exhibited a remarkable 5% surge accompanied by significant trading volume.

Upon scrutinising today’s share volumes, it becomes apparent that there has been a substantial increase of over 1.5 times in trading volumes compared to its average volumes on the BSE. As of writing this article the shares of the company are up by Rs 34.65 which is 5.1% and are trading at Rs 715.05 each on the BSE.

The stock’s 52-week high and low are Rs 811.35 and Rs 447.10, respectively. Possessing a market capitalization of Rs 2786.75 crore, the stock has showcased outstanding performance in recent periods, yielding a modest 5% return in the last months and an impressive 44% return in the past three months.

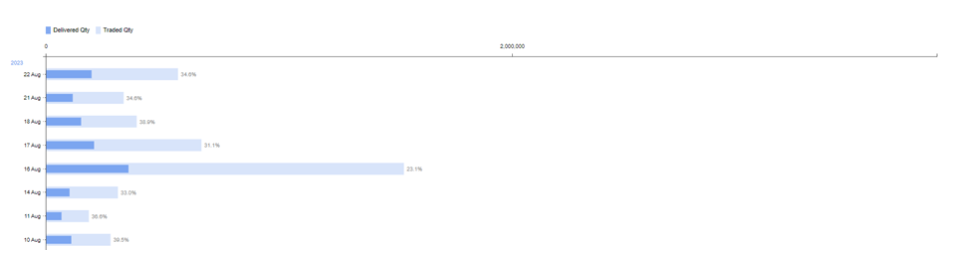

Below are the daily trading and delivery volumes of the shares in both NSE and BSE:

In the June quarter of FY24, the Company’s revenue from operations experienced an increase of 7.80% YoY, going from Rs 41.48 crore to Rs 44.72 crore. The operating profit of the company fell from Rs 11.80 crore to Rs 10.52 crore and on a sequential basis it decreased from Rs 13.64 crore to Rs 10.52 crore, the operating profit stood at 23.5%.

Whereas the net profit of the company amounts to Rs 6.20 crore, the net profit margins stood at 14% in Q1 FY24.

The company’s return on capital employed (ROCE) and return on equity (ROE) are at 13% and 9%, respectively. The Book value of the company is Rs 106 which means the stock is trading at Price to book value of 7 times in the market, whereas the price-to-earnings ratio is 80 times.

Paras Defence and Space Technologies (PDST) is a private sector company primarily engaged in designing, developing, manufacturing, and testing a variety of defence and space engineering products and solutions. The company caters to four major segments – Defence & Space Optics, Defence Electronics, Heavy Engineering, and Electromagnetic Pulse Protection Solutions.

Here is the chart presentation of the company’s shares on the weekly time frame:

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 23, 2023, 12:51 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates