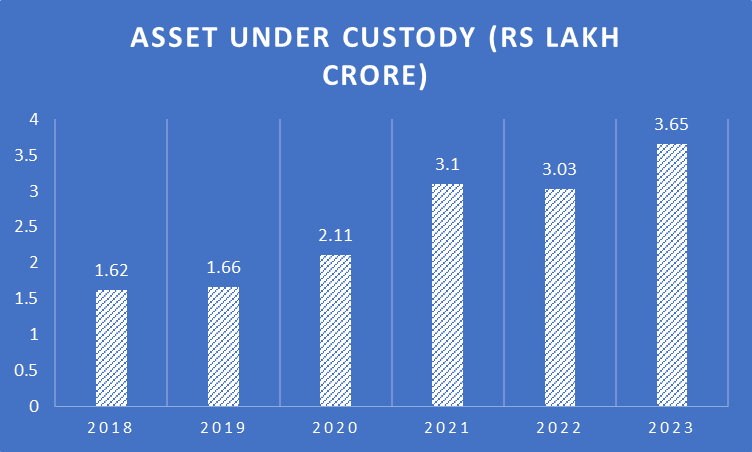

The assets of India’s Sovereign Wealth Funds (SWF) have doubled in the last five years, reaching 3.65 lakh crore in 2023, growing by about 125% compared to the last five years. In, August 2018, the Sovereign Wealth Fund investment stood at Rs 1.62 lakh crore. The sovereign wealth funds are also playing an important role in financing infrastructure projects and other strategic investments. This is helping to improve the country’s infrastructure and boost its competitiveness. In the last 3 years, India has seen a sovereign fund flow of about Rs 9.78 lakh crore.

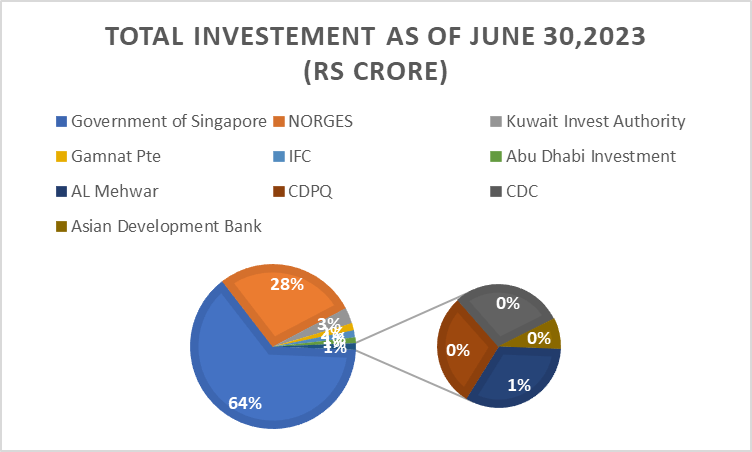

The Singapore government is one of the largest sovereign wealth funds, which has invested about Rs 1.76 lakh crores, NORGES, a Norway-based fund is the second largest SWF investor with an amount of Rs 76,812 crore. Further, Kuwait Investment Authority and Gamnat Pte have also invested about Rs 8,790 crore and 4,140 crores, respectively.

One factor is the strong performance of the Indian economy. The second important factor is the strategic investments made by the sovereign wealth funds. The funds have been investing in a number of strategic sectors, such as infrastructure, technology, and healthcare. These investments are expected to generate long-term returns for the funds.

The sovereign wealth funds of India are a valuable asset to the country. They are helping to boost economic growth, improve the lives of Indians, and make India a more attractive destination for foreign investment.

According to the Invesco Global Sovereign Asset Management Study, India is the most attractive emerging market for investing in 2023. The study, which surveyed 85 sovereign wealth funds and 57 central banks, found that India was seen as a favourable investment destination due to its improved business and political stability, favourable demographics, regulatory initiatives, and a friendly environment for sovereign investors

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 14, 2023, 3:35 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates