Strides Pharma Science Limited (Strides) has announced today that its subsidiary, Strides Pharma Global Pte. Limited in Singapore, has received approval from the United States Food & Drug Administration (USFDA) for Levetiracetam Oral Solution USP, 100 mg/ml.

This medication is both bioequivalent and therapeutically equivalent to the Reference Listed Drug (RLD), Keppra Oral Solution, 100 mg/mL of UCB, Inc., and is utilized in managing seizures.

The market size for Levetiracetam Oral Solution is estimated to be around USD 55 million according to IQVIA. Manufacturing of this product will take place at the company’s facility in Bengaluru. Strides currently holds 260 cumulative ANDA filings with the USFDA, which includes the recently acquired portfolio from Endo at Chestnut Ridge. Out of these filings, over 230 ANDAs have been approved. Additionally, the company aims to introduce approximately 60 new products in the US market over three years.

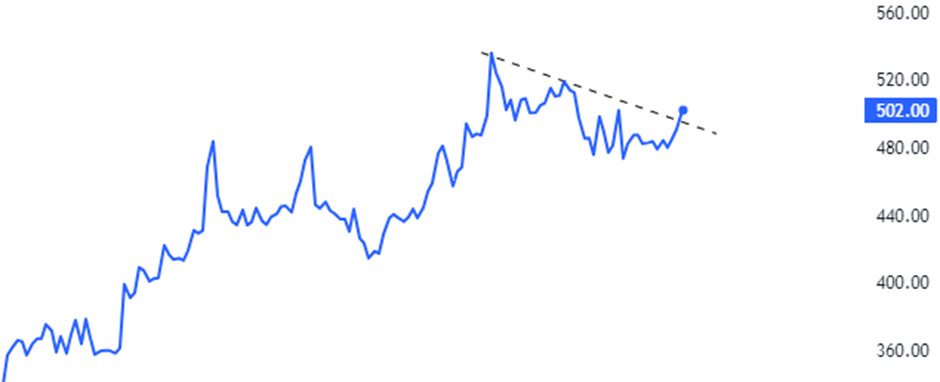

Today, the Strides Pharma shares opened at Rs 491 per share, reaching intraday highs and lows of Rs 509.20 and Rs 491, respectively. As of writing this article, they are trading at Rs 502 per share on the BSE. The current market capitalization of the company stands at Rs 4,523 crore. Furthermore, the stock has delivered an impressive return of over 50% during the last year.

Strides Pharma Science Limited is engaged in the development and manufacturing of pharmaceutical products. Its pharmaceutical offerings are distributed across more than 100 countries. The company has consistently pursued an inorganic growth approach, leading to expansions into fresh markets, the incorporation of new business and therapy segments, and the enhancement of its manufacturing infrastructure. It primarily operates within regulated markets and implements an ‘in Africa for Africa’ strategy alongside an institutional business catering to donor-funded markets. Its global manufacturing facilities are situated in various regions including India (Chennai, Puducherry, and two sites in Bengaluru), Singapore, Italy (Milan), Kenya (Nairobi), and the United States (New York).

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 21, 2023, 12:55 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates