Investing in mutual funds is undoubtedly a good choice for someone who is not active in the stock market and can’t track the market regularly.

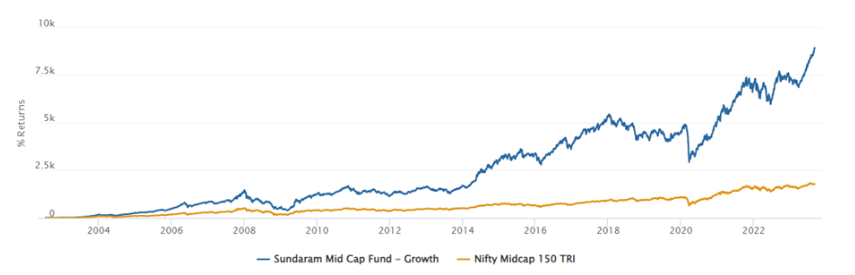

Sundaram Mid Cap Fund (Regular Plan – Growth) achieved a remarkable milestone with its Net Asset Value (NAV) crossing Rs 900 as of yesterday. Its journey commenced on July 19, 2002, with an NAV of Rs 10, and as of yesterday, it closed at Rs 905.28. When we calculate this growth, it becomes evident that the fund has achieved an astounding increase of 8952% during this period.

In contrast, its benchmark, the Nifty Midcap 150 Tri Index, has shown a growth of 1785.20%. We can clearly observe that the fund’s growth has showcased remarkable performance throughout its history.

Since its inception, it has generated an annualized return of 23.75%. If someone had invested Rs 10,000, it would now be valued at Rs 9,05,284, whereas the category average return during the same period is 18.19%.

The fund’s portfolio predominantly consists of domestic equities, accounting for 95.82% of its investments. Within this allocation, 8.76% is dedicated to large-cap stocks, 52.5% to mid-cap stocks, and 15.14% to small-cap stocks.

Both minimum SIP and lump-sum investing can start with Rs 100. The Sundaram Mid Cap Fund-Growth imposes an exit load of 1.0% on the selling value if the fund is sold within 365 days of purchase. There are no additional charges associated with this fund.

The scheme has made significant investments in Shriram Finance, Federal Bank, Cummins India, and Tube Investment of India, which account for 3.68%, 3.59%, 2.81%, and 2.72% of the portfolio, respectively, as per the latest update.

The primary goal of this scheme is to seek capital appreciation by primarily investing in a diversified portfolio of stocks commonly categorized as mid-cap stocks.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 5, 2023, 3:03 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates