The Sundaram Business Cycle Fund is a new open-ended equity mutual fund launched by Sundaram Mutual Fund on June 5th, 2024. It aims for long-term capital appreciation by investing in equity and equity-related securities. The fund focuses on identifying medium-term business cycles and dynamically allocates between themes and stocks based on their position in the economic cycle. There is no entry load, but an exit load of 1% applies within one year of investment. This exit load is waived for redemptions after a year and for switching between Sundaram Mutual Fund schemes. The minimum investment amount is Rs 100.

The investment objective of the Sundaram Business Cycle Fund is to provide long term capital appreciation by investing predominantly in equity and equity related securities with a focus on identifying medium term cycles which can impact the business fundamentals. This will be done through dynamic allocation between various themes and stocks at different stages of cycles in the economy.

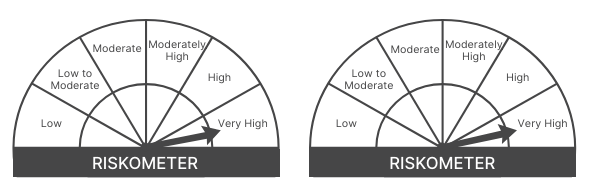

This NFO of Sundaram Business Cycle Fund is suitable for investors who are seeking to generate medium to long-term capital appreciation over long term and an equity scheme investing in equity & equity related securities with focus on riding business cycle through dynamic allocation between various sectors and stocks at different stages of business cycle in the economy.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity & Equity related instruments selected on the basis of business cycle | Very High | 80 | 100 |

| Other Equity & Equity Related instruments | Very High | 0 | 20 |

| Debt and Money Market Securities including units of Debt oriented mutual fund schemes. | Low to Medium | 0 | 20 |

| Units issued by REITs & InvITs | Very High | 0 | 10 |

The performance of the Sundaram Business Cycle Fund is benchmarked against Nifty 500 TRI.

Mr. Ratish B Varier, a 39-year-old B.Com graduate with an MBA in Finance and a PG certification in Investment Analysis as a Certified Portfolio Manager, has been a significant player in the asset management industry. Currently serving at Sundaram Asset Management Company since November 2018. Over 17 years of experience in equity fund management.

Bharath S, aged 43, holds a B.Com, MBA, FRM, and ICWA, and currently leads as the Head of Investment Research & Senior Fund Manager at Sundaram Asset Management Company since April 2018. His tenure at Sundaram began in July 2012, where he progressed from a Fund Manager to a Senior Fund Manager. Over 21 years in investment research and fund management.

Dwijendra Srivastava, 51 years old, brings a diverse academic background with a Bachelor of Technology in Textile Technology, a CFA charter, and a PGDM in Finance. He has been with Sundaram Asset Management Company Limited since April 2014, currently serving as the Chief Investment Officer – Debt. Over 21 years in fixed income fund management.

Sandeep Agarwal, 38, is a B.Com graduate and holds ACA and CS qualifications. He has been with Sundaram Asset Management Co Ltd. since September 2012, initially as a Dealer in Fixed Income and currently as a Fund Manager for Fixed Income. Over 16 years in fixed income fund management.

At 29 years old, Mr. Pathanjali Srinivasan is a Chartered Accountant with a Bachelor’s degree in Commerce (B.Com). He joined Sundaram Asset Management Co Ltd. in March 2024, bringing fresh perspectives from his previous role as a Junior Research Analyst at Mirabilis Investment Trust, where he worked for 1.1 years.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 04-06-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| HDFC Housing Opportunities | 06-12-2017 | 1430.6149 | 2.19 | 7.04 | 39.17 | 13.13 | 29.95 | 2.95 |

| HSBC Business Cycles Fund | 20-08-2014 | 833.40041 | 2.35 | 14.76 | 31.32 | 5.33 | 34.51 | 9.32 |

| Union Business Cycle | 05-03-2024 | 449.4315 | 2.43 | – | – | – | – | – |

| HDFC Business Cycle Fund | 02-11-2022 | 2970.5298 | 1.95 | 1.09 | 28.01 | – | – | – |

| Axis Business Cycles Fund | 22-02-2023 | 2715.1417 | 1.96 | 6.3 | – | – | – | – |

| Baroda BNP Paribas Business Cycle Fund | 05-09-2021 | 519.6561 | 2.45 | 6.93 | 30.98 | 1.44 | – | – |

| Kotak Business Cycle Fund | 05-09-2022 | 2442.7751 | 1.95 | 8.15 | 22.64 | – | – | – |

| Tata Business Cycle Fund | 04-08-2021 | 2200.75188 | 1.97 | 8.94 | 34.29 | 13.47 | – | – |

| ABSL Business Cycle Fund | 08-12-2021 | 1701.6877 | 2.09 | 10.44 | 19.18 | 4.99 | – | – |

Data as of June 4, 2024

Elevate your savings strategy with our easy-to-use SIP Return Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 5, 2024, 5:57 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates