A comprehensive analysis of two renewable energy giants driving India's green transition, Suzlon Energy vs Inox Wind.

The global push for sustainable energy solutions has given rise to a vibrant renewable energy sector, with India emerging as a significant player. In this article, we will undertake a comprehensive comparison between two prominent renewable energy giants: Suzlon Energy and Inox Wind. These companies have been instrumental in driving the growth of the Indian wind energy industry and are leading the way towards a greener tomorrow.

About the Companies:

- Suzlon Energy: Suzlon Energy, a global leader in renewable energy solutions, has been at the forefront of the wind energy sector since its inception in 1995. With a presence in 17 countries spanning Asia, Australia, Europe, Africa, and the Americas, Suzlon is a force to be reckoned with. Their commitment to sustainability and innovation has resulted in an extensive range of wind energy products and services, supported by cutting-edge research and development. Suzlon’s flagship “Concept to Commissioning” model sets them apart, providing end-to-end solutions across the renewable energy value chain.

- Inox Wind: Inox Wind, another key player in the Indian wind energy market, is a fully integrated wind energy solutions provider. Operating through three state-of-the-art manufacturing facilities in India, Inox Wind has a cumulative manufacturing capacity of 1,600 MW. Their business model offers turnkey solutions and equipment supply for wind power projects, catering to IPPs, utilities, PSUs, corporates, and retail investors. Inox Wind’s focus on quality, advanced technology, and cost competitiveness has enabled it to serve low wind speed sites in India effectively.

Market Presence and Industry Impact:

Both Suzlon Energy and Inox Wind have made significant contributions to the Indian renewable energy sector. Suzlon’s global reach positions them as a market leader, while Inox Wind’s three manufacturing plants strategically located in Gujarat, Himachal Pradesh, and Madhya Pradesh have bolstered their presence in the Indian market. Suzlon’s wide array of wind turbines caters to various project requirements, while Inox Wind’s focus on low wind speed sites reflects their adaptability to Indian conditions.

Business Strategies:

- Suzlon Energy’s holistic approach to wind energy projects is exemplified by their “Concept to Commissioning” model, which covers everything from wind studies and energy assessment to erection, commissioning, and long-term maintenance. This approach ensures that they can meet diverse customer requirements across the renewable energy value chain.

- Inox Wind, on the other hand, offers both turnkey solutions and equipment supply models, providing flexibility to their customers. Their focus on in-house manufacturing and advanced technology keeps them at the forefront of the industry, especially in low wind speed regions of India.

Comparative Highlights:

- Global vs. Domestic Focus: Suzlon Energy boasts a global presence in 17 countries, while Inox Wind primarily caters to the Indian market, underlining its distinct market strategies.

- End-to-End vs. Flexible Solutions: Suzlon’s “Concept to Commissioning” model provides a comprehensive package, whereas Inox Wind offers flexible solutions, including equipment supply, turnkey projects, and in-house manufacturing.

- Manufacturing Capabilities: Suzlon emphasizes the use of cutting-edge R&D, with eight facilities worldwide, whereas Inox Wind maintains in-house manufacturing, ensuring control over quality and technology.

- Low Wind Speed Expertise: Inox Wind specializes in serving low wind speed sites in India, a significant advantage in a country with varying wind conditions.

- Green Initiatives: Suzlon’s headquarters at One Earth, Pune, showcases their commitment to sustainability, boasting LEED Platinum certification and GRIHA 5-star rating.

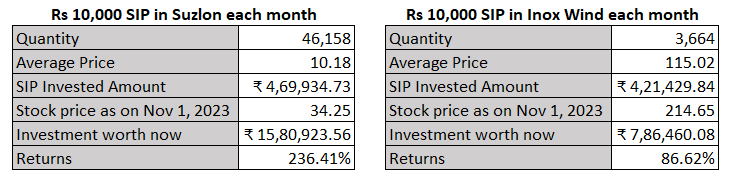

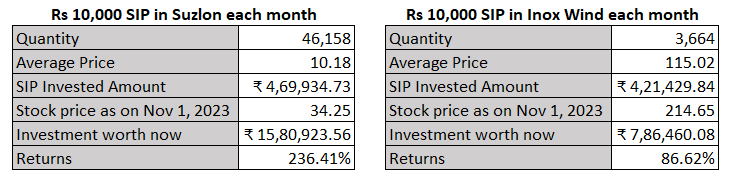

3 Year SIP Comparison

Here are the parameters used to calculate the SIP amount in a bulleted format:

- Timeframe is between November 1, 2020, to November 1, 2023

- Monthly Investment: Rs 10,000 for each company

- Average Price Calculation: Monthly average of the opening and closing prices on the 1st date of each month

- Number of Stocks Purchased: Rs 10,000 divided by SIP price

- SIP Invested Amount: Sum of SIP price multiplied by the number of stocks purchased each month

- SIP Investment Now Amount: Number of stocks purchased multiplied by the stock price as of November 1, 2023

In the 3-year SIP comparison, Suzlon Energy has demonstrated remarkable performance with an impressive 236.41% return, showcasing strong growth potential. On the other hand, Inox Wind, while respectable with an 86.62% return, lags behind Suzlon Energy in this investment horizon. Investors in Suzlon Energy have experienced substantial wealth accumulation, underscoring the benefits of consistent investment in this renewable energy stock.

In conclusion, Suzlon Energy and Inox Wind are pivotal players in India’s renewable energy sector. Suzlon’s global reach and all-encompassing solutions showcase its international influence, while Inox Wind’s adaptability to Indian conditions and in-house manufacturing exemplify their domestic focus.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.