Shares of Tata Chemicals experienced a sharp rise today. The stock opened at Rs 988.35, which was almost flat compared to the previous day’s closing price of Rs 993.65. During the intraday session, the stock surged by 5% with significant trading volume.

Upon analysing today’s share volumes, it is evident that there has been a substantial increase of more than 2.15 times in volumes on the BSE. As of the current moment, while writing this article, the shares of the company are up by Rs 50, trading at Rs 1041.65 on the BSE.

The stock’s 52-week highs and lows are recorded at Rs 1214.65 and Rs 876.05, respectively. With a market capitalization of just Rs 26594 crore.

The stock has not performed well so far, even when the Indian market has outperformed other foreign markets. If we examine the past returns of the stock, it has generated a modest return of only 4.55% in the last month, while it has given a mere 17% return in the last year. This historical performance suggests that the stock has not yet participated in the bull run.

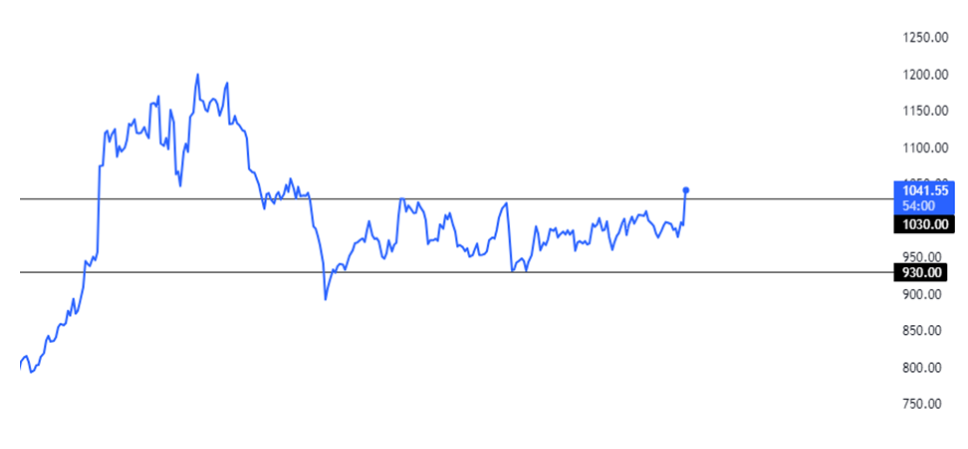

Upon examining the technical charts, it is evident that the stock entered a consolidation phase after achieving its all-time high price of Rs 1214.65 on October 11, 2022. During this period, the stock declined by approximately 28% from its peak price and reached a low of Rs 876.05 in December of the same year.

Following this low point, the stock displayed some signs of recovery and managed to regain approximately 18% within 48 days. However, starting from February 7, 2023, the stock once again entered a consolidation phase. It remained within a narrow range of approximately 100 points, fluctuating between Rs 1030 on the higher side and Rs 930 on the lower side.

Following is the chart presentation of Tata Chemicals on the daily time frame.

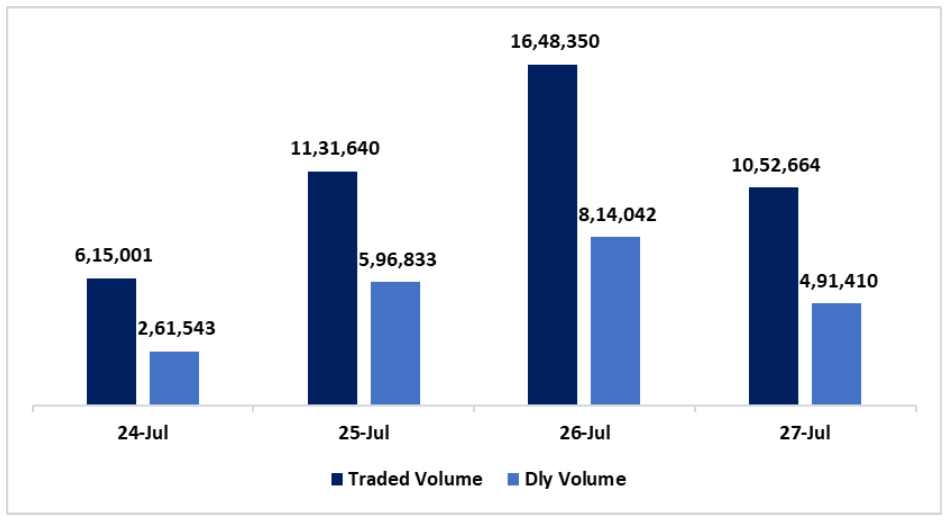

Below are the volume analysis results for the stock in both BSE and NSE:

| Date | Closing Price Rs | % Change | Traded Volume | Dly Volume | Dly % |

| 24-Jul | 991 | 0.30% | 6,15,001 | 2,61,543 | 42.53% |

| 25-Jul | 977 | -1.40% | 11,31,640 | 5,96,833 | 52.74% |

| 26-Jul | 998 | 2.20% | 16,48,350 | 8,14,042 | 49.39% |

| 27-Jul | 994 | -0.50% | 10,52,664 | 4,91,410 | 46.68% |

Tata Chemicals Limited, a holding company, operates in two main business segments: Basic chemistry products and speciality products. The Basic chemistry products segment focuses on manufacturing inorganic chemical products, catering to various industries like glass, detergents, pharmaceuticals, biscuits, bakeries, and others. This segment’s product range includes soda ash, sodium bicarbonate, salt, and more.

On the other hand, the Specialty Products segment offers specialized food ingredients, including prebiotics and formulations for feed, food, and pharmaceutical customers. Additionally, it produces speciality silica for the rubber and tire industry and provides crop care and seeds through its subsidiary, Rallis India Limited.

Published on: Jul 28, 2023, 4:55 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates