During the 1990s, when the telecommunications sector in India remained closed to competition, Videsh Sanchar Nigam Limited (VSNL) was an absolute monopoly. The company earned revenue from every one of the four billion minutes of calls entering or departing from India’s shores until 2002. This monopoly status resulted in substantial profitability, with VSNL having a cash reserve of Rs 4,800 crore by March 2001. However, the telecom sector was ripe for increased competition.

In 2000, the government announced to permit private enterprises to offer international telephone services starting in April 2002. During this period, the government opted to divest its controlling stake in VSNL rather than engage in direct competition with private players.

The Tata Group took a strategic bet when they bid for VSNL in 2001, fully aware that VSNL’s monopoly was nearing its end. Despite this, they proceeded with the acquisition. In February 2002, the Tata Group purchased a 25% stake in VSNL for Rs 1,439 crore, while the government retained 26% ownership. Subsequently, the Tata Group issued a cash-tender offer to acquire an additional 20% stake from other minority shareholders of VSNL.

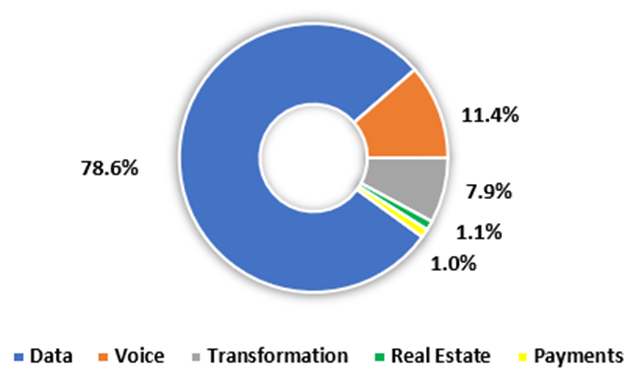

During the acquisition, the major revenue came from tariff revenue. However, Tata Communications now generates revenue from five different segments.

Let’s explore each segment.

Data and Managed Services encompass a range of services, including Core and Nextgen Connectivity services, Digital platforms, and connected services. This segment is the largest source of revenue among all the services provided by the company. During FY23, the company reported a revenue of Rs 14,156 crore from this segment, compared to Rs 12,842 crore, registering an impressive 10% YoY growth.

Voice Solutions segment includes both International and National Long-Distance Voice services. This segment is the second-largest source of revenue after data services. During FY23, the company reported a revenue of Rs 2,054 crore from this segment, with a negative growth of 10% YoY compared to FY22 when it was Rs 2,286 crore.

Transformation Services involve the provision of telecommunication network management and support services. These services are carried out by the company’s wholly-owned subsidiary, Tata Communications Transformation Services Limited, and its subsidiaries. This vertical serves as the third main source of revenue, recording a mere 0.5% YoY growth during FY23. The company reported revenue of Rs 1,417.78 crore, compared to Rs 1,411 crore in FY22.

The real Estate segment pertains to lease rentals for properties that have been leased and do not include properties held with the intention of capital appreciation. During FY23, the company reported revenue of Rs 200.87 crore from this segment, compared to Rs 192.94 crore, registering a 4.1% growth.

Payment Solutions cover various services, such as end-to-end ATM deployment, end-to-end POS enablement, hosted core banking, comprehensive financial inclusion, card issuance, and associated managed services. These services are provided by the company’s wholly-owned subsidiary, Tata Communications Payment Solutions Limited, and include switching services for the banking sector. This segment, however, has the smallest contribution to overall revenue and scored the highest YoY growth of 12.6% among all the other segments. The company reported revenue of Rs 185.36 crore in FY23, compared to Rs 164.6 crore in FY22.

Turning your attention to the company’s share performance during the long term, the stock has generated an impressive multibagger return of 1,110% over the last decade and 490% in the last five years. In the last year, the stock did not generate an impressive return compared to other stocks, but it still managed to beat the benchmark return during the same period, with a return of 44%.

Currently, it is trading at Rs 1,780 per share on the BSE.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 18, 2023, 3:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates