The Tata Nifty Auto Index Fund is an open-ended index fund offered by Tata Mutual Fund that aims to track the performance of the Nifty Auto Index (TRI). It invests in the companies that comprise the Nifty Auto Index in proportion to their weightage in the index. The scheme does not guarantee returns, but its objective is to provide returns that are in line with the performance of the Nifty Auto Index. There is an exit load of 0.25% of the applicable NAV if you redeem your investment within 15 days from the date of allotment. The minimum subscription amount is Rs 5,000. This new fund offer opened for subscription on April 8, 2024, and will close on April 22, 2024.

The investment objective of the Tata Nifty Auto Index Fund (NFO) is to provide returns, before expenses, that are in line with the performance of the Nifty Auto Index (TRI), subject to tracking error. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns.

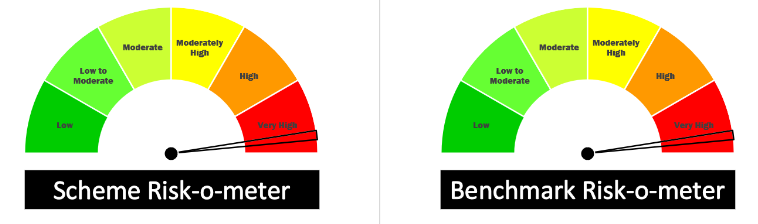

This NFO of Tata Nifty Auto Index Fund is suitable for investors who are seeking long-term capital appreciation and investment in equity and equity-related instruments comprised in the Nifty Auto Index. Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Investments | Indicative Allocation | Risk Profile |

| Securities covered by Nifty Auto Index | Minimum 95% – Maximum 100% | Very high |

| Debt & Money Market Instruments including units of Mutual Funds | Minimum 0% – Maximum 5% | Low |

The performance of the Tata Nifty Auto Index Fund is benchmarked against the Nifty Auto Index Fund (TRI).

Kapil Menon, a 41-year-old B. Com graduate, boasts an extensive tenure in the finance industry, particularly with Tata Asset Management Pvt Ltd. He commenced his journey with Tata in September 2006, steadily progressing from Senior Manager of investments to his current role as Dealer, where he has served since June 2021. In his current role, he reports directly to the Chief Investment Officer – Equities

Peer Comparison

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as of – 05-04-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| ICICI Pru Nifty Auto Index Fund Gr | 11-10-2022 | 61.14 | 0.99 | 15.66 | 46.78 | – | – | – |

| Index Fund | – | – | – | 5.42 | 21.46 | 1.91 | 27.96 | 15.29 |

| ICICI Pru Nifty Auto ETF | 12-01-2022 | 44.53 | 0.2 | -88.4 | 48.43 | – | – | – |

| Nippon India Nifty Auto ETF | 21-01-2022 | 101.06 | 0.22 | 16 | 48.38 | – | – | – |

| ETFs | – | – | – | 3.36 | 20.91 | 3.44 | 21.68 | 13.63 |

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 8, 2024, 1:26 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates