The Tata Nifty500 Multicap Infrastructure 50:30:20 Index Fund, launched by Tata Mutual Fund on April 8, 2024, is an open-ended index fund that aims to mirror the performance of the Nifty500 Multicap Infrastructure 50:30:20 Index (TRI), allocating investments across large-cap, mid-cap, and small-cap companies in a 50:30:20 ratio. There is no guarantee that the fund will achieve its objective, and investors should be aware of the associated risks. This scheme has no entry load, but an exit load of 0.25% applies if redeemed within 15 days of allotment. The minimum investment amount is Rs 5,000

The investment objective of the Tata Nifty500 Multicap Infrastructure 50:30:20 Index Fund is to provide returns, before expenses, that are in line with the performance of Nifty500 Multicap Infrastructure 50:30:20 Index (TRI), subject to tracking error. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns.

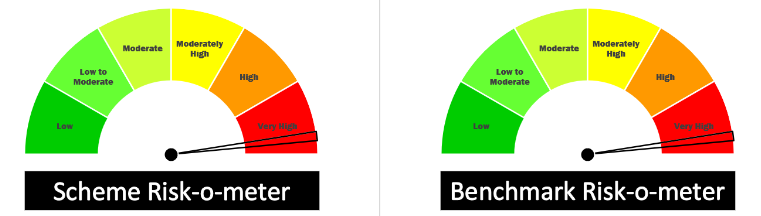

This NFO of Tata Nifty500 Multicap Infrastructure 50:30:20 Index Fund is suitable for investors who are seeking long-term capital appreciation and investment in equity and equity-related instruments comprised in the Nifty500 Multicap Infrastructure 50:30:20 Index. Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Investments | Indicative Allocation | Risk Profile |

| Securities covered by Nifty500 Multicap Infrastructure 50:30:20 Index | Minimum 95% – Maximum 100% | Very high |

| Debt & Money Market Instruments including units of Mutual Funds | Minimum 0% – Maximum 5% | Low |

The performance of the Tata Nifty500 Multicap Infrastructure 50:30:20 Index Fund is benchmarked against the Nifty500 Multicap Infrastructure 50:30:20 Index (TRI)

Kapil Menon, a 41-year-old B. Com graduate, boasts an extensive tenure in the finance industry, particularly with Tata Asset Management Pvt Ltd. He commenced his journey with Tata in September 2006, steadily progressing from Senior Manager of investments to his current role as Dealer, where he has served since June 2021. In his current role, he reports directly to the Chief Investment Officer – Equities

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 09-04-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Nippon India ETF Nifty Infrastructure BeES | 29-09-2010 | 80.42 | 1.04 | 15.34 | 38.42 | 6.32 | 35.78 | 12.86 |

| ICICI Pru Nifty Infrastructure ETF | 17-08-2022 | 118.29 | 0.5 | 15.55 | 39.33 | – | – | – |

| ETFs | – | – | – | 3.91 | 20.91 | 3.44 | 21.68 | 13.63 |

Elevate your savings strategy with our easy-to-use Angel One SIP Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 10, 2024, 5:56 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates