The Financial Year 2024 has concluded, and the new financial year commenced at the beginning of this month. Therefore, it would indeed be a wise decision to analyze past performance. Doing so provides insight into how various indices have performed and which ones have outperformed others. This analysis can guide us on where to focus our investment efforts in FY25. Before delving directly into historical performance, let’s analyze Nifty50’s performance since January 1, 2024, to discern any prevailing trends.

Nifty50 started the month of April at 22455, representing a 0.57% increase compared to the closing levels of March. Currently, it is trading around 22505 levels, which is approximately 0.78% or 181 points higher than last month’s close. Since the month has just begun, making judgments based on the candle at this early stage may not be wise.

Let’s analyze the performance of the last three months since January 2024. Nifty ended CY 2023 at 21731.40 with a significant bullish trend on the monthly candle, as shown in the image below. It’s obvious that even after an athlete covers a long distance with good speed, their speed declines for some period before increasing again to complete the race. Similarly, the markets behave similarly, where Nifty had showcased a strong rally in November and December 2023. However, we have not witnessed a significant upward move lately, except for gap-ups in the opening. Upon examining the monthly candles during this period, it’s clear that the wicks are present on both sides of the candles, representing volatility and indecision in the markets. Even today, after the RBI’s policy announcement, volatility was observed, but the intraday direction is still not quite clear.

| INDEX | Current Levels | 31-Mar-23 | 28-Mar-24 | % Gain |

| NIFTY MICROCAP 250 | 20,410.40 | 10,241.55 | 18,958.50 | 85.11% |

| NIFTY SMALLCAP 50 | 7,493.90 | 4,097.70 | 7,029.95 | 71.56% |

| NIFTY SMALLCAP 100 | 16,332.15 | 8,994.70 | 15,270.40 | 69.77% |

| NIFTY SMALLCAP 250 | 15,249.75 | 8,787.90 | 14,330.50 | 63.07% |

| NIFTY NEXT 50 | 62,446.30 | 37,797.15 | 60,624.30 | 60.39% |

| NIFTY MIDCAP 100 | 49,980.45 | 30,035.15 | 48,075.75 | 60.06% |

| NIFTY MIDCAP 50 | 13,957.85 | 8,466.80 | 13,256.50 | 56.57% |

| NIFTY MIDCAP 150 | 18,468.40 | 11,352.20 | 17,766.00 | 56.50% |

| NIFTY MIDCAP SELECT | 10,838.05 | 6,816.35 | 10,525.30 | 54.41% |

| NIFTY500 MULTICAP 50:25:25 | 14,296.35 | 9,466.80 | 13,850.10 | 46.30% |

| NIFTY TOTAL MARKET | 11,630.30 | 8,102.10 | 11,363.90 | 40.26% |

| NIFTY 500 | 20,694.05 | 14,557.85 | 20,255.15 | 39.14% |

| NIFTY 200 | 12,535.25 | 9,007.90 | 12,329.70 | 36.88% |

| NIFTY 100 | 23,209.65 | 17,186.15 | 22,920.70 | 33.37% |

| NIFTY 50 | 22,493.45 | 17,359.75 | 22,326.90 | 28.61% |

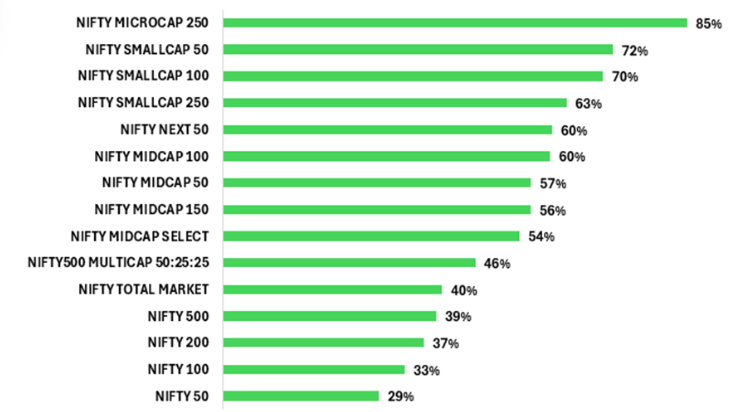

Surprisingly, the Nifty Micro Cap 250 index, representing micro-cap companies listed on the NSE, emerged as the top-performing index among all those mentioned in the image below. In FY24, the index delivered an impressive 85% return during the same period. Three indices representing the small-cap category—Nifty Small Cap 50, 100, and 200—were the second-best gainers among all. They delivered returns of around 72%, 70%, and 63%, respectively.

Additionally, Nifty50, which represents the top 50 listed companies in India, has emerged in the last position among all and has delivered an impressive return of around 29% during the same period.

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 5, 2024, 6:13 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates