Tata Motors is a prominent automobile maker in India, with a strong presence and an extensive history in the automotive market. Its name is widely recognized and familiar to most people.

Tata Motors has a commendable ethical record and has been operating in India for a significant period. It is rare to find a road in India without vehicles from Tata Motors. They manufacture a wide range of vehicles, including passenger vehicles and commercial vehicles.

In recent years, Tata Motors has been active in capturing the EV market. They are expected to invest in expanding their electric vehicle segments across the country. While there are other private players in the market, Tata Motors holds a larger share compared to its rivals.

Overall, Tata Motors has a solid reputation in the industry and is a key player in the Indian automotive market.

Have you ever wondered how Tata Motors makes money, and if yes, how much from each segment? Of course, it generates revenue by selling automobiles, but this is not the complete picture on the screen. In this article, we will cover how this auto giant generates revenue and stands as a prominent car maker.

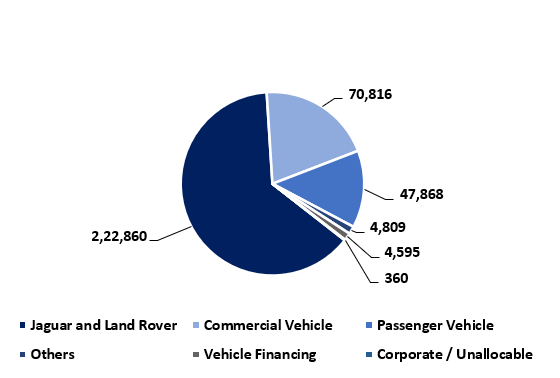

If we examine the company’s revenue segmented by category, it includes Commercial Vehicles, Passenger Vehicles, Corporate/Unallocable, Vehicle Financing, Jaguar and Land Rover, and Others.

| Revenue by Segments | Amt (Rs Cr) FY23 | Amt (Rs Cr) FY22 | Changes % YoY |

| Jaguar and Land Rover | 2,22,860 | 1,87,697 | 18.73% |

| Commercial Vehicle | 70,816 | 52,287 | 35.44% |

| Passenger Vehicle | 47,868 | 31,515 | 51.89% |

| Others | 4,809 | 3,809 | 26.24% |

| Vehicle Financing | 4,595 | 4,585 | 0.23% |

| Corporate / Unallocable | 360 | 314 | 14.59% |

| Total Revenue | 3,51,307 | 2,80,207 | 25.37% |

The shares of the company are trading at Rs 619.25 on the BSE, which is 1.99% up from the previous day’s closing price of Rs 607.15 each. Shares of Tata Motors have generated an impressive return of 40% in the last six months and 398% in the last three years.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 16, 2023, 6:37 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates