Mutual fund is an investment vehicle that pools money from various investors and invests in different securities like equity, debt, bonds and government securities. These funds are managed by highly qualified and experienced fund managers and they make investment decisions based on their expertise that help maximise the returns.

Also Read More About What is Mutual Fund?

The Mutual Fund industry in India had its beginning in 1963. The Unit Trust of India (UTI) was formed through a Parliamentary act and was under the supervision of the Reserve Bank of India (RBI). UTI launched the first mutual fund scheme in India called Unit Scheme 1964.

The Industry’s AUM had crossed the milestone of Rs10 lakh crore for the first time in May 2014 and in a short span of about three years, the AUM size had increased more than two folds and crossed Rs 20 lakh crore for the first time in August 2017. The AUM size crossed Rs 30 lakh crore for the first time in November 2020. The Industry AUM stood at Rs 41.62 lakh crore as on April 30, 2023.

India currently representing a mere 2% of the global mutual fund industry, it becomes evident that there exists substantial room for further expansion in the near future. In comparison, while the Assets Under Management (AUM) to Gross Domestic Product (GDP) ratio in India stands at 16%, developed countries like the USA boast a ratio of 140% and the global average stands at 63%.

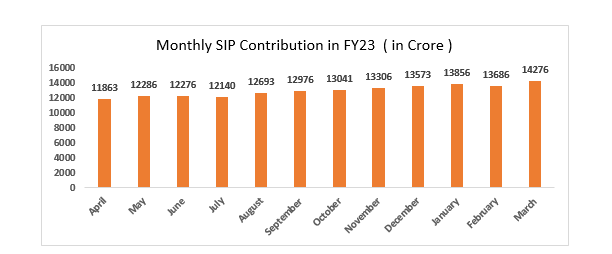

Systematic Investment Plan or SIP, is an investment plan offered by Mutual Funds wherein one could invest a fixed amount in a mutual fund scheme periodically at fixed intervals – say once a month – instead of making a lump-sum investment. One can start SIP with minimum amount of Rs 500 per month. SIP has been gaining popularity day by day, as it helps in Rupee Cost Averaging and also in investing in a disciplined manner without worrying about market volatility and timing the market.

Indian Mutual Funds have currently about 6.42 crore SIP accounts through which investors regularly invest in Indian Mutual Fund schemes and the total amount collected through SIP during April 2023 was Rs 13,728 crore.

| Year | Total No. of Outstanding SIP Accounts * | No. of New SIP Registered | No. of SIP discontinued / Tenure Completed | SIP AUM | SIP Contribution |

| FY 23 | 6.35 Cr | 2.51 Cr | 1.43 Cr | 6.8 lakh crore | 1.5 lakh crore |

| FY 22 | 5.27 Cr | 2.66 Cr | 1.11 Cr | 5.7 lakh crore | 1.2 lakh crore |

(Source AMFI India)

*Total No. of Outstanding SIP Accounts are the accounts through which investors regularly invest in Indian Mutual Fund schemes.

(Source AMFI India)

Overall, the increase in SIP inflow in India can be attributed to the convenience, flexibility, disciplined approach, professional management, financial awareness, tax benefits and risk mitigation factors associated with SIP investments.

The mutual fund industry in India has seen tremendous growth since its inception and it is on the trajectory to grow even more amid the increasing participation from retail investors. Going ahead, awareness and participation from young millennials and early Gen-Z investors will be key growth drivers for the mutual fund industry.

Published on: May 25, 2023, 12:32 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates