Today the broader index Nifty50 closed the session at 19398.5 in green with a mere 9.5 points up. It opened at 19405.95, 16 points up from its previous day’s closing of 19389. Whereas Sensex closed the day on red with 33 points down at 65446.04.

In this article, we will explore the stocks which have created new 52-week highs approximately after one year.

When stocks reach a 52-week high, it reflects a positive market sentiment and indicates confidence in the company’s performance. This occurrence can signify potential price momentum and draw the interest of more investors, thereby boosting demand and driving up the stock price.

Psychologically, it generates enthusiasm and captures the attention of traders and investors. Crossing this threshold can also serve as a breakout signal for technical traders. Analysts frequently take note of stocks surpassing their 52-week high, resulting in heightened coverage and enhanced investor trust.

| Company Name | CMP Rs | %change | New 52-Week high Rs | Prv. 52-W high Rs | Prv high date |

| Mangalore Refinery and Petrochemicals Ltd | 88.2 | 11.3 | 91 | 83.5 | 04-Jul-22 |

| Samvardhana Motherson International Ltd | 90.35 | 6.1 | 93.65 | 91.67 | 21-Jul-22 |

| MOIL Ltd | 177.75 | 6.2 | 181.05 | 178.6 | 03-Aug-22 |

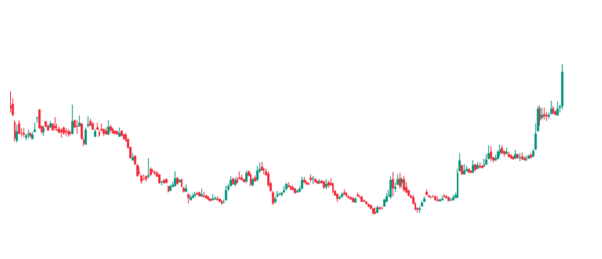

Mangalore Refinery and Petrochemicals Ltd is mainly engaged in the business of refining crude oil, the petrochemical business, trading of aviation fuels, and distribution of petroleum products through retail outlets and transport terminals. It was set up as a joint venture between the Birla Group and Hindustan Petroleum Corporation Ltd. It is now a subsidiary of Oil & Natural Gas Corporation.

The market cap of the company is Rs 15579 Crore. The company’s revenue significantly surged by 56% in FY23 from Rs 69727 Crore to Rs 108856 Crore. For the first time in history, the company’s revenue touched a milestone of six-digit figures in the top line. Company’s Operating Profit is Rs 6497 Crore with an operating profit margin of 6%. In the last financial year company’s net profit was Rs 2638 Crore. Its ROCE and ROE are 20% and 31%. The stock has generated a return of 15% in the past year.

Below is the chart presentation of stock from the last 52-week high date till today.

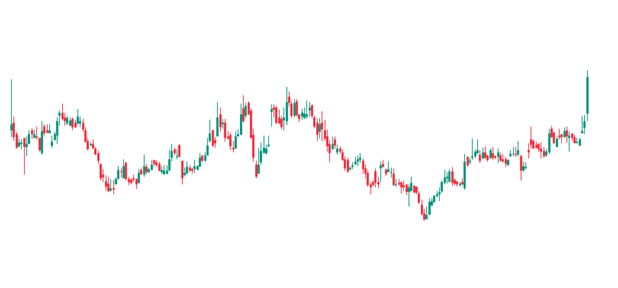

Samvardhana Motherson International Ltd is a globally diversified manufacturer. The Company is a full system solutions provider to customers in automotive and other industries. It has a diversified product portfolio, which includes electrical distribution systems, fully assembled vehicle interior and exterior modules, automotive rear vision systems, moulded plastic parts and assemblies, and so on.

The market cap of the company is Rs 61,205 Crore. The company’s revenue significantly surged by 24% in FY23 from Rs 63,536 Crore to Rs 78701 Crore. Company’s Operating Profit is Rs 6,164 Crore with an operating profit margin of 8%. In the last financial year company’s net profit was Rs 1,670 Crore. Its ROCE and ROE are 9.2% and 7.2%. The stock has generated a return of 18% in the past year.

Below is the chart presentation of stock from the last 52-week high in the year 2022 till today.

MOIL Ltd is primarily engaged in the mining of manganese ore and is the largest manganese ore producer in the country. It is a “Mini Ratna” state-owned company owned by the Government of India.

The market cap of the company is Rs 3,648 Crore. The company’s revenue declined by 6% in FY23 from Rs 1,433 Crore to Rs 1,342 Crore. Company’s Operating Profit is Rs 369 Crore with an operating profit margin of 28%. In the last financial year company’s net profit was Rs 251 Crore. Its ROCE and ROE are 15.1% and 11.3%. The stock has generated a return of 24% in the past year.

Below is the chart presentation of stock from the last 52-week high in the year 2022 till today.

Published on: Jul 5, 2023, 7:15 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates