The IPO craze was on the next level in the year 2023. Many IPOs came throughout the year, both on the Main Board and the SME Board. Many investors made a tremendous amount of money on the listing day itself, while some IPOs listed flat or at a discount, disappointing many investors. Several IPOs registered an impressive subscription rate, leading to disappointment among some investors who did not get the allotment, especially on those IPOs that were listed with a remarkable premium.

During the year 2023, a total of 180 IPOs opened for subscription, while 174 IPOs hit the market on the SME board, which is more than the IPOs in the year 2022.

In this article, we are going to explore the top 3 IPOs that hit the Indian market and created exceptional wealth for their shareholders.

Incorporated in 2013, RBM Infracon Limited is primarily engaged in the engineering, execution, testing, commissioning, operation, and maintenance of mechanical and rotary equipment for oil and gas refineries, cement, fertilizers, petrochemicals, coal/gas-based power plants, etc.

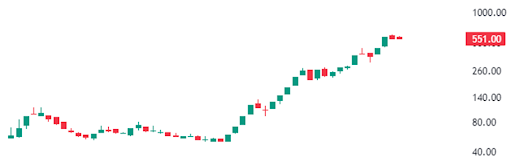

The stock debuted on the Indian markets on January 04, 2023, at Rs 52.50 per share, reflecting a premium of 46% on the listing day compared to the issue price of Rs 36 per share. Furthermore, on the last trading day of the year 2023, the closing price reached Rs 443.20 per share, signifying an approximate 1130% return based on its issue price.

If someone had purchased the shares at the closing price on the listing day itself, they would have gained over 700% return during the same period. As of now, the shares are trading at Rs 551 per share, and based on the current market price the stock has delivered an impressive multibagger return of 1430% over its issue price. The company’s shares are trading at a PE of 125 times in the market.

The IPO was subscribed 40.32 times. The public issue witnessed a subscription of 34.33 times in the retail category and 46.32 times in the NII category.

Sahana System Limited is engaged in the business of offering IT-related services, including web app development, mobile application development, AI & ML development, ChatBot development, and product prototyping. The company was incorporated in 2020.

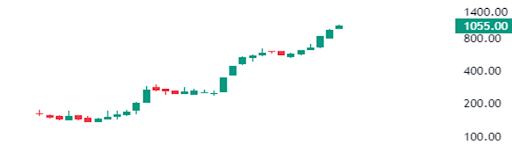

The stock debuted on the Indian markets on Jun 12, 2023, at Rs 163 per share, reflecting a premium of 20.75% on the listing day compared to the issue price of Rs 135 per share. Furthermore, on the last trading day of the year 2023, the closing price reached Rs 1060 per share, signifying an approximate 685% return based on its issue price.

Moreover, if someone had purchased the shares at the closing price on the listing day itself, they would have gained over 519% return during the same period. As of now, the shares are trading at Rs 1060 per share, and based on the current market price the stock has delivered an impressive multibagger return of 685%. The company’s shares are trading at a PE of 103 times in the market.

The IPO was subscribed 9.99 times. The public issue witnessed a subscription of 12.97 times in the retail category, 9.70 times in the QIB category, and 7.07 times in the NII category.

Meson Valves India Limited, previously known as Sander Meson India Private Limited, is a supplier of valves, actuators, strainers, and remote-control valve systems to industries. The company was incorporated in 2016.

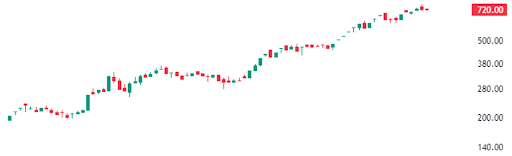

The stock debuted on the Indian markets on September 21, 2023, at Rs 193.80 per share, reflecting a premium of 90% on the listing day compared to the issue price of Rs 102 per share. Furthermore, on the last trading day of the year 2023, the closing price reached Rs 611 per share, signifying an approximate 500% return based on its issue price.

Moreover, if someone had purchased the shares at the closing price on the listing day itself, they would have gained over 200% return during the same period based on the issue price. As of now, the shares are trading at Rs 720 per share, and based on the current market price the stock has delivered an impressive multibagger return of 605%. The company’s shares are trading at a PE of 162 times in the market.

The IPO was subscribed 173.65 times. The public issue witnessed a subscription of 203.02 times in the retail category, and 132.74 times in the NII category.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 17, 2024, 3:46 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates