The Asset Management Company (AMC) industry plays a crucial role in the world of finance. AMCs are responsible for managing and investing assets on behalf of their clients, which can include individuals, institutions, and governments. This blog aims to provide an in-depth analysis of the AMC industry, shedding light on its key trends, challenges, and opportunities.

Key Players in the AMC Industry

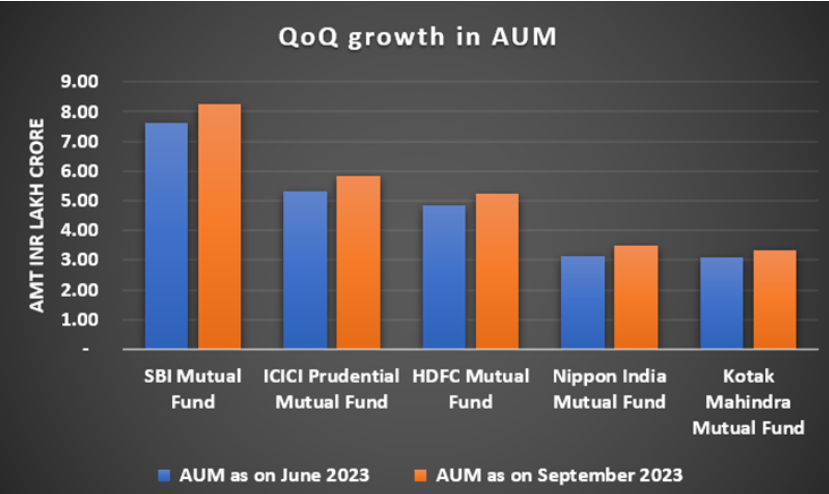

The AMC industry consists of numerous players, both large and small, that manage a wide range of assets. Some of the major players in the industry include SBI Mutual Fund, ICICI Prudential, HDFC AMC, Nippon India and Kotak Mahindra. These companies have established themselves as leaders in the field and manage trillions of assets collectively. These top 5 AMCs in India collectively manage about 55% of the total assets in the industry.

Here are the top 5 AMCs in India:

It is established in 1987 and headquartered in Mumbai, India, is an Asset Management Company introduced by the State Bank of India (SBI). It is a joint venture between SBI, a prominent Indian public sector bank, and Amundi, a leading European asset management company.

A leading AMC, aims to help investors build long-term wealth through simple and relevant investment solutions. This joint venture between ICICI Bank, a renowned Indian financial services provider, and Prudential Plc, a prominent pan-Asia & Africa-focused group specializing in health, protection, and savings solutions, has achieved pre-eminence in the Indian Mutual Fund industry.

Also Check Out ICICI Prudential Asset Management Company Ltd

It manages HDFC Mutual Fund, one of India’s largest with an AUM of Rs 5.2 trillion as of September 30, 2023. They offer a wide range of investment options, serving 7.9 million investors through 1.36 million accounts across 229 branches, 80,000 distribution partners, and digital platforms nationwide.

It is involved in overseeing a range of financial products, such as mutual funds, ETFs, managed accounts (including portfolio management services), alternative investment funds, pension funds, offshore funds, and advisory mandates.

Also Check Out Nippon Life India Asset Management

It is a public company, it manages Kotak Mahindra Mutual Fund and operates as a wholly owned subsidiary of Kotak Mahindra Bank. It offers a variety of 261 schemes to suit different investor risk appetites, primarily investing in AAA and AA rated companies with a substantial assets under management.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 13, 2023, 9:23 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates