In this era, we are the ones who spend a lot of time in front of screens. For working employees, it’s often a laptop during work hours, but once free, leisure time is spent watching content on mobiles, tablets, or laptops. Nowadays, people can enjoy their favorite shows on their personal devices, a shift from the earlier reliance on TV sets. This flexibility means that if there are four members in a household, they can each watch their favorite shows without any problems on their own personal devices.

Furthermore, this week marks the beginning of the IPL season, and in India, cricket holds more affection than the national game, hockey. People dedicate even their crucial time to watching matches till the last ball. Don’t you think we to keep media and entertainment companies listed in the Indian stock market on our radar for investment purposes? In this article, we will explore these companies and their market shares, along with their past performance in the stock market.

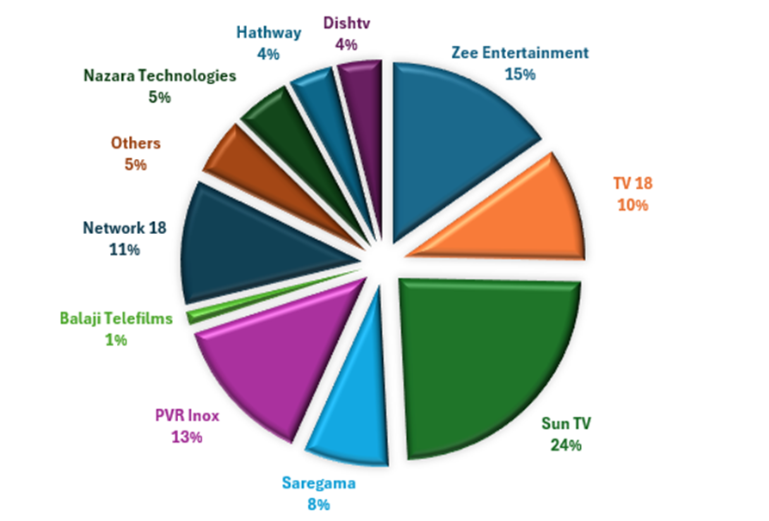

Source: Capital Market

Based on the provided data, it’s evident that Sun TV Network, engaged in producing and broadcasting satellite television and radio programming in South Indian regional languages, holds the highest market share of approximately 24%. Following closely behind is Zee Entertainment, with the second-highest market share of around 15% among the mentioned companies.

| Companies | CMP Rs | M Cap Rs Cr | ROCE % | ROE % | PE | Debt to Equity | Sales Growth 3Yrs % | Profit Growth 3Yrs % | 1-Yr return % |

| Balaji Telefilms | 78.90 | 801.05 | -5.10 | -10.94 | 27.56 | 0.21 | 1.12 | 6.52 | 88.46 |

| TV18 Broadcast | 48.51 | 8,316.39 | 2.75 | 2.46 | 365.02 | 0.11 | 4.54 | -22.61 | 57.78 |

| Netwrk.18 Media | 87.25 | 9,134.65 | 2.20 | -2.21 | – | 0.28 | 5.12 | – | 48.02 |

| Hathway Cable | 19.81 | 3,506.56 | 2.15 | 1.55 | 65.28 | – | 1.10 | -1.45 | 41.61 |

| Sun TV Network | 586.90 | 23,128.86 | 25.49 | 19.19 | 12.22 | 0.01 | 2.33 | 9.56 | 33.28 |

| Nazara Technologies | 675.55 | 4,952.99 | 7.17 | 3.56 | 75.24 | 0.09 | 63.96 | 166.50 | 32.92 |

| Saregama India | 374.15 | 7,221.42 | 17.55 | 12.82 | 38.59 | – | 12.20 | 58.82 | 18.87 |

| Dish TV India | 17.16 | 3,159.64 | 70.50 | 429.80 | 15.08 | – | -14.00 | 5.34 | 17.67 |

| PVR Inox | 1,312.25 | 12,877.64 | 3.28 | -7.76 | – | 1.10 | 3.18 | – | -17.63 |

| Zee Entertainment | 141.55 | 13,596.21 | 7.94 | 0.35 | 62.46 | 0.02 | -0.17 | -60.84 | -34.43 |

According to the data provided, we can analyse both the financial and stock performance of the mentioned companies over the past year. Among all the companies listed, only two have delivered negative returns during this period.

Balaji Telefilms stands out with the highest return of approximately 88%, showcasing robust performance in the market. Meanwhile, Sun TV Network, holding the highest market share, has delivered a return of 33% during the same timeframe.

However, PVR, Inox, and Zee Entertainment have experienced negative returns despite their well-known names and strong goodwill in the market.

Conclusion:

The analysis of top media and entertainment stocks reveals a diverse landscape of financial and stock performance over the past year. While companies like Balaji Telefilms and Sun TV Network have demonstrated impressive returns, others such as PVR, Inox, and Zee Entertainment have faced challenges with negative returns despite their established presence in the market. This highlights the importance of thorough research and careful consideration when investing in this sector. As the era of digital entertainment continues to evolve, keeping an eye on the performance of media and entertainment companies listed in the Indian stock market remains essential for investors seeking opportunities in this dynamic industry.

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Mar 21, 2024, 4:29 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates