Nifty formed a bullish Opening Marubozu pattern, indicating the bulls’ control over Dalal Street on the daily chart. The pattern resembles a long bullish candlestick pattern with a minor upper shadow and no lower shadow on the daily chart. Nifty opened higher at 19,566, which also served as the day’s low, and gained momentum throughout the day. It reached the day’s high of 19,718 before closing at 19,690, up 178 points, or 0.91% from the previous day. Nifty surpassed the previous week’s high, decisively breaking out of the horizontal as well as the downward sloping resistance trendline. It not only climbed back above the 50-day exponential moving average (EMA) of 19,560 but also the 20-day EMA (19,650) in a single session.

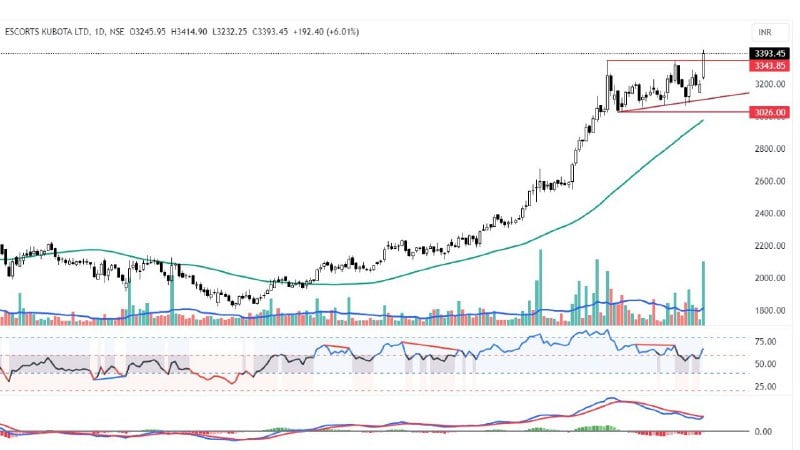

The Escorts Kubota stock has broken out of a 27-day flat base and closed at a new lifetime high. Its price relative strength is also at a new high. The massive volume validates the breakout. It is trading above all moving averages. The moving average ribbon is in an uptrend, and the Bollinger bands have begun to expand. It is currently 13.99% above the 50 DMA. The MACD is about to give a bullish signal, and the RSI has entered the bullish zone. The Elder’s impulse system has formed a strong bullish bar, and the stochastic oscillator has also given a bullish signal. In short, the stock has registered a bullish breakout. A move above Rs. 3,395 is positive, and the next level to watch out for is 3,480.

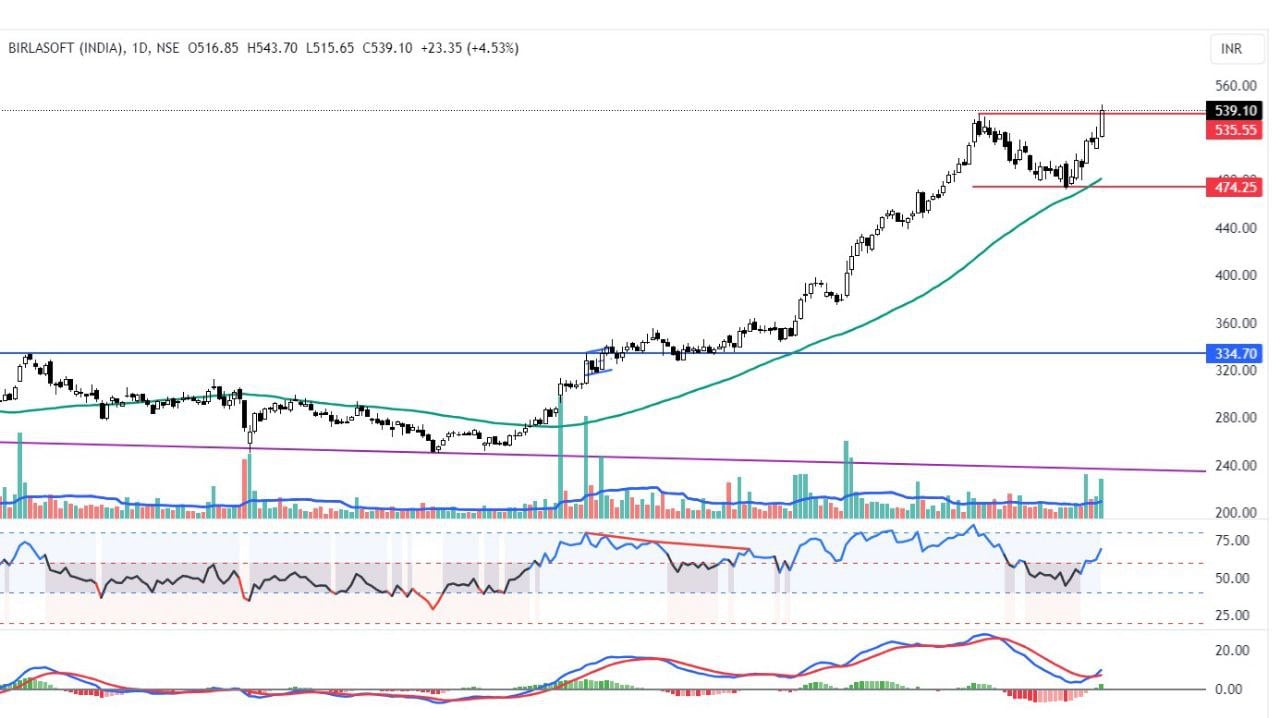

The Birlasoft stock has broken out of a 24-day cup pattern with high volume. It closed at the 52-week high, and its price relative strength line is at a new high, indicating outperformance compared to the broader market. The stock is trading above all key moving averages, and the moving average ribbon is in an uptrend. The Bollinger bands have begun to expand, signaling a sharper move. The RSI is in the strong bullish zone, and the MACD has given a fresh buy signal. The Elder’s impulse system has formed a strong bullish bar, and the TSI has also given a fresh bullish signal. The KST is about to give a bullish signal, and it closed above the historical Anchored VWAP. In short, the stock has registered a bullish breakout. A move above Rs. 540 is positive, and it can potentially test Rs. 555.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 11, 2023, 7:48 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates