Insurances help you to meet a sudden, unexpected, disproportionate amount of financial requirement by investing regularly in the instrument with periodic amounts. For example, if you take car accident insurance, then you will have to pay a small sum every year to your insurer – in return, if you ever suffer a car accident, the insurer will likely pay you a lump sum amount. If such a car accident never happens, then the insurer gets to keep the entire amount, as well as the possible returns from its investment.

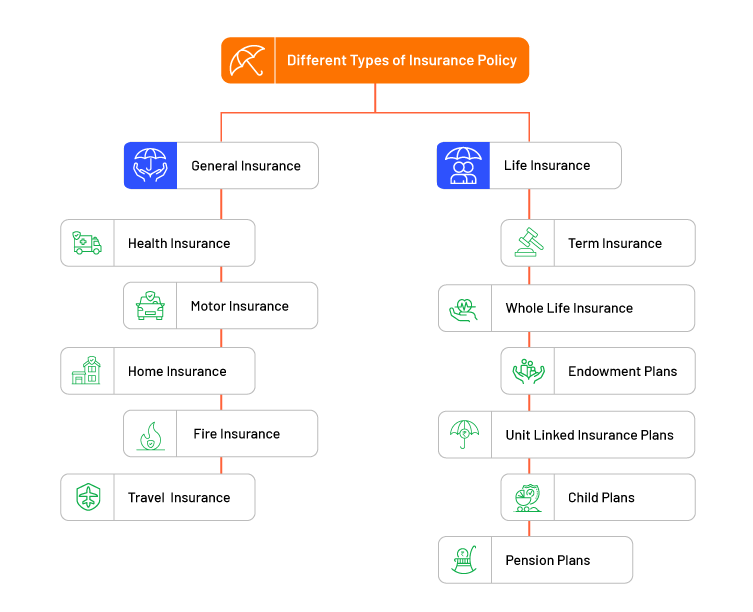

Let us now see the different types of insurance options available in India.

There are two broad categories of insurance –

The following are the different types of insurance policy under each category –

It is a type of insurance in India that offers coverage of losses incurred other than the death of the policy holder. The losses covered, therefore, usually include monetary losses related to health, car etc.

Health Insurance plans cover expenses/losses due to illness or injury and consequent expenditure related to the recovery e.g. hospital bills. Health Insurance may cover pre-hospitalisation expenses, hospitalisation, treatment of illness, medical bills post-hospitalisation, residential treatment and daycare procedures.

There are various types of health insurance available in India such as –

It is a type of insurance that offer financial assistance for accidents related to your bike or car. Types of motor insurance policies in India include:

A home insurance policy gives comprehensive protection to the contents and structure of your house against any physical destruction or damage. Coverage will include any natural and human-made calamities like fire and robbery.

Different types of home insurance policies include:

1) Home Structure/Building Insurance – Protects the structure of the house against damage during any calamity

2) Public Liability Coverage – Coverage against any damage to a guest or third-party on the insured residential property

3) Standard Fire and Special Perils Policy – For damages caused due to fire outbreaks, natural calamities (like landslides, earthquakes, floods etc.), and antisocial human activities (e.g., vandalism)

4) Personal Accident – Financial coverage to you and your family against any kind of permanent dismemberment or death of the insured individual, anywhere around the world

5) Burglary and Theft Insurance – Compensation for stolen goods

6) Contents Insurance – Compensation for loss of furniture, vehicles, appliances etc.due to fire, theft, flood, or riots

7) Tenants’ Insurance – Protection to tenants against any loss of personal property living in a rented house

8) Landlords’ insurance – Coverage to landlords against contingencies such as public liability and loss of rent

Fire insurance policies compensate for any losses due to a fire breakout. They help both individuals and companies to reopen their places after they have suffered damages due to fire. These insurances even cover war risk, turmoil, riots losses as well.

Different types of fire insurance in India include valued policy, specific policy, floating policy, consequential policy, replacement policy and comprehensive fire insurance policy.

It provides financial protection for you and your loved ones while you are visiting any place in India or abroad – it helps ensure that you are able to have a peaceful journey.

Coverage includes any issues that you may face during your trip such as loss of baggage, flight cancellations, loss of passport, personal and medical emergencies.

Types of travel insurance policies include:

It is a type of insurance that offers coverage against unfortunate events like death or disability of the policyholder. The policy coverage comprises a large amount, which is payable to your loved ones if anything happens to you. With this insurance type, you have the flexibility to choose the life insurance policy period, coverage amount, and payout option based on the financial requirements.

Term insurance is probably the most affordable type of insurance policy in which you can opt for a life cover for a specific period. Term insurance plans generally do not have any maturity value. Therefore, they involve lower rates of premium than other life insurance products.

If anything happens to you during the policy period, your loved ones would receive the sum assured as per the payout option chosen.

Whole life insurance plans provide coverage for the entire life of the insured individual, and not just for a specific number of years.

The plan also contains a savings component, which helps accumulate a cash value throughout the policy term. The maturity age for a whole life insurance policy is 100 years. If the insured individual lives past the maturity age, the whole life plan will become a matured endowment.

Endowment plans facilitate financial coverage to the policyholder against life’s uncertainties, while allowing them to save regularly over a certain period. When the endowment plan matures, the policyholder receives a lump sum amount if he or she is alive beyond the end of the policy term.

On the other hand, if the policyholder is not alive upon maturity of the policy, the family is in turn paid the complete sum assured.

Unit Linked Insurance Plans are types of insurance policy that offer both investment and insurance benefits under a single policy contract – the money invested by the policyholder is partly invested in equity and debt instruments.

The remaining premium contributes towards providing the life cover throughout the policy tenure. Moreover, you have the flexibility to choose the allocation of premium into different instruments.

Child plans financially secure your child’s life goals such as college fees, even in your absence. They offer both savings and insurance benefits that aid you in the financial planning for your child’s future needs at the right age.

Pension plan, also known as a retirement plan, aids you in accumulating a part of your savings over an extended period. It helps you deal with financial uncertainties post-retirement, by ensuring that you continue to receive a steady flow of income even after your working years are over. The accumulated amount is given back to you as annuity or pension at regular intervals.

Now that you have a fair idea about the different types of insurance policy available in India, you may also want to check out other avenues of investment available to you. If you have never traded stocks or invested in bonds before, open demat account with Angel One and explore the world of investing!

Published on: Jan 16, 2023, 3:30 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates