In the dynamic world of initial public offerings (IPOs), 2023 has emerged as a remarkable year, witnessing an intriguing trend that has investors and financial enthusiasts buzzing with excitement. The secret to substantial gains appears to lie in the IPOs that have garnered an astonishing 50 times or more in subscription rates. Let’s delve into this phenomenon and explore how these IPOs have not only met but exceeded expectations.

The IPOs that have grabbed headlines are not your average offerings—they’ve witnessed subscription rates soaring to staggering heights of 50 times or more. This unprecedented level of investor interest signifies a resounding vote of confidence in these companies, reflecting a keen appetite for their shares.

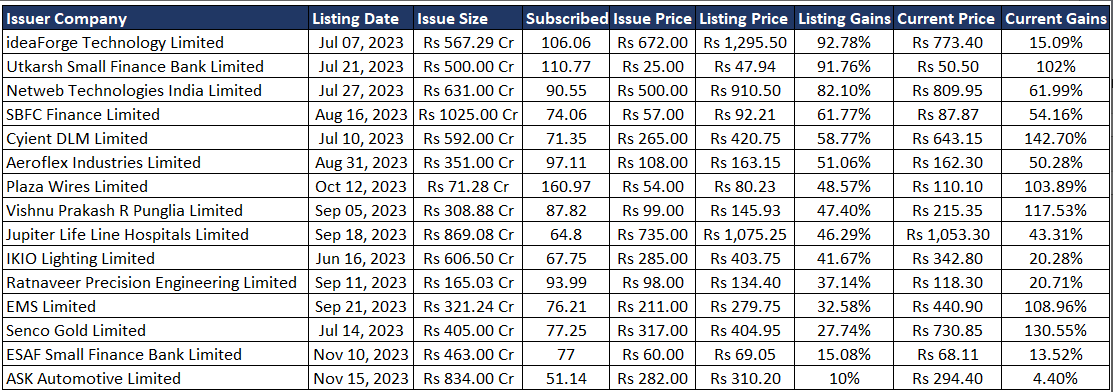

Here’s a snapshot of the mainline IPOs that have experienced extraordinary subscription rates and subsequent listing gains:

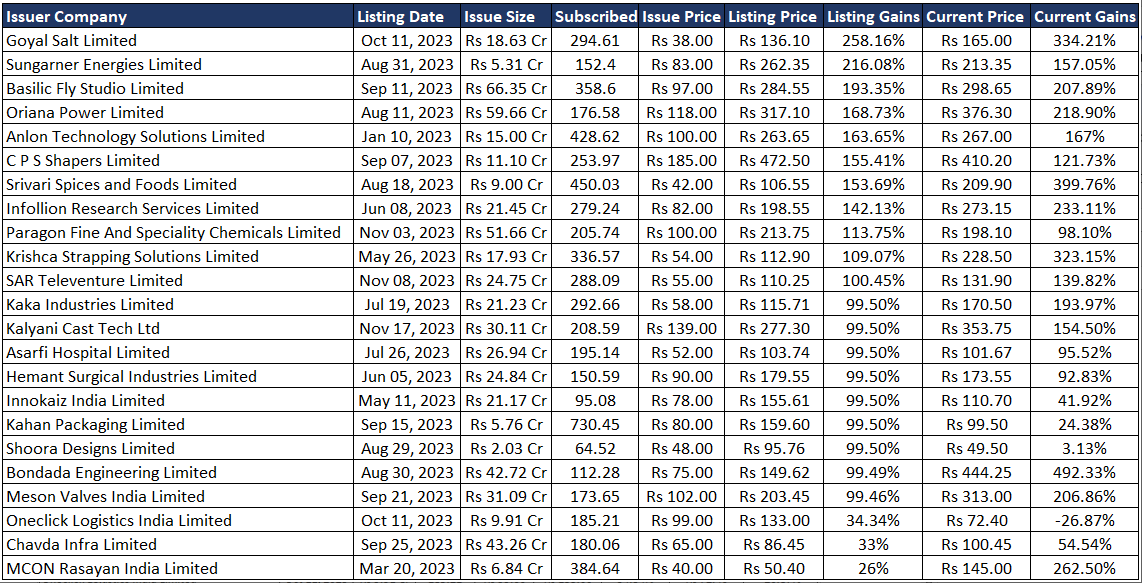

The surge is not limited to mainline IPOs; SME IPOs have also demonstrated their prowess:

Investors who recognized the potential in these high-subscription IPOs are now enjoying substantial gains. The listing gains, in some cases exceeding 100%, underscore the lucrative nature of these investment opportunities.

As we navigate the IPO landscape, it’s crucial for investors to stay vigilant, conduct thorough research, and assess the subscription demand. While high subscription rates can signal confidence, it’s essential to consider various factors, including the company’s fundamentals and market conditions.

In conclusion, the surge in 50x subscribed IPOs in 2023 highlights the dynamic nature of the financial markets. Investors who successfully identified and capitalized on these opportunities are now reaping the rewards of their strategic investments. As the IPO journey continues, the key lies in staying informed, analysing trends, and making well-informed investment decisions.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions

Published on: Nov 28, 2023, 10:17 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates