Nifty50 has broken its own record today by registering its new all-time high level of 20,180 today. It opened the day at 20,156, marking a 0.26% increase from the previous closing level of 20,070.

Among the fifty stocks included in the index, most have demonstrated strong performance and contributed to the index rally, except for one company: UPL Limited.

Here’s some background on UPL Limited.

The company is primarily engaged in agrochemicals, industrial chemicals, chemical intermediates, speciality chemicals, and the production and sale of field crops and vegetable seeds. Today, its stock is trading at Rs 624 on the BSE, which is nearly unchanged from the previous day’s closing price.

While many other stocks are trading near their all-time highs, or at higher levels, UPL Limited’s stock is trading nearly 28% below its all-time high price of Rs 865, which it reached in June 2021. It is also 23% lower than its 52-week high price of Rs 807. Its 52-week low price is Rs 577, recorded on August 18, 2023.

If we compare the returns of Nifty50 with those of UPL Limited, the Index has generated a 3.3% return, while UPL Limited has generated a 7% return. Looking at longer time frames, the Index has generated a 7.2% return in the last three months, while UPL Limited’s stock has experienced a negative return of approximately 8%.

Furthermore, if we examine the one-year returns of the index and UPL Limited stocks, the index has produced an impressive return of 12.4%, while the stock has seen a negative return of approximately 15%.

Analysing the chart, it appears that the stock has been in a consolidation phase, trading in the range of Rs 860 to Rs 600. However, last week, it broke out of this range, but the buyers have shown interest in purchasing near the lower end of the range post-breakout, and this week it has risen by around 4.3% compared to the previous week’s closing price.

Over the longer term, the stock has generated an impressive multibagger return of 600% over the last decade.

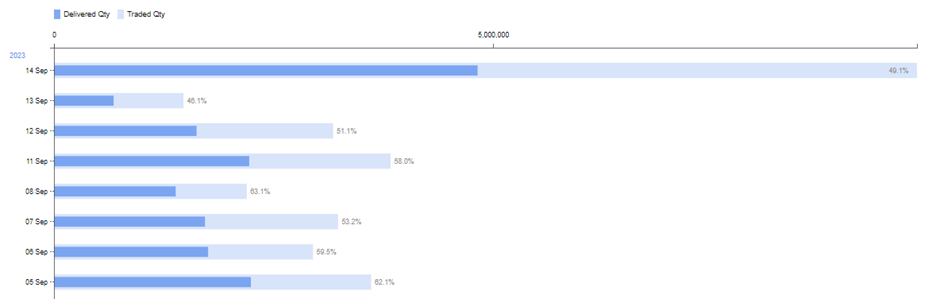

Trading and delivery volumes surged in yesterday’s trading session. Below is the day-wise data:

Turning to the company’s recent quarter financial performance, its revenue from operations fell by 17% YoY to Rs 8,963 crore. Operating profit decreased from Rs 2,146 crore to Rs 1,216 crore in the last quarter, representing a nearly 43% decline.

The net profit reported by the company is a mere Rs 102 crore, compared to Rs 1,005 crore in the corresponding year-ago quarter, marking a significant 90% decrease.

These disappointing financial situations might be the reason why the stock is not reflecting strong movement, as its June quarter results were not impressive from top to bottom line.

Investors who had bought at the higher levels are waiting for it to start moving and this week it has brought some hope by giving some move from its lower levels.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 15, 2023, 2:00 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates