The Indian Automobile industry is 4th largest automobile producer in the world, with an average annual production of 4 million motor vehicles. The sector is expected to grow at a CAGR of 8.1% in the upcoming forecast period. India is well reconfigured as an automobile production hub due to its low-cost production. Cheap labour, easy availability of low-cost raw materials, and weak currency are key drivers of the auto industry.

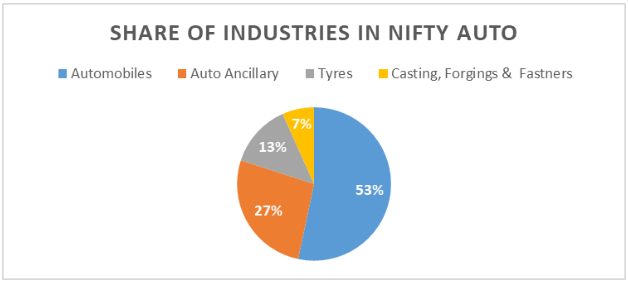

NIFTY Auto Index represents the performance and behaviour of the Automotive sector of India. The index comprises industries such as cars and motorcycles, heavy vehicles, auto ancillaries, tyres, etc. The index consists of 15 stocks from the above-mentioned industries which are listed on the National Stock Exchange (NSE). Nifty Auto is computed using the free float market capitalisation method.

All 15 stocks listed on the index are majorly part of two industries – Automobile and Auto components at 91.33% and capital goods with a remaining share of 8.667%. Nifty Auto is rebalanced semi-annually to reflect the changing nature of the Indian automotive sector.

Nifty Auto has outperformed Nifty50 and Sensex for FY 23-24 with an annual return of 72.69%. Also, quarterly returns for the Automotive sector have given a positive return for the last three quarters. FY 23-24 and Q2 have outperformed other quarters for the year giving a return of 23.72%.

Tailwinds to the automotive sector for FY 25 to perform better are the rising income of the middle class in the country. Also, the growing young population helps create demand for passenger vehicles and two-wheelers due to changing lifestyles and consumer preferences. The automotive market is expected to reach $160 billion by 2027, which is an opportunity for market expansion. As the government provides subsidies to electric vehicles (EV) it going to increase demand for EVs and so forth more innovations are to come into the automotive sector. Another positive sign is that the exports of vehicles have seen a significant rise.

Headwinds for the automotive sector can be increasing regulation by the government on different issues that will arise in the future. Recently the government has issued regulations regarding the production of automobile parts to ensure the safety of passengers. Also, it is keen to reduce the use of fossil fuels to reduce the pollutants.

The Indian Automotive sector is on an upward trajectory due to its increasing middle-class income and increasing young population who are more attracted towards the technological advancement of EVs. Government tax incentives and scrap policy will create more demand in the sector and financing will become easy. Thus, increasing access to a wider audience.

India’s biggest automobile IPO of 2024! Hyundai’s IPO will open from October 15 to 17, 2024. Don’t miss your chance to be part of the automobile industry!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions

Published on: Mar 27, 2024, 1:13 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates